Tax Plan Will Widen Racial Wealth Gap

Federal estate tax rollback mostly benefits whites, leaving blacks, Latinos further behind.

Both versions of the federal tax bill currently under consideration expand the already-significant ability of extremely rich families to keep wealth within their own circles, a move that would contribute to the widening chasm between the very wealthiest and everybody else and would place additional obstacles to economic security in the path of families of color.

New figures point to the degree to which a growing amount of the nation’s resources are held by a select few. In 2016, 39 cents out of every dollar of wealth was held by the top 1 percent, according to the newest Survey of Consumer Finances, released this fall by the Federal Reserve Board. That amount is up from 30 cents a quarter-century ago.

Growing levels of wealth inequality block access to opportunity for those not lucky enough to be born to the top 1 percent. On Inequality.org, Chuck Collins describes how:

“The story goes like this: as wealth inequalities grow, two things happen that undermine equality of opportunity. First, affluent families help their kids in dozens of ways to get a leg up in preparing for school, getting into selective colleges and launching decent paying careers. They pull further and further ahead…

Secondly, extremely unequal societies historically disinvest the public sector and the social investments that give non-affluent households opportunities, such as 0-6 preschool, decent K-12 education and access to college or vocational skills. Those who are not fortunate enough to have wealthy parents lose some of the tools needed to advance up the economic ladder.”

In other words, growing levels of wealth inequality spark an unwillingness to make the kind of public investments needed to make sure all families can thrive economically — and then the unwillingness to make those investments further widens the wealth gap, completing a vicious circle.

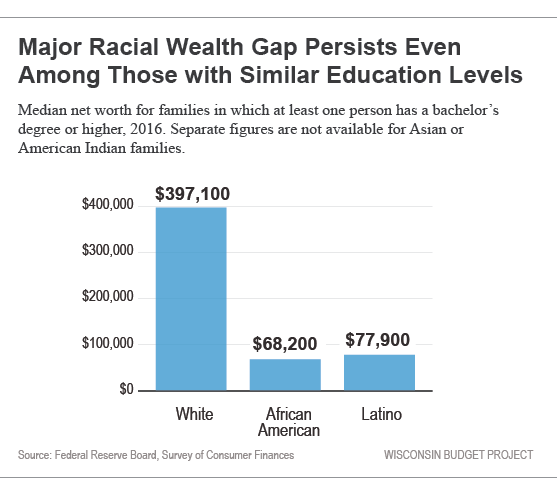

Families of color are especially likely to get caught in this circle, which can largely block them from methods of wealth accumulation that are available to other families. White families have much more wealth than families of color, and while part of that difference is because white households are more likely to be college-educated than African American or Latino ones, even similarly-educated white families hold much more wealth than families of color. The typical college-educated white family had a net worth of $397,100 in 2016, according to the Survey of Consumer Finances. That is more than five times the wealth that a typical college-educated African American family held ($68,200) or Latino family ($77,900).

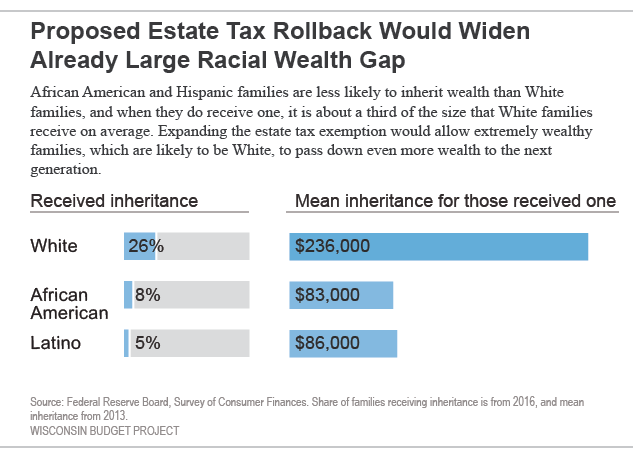

One of the reasons that white families have more wealth than African American and Latino families is because white families are far more likely to inherit wealth. Only a small share of families of any race receives an inheritance and white families are more than three times as likely to inherit wealth than African American or Latino families. Twenty-six percent of white families received an inheritance, compared to eight percent of African American families and five percent of Latino ones. And when white families do receive an inheritance, it is on average much larger than the size of the inheritance African American or Latino families receive: $236,000 for white families, compared to $83,000 for African American families and $86,000 for Latino ones.

Now Congress is looking to expand even further the ability of extremely rich people to keep wealth within their own families. Currently, a married couple can leave up to $11 million to their heirs without paying an estate tax. In Wisconsin, only 70 estates are estimated to owe estate tax in a year, and 99.9 percent of estates in Wisconsin owe no estate tax at all. The tax plan passed by the U.S. Senate in a nearly party-line vote doubles the exemption level to allow a couple to pass down $22 million to their heirs tax-free; the version of the plan passed by the House of Representatives eliminates the estate tax altogether. Eliminating the estate tax costs $275 billion in tax revenue over ten years — more than the combined cost of funding the Food and Drug Administration, the Centers for Disease Control and the Environmental Protection Agency.

The massive windfall that the extremely wealthy would get from repealing or scaling back the estate tax would allow wealth to become even more concentrated in just a few hands — hands that are likely to be white — and would make it harder for everyone else to climb the economic ladder, especially families of color. It is one more provision in the federal tax proposal, among literally dozens of others, that would limit opportunity, economic mobility, and financial security. This page on the Wisconsin Budget Project site has more about how the federal tax proposals would affect Wisconsin residents.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Agree the wealth gap is an increasing problem which needs solutions.

I don’t agree that the tax plan would drive an increasing gap in a significant way. The effective tax rate is much, much, much higher for mid-to-high income levels than lower income levels. Current effective tax rates are about 5% for people at 25k to 50k income and doubles over 100k of income, then is 5X the lower rate for people in the 500K to 1M income range. So changes to the tax code that affect tax payers across the board (like removing SALT deductions) mean they have a greater affect on higher income and tax levels.

The consolidation of tax rates in the Senate and House plans will mean some people will pay a higher rate than they do now and some will pay a lower rate. Although I don’t want to be on the losing end of the consolidation, this doesn’t appear to the a measure to widen the wealth gap to me.

The inheritance difference between races is an interesting concept, but I do not see the numbers to support the conclusion that it is one of the reasons that there is a wealth gap between the races. The actual inheritance amounts on the whole are not large enough for individuals to create “wealth”….it’s more like enough to create a good Christmas for someone’s family.