Which Federal Tax Plan Is Better?

Majority of taxpayers lose under both plans, but in different ways.

Republican leaders in the U.S. House of Representatives and in the Senate have put forth their own versions of the changes they would like to see made to federal income taxes. While there are different provisions included in the two plans, they are more alike than different. Here are five ways that the House and Senate tax plans are fundamentally similar.

1. A sizeable number of taxpayers with low and moderate incomes would be paying higher taxes under both bills.

Under the newest Senate plan, more than a third – 34% — of Wisconsin taxpayers in the bottom three-fifths of the income spectrum would have a tax increase by the time all the provisions are fully phased in. In contrast, only 1% of the Wisconsin taxpayers in the top 1% by income would experience a tax increase. That group has an average annual income of $2.5 million.

In the House tax plan, 10% of Wisconsin taxpayers with low and middle incomes would have a tax hike, compared to 8% of taxpayers in the top 1% by income.

Under the newest Senate plan, the top 1% of Wisconsin taxpayers by income would pay $7,870 less in income taxes on average. Low- and middle-income taxpayers would pay $190 more on average each year when the provisions are fully implemented.

Under the bill that was approved by House of Representatives, the top 1% would receive an average tax cut of $81,330. That’s more than two hundred times the size of the average tax cut of $340 that taxpayers in the bottom three-fifths of the income spectrum would receive. This bill has passed the U.S. House of Representatives, with six Wisconsin representatives voting in favor: Paul Ryan (R-Janesville), Jim Sensenbrenner (R-Menominee Falls), Glenn Grothman (R-Campbellsport), Sean Duffy (R-Wausau), and Mike Gallagher (R-Green Bay).

3. Corporations, rather than individuals and families, win big in both bills.

This article from National Public Radio explains how the Senate’s revised bill includes some temporary tax cuts for individuals, but permanent tax cuts for corporations:

[A]mong the proposals: making nearly all of the tax changes for individuals temporary, while keeping major corporate changes permanent. The cuts in individual tax rates, the bump in the standard deduction and the larger child tax credit, among other things — all these would end at the end of 2025, as would proposed tax cuts for “pass-through” entities — businesses that pay taxes through the individual income tax code. However, many changes on the corporate side, which are centered on a rate cut from 35 to 20 percent, would remain permanent, as would the proposed elimination of the individual mandate penalty.

Like the Senate bill, the House tax plan drastically cuts the corporate income tax rate from 35% to 20%.

4. Economic security for many taxpayers would be jeopardized by both bills.

Both bills include several changes that would make it harder for low- and middle-income families to thrive economically. One example in the revised Senate bill is the repeal of the requirement that everyone have health insurance, a change that would increase the number of uninsured people by 13 million. That move would drive up premium costs as healthy people with low health care costs opt out of the health insurance system, leaving the remaining pool of people saddled with higher costs.

The House bill includes several changes that would make higher education less affordable, including eliminating the deduction for student loan interest, and requiring students pursuing advanced degrees who have their tuition waived to pay taxes on the value of that tuition. The House bill also scraps a deduction for people with very high out-of-pocket health costs, making it harder for taxpayers to afford long-term care and other major medical expenses.

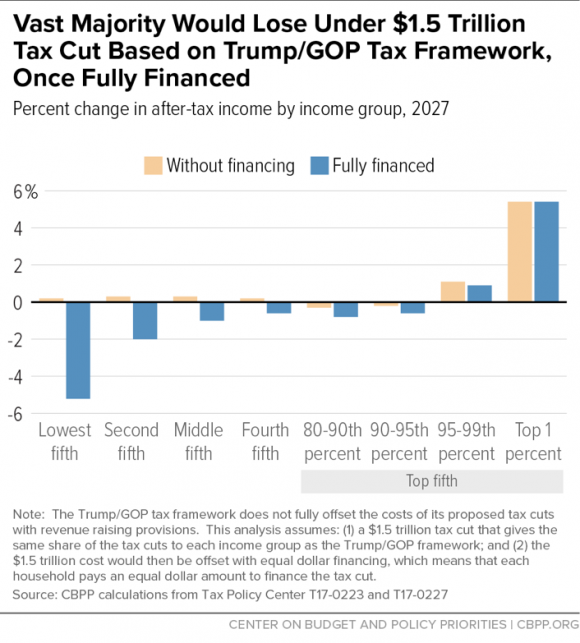

5. The vast majority of taxpayers would be losers under both bills when you consider how the tax plan will likely be paid for.

Both plans add $1.5 trillion to the deficit over ten years, and it’s likely that the tax cuts will be at least partially financed with the types of spending cuts included in recent GOP budget proposals, which fall overwhelmingly on low- and middle-income people. As the Center on Budget and Policies noted:

Sooner or later, the cost will need to be offset through some combination of spending cuts and tax increases. We conclude that the spending cuts and tax increases needed to offset the cost of the Trump/GOP tax cuts would cause most Americans’ incomes to fall more than they would gain from the tax cuts themselves.

The chart below dates from before the details of the bills were released, but it gives an overall picture of how the cost of these plans for low- and middle-income taxpayers increases dramatically when the effect of the budget cuts that will likely follow in the wake of the tax cuts are included.

Vast Majority Would Lose Under $1.5 Trillion Tax Cut Based on Trump/GOP Tax Framework, Once Fully Financed

For more information on how the federal tax plans affect taxpayers, go to the Institute on Taxation and Economic Policy or the Wisconsin Budget Project page on this issue.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

“Which federal tax plan is better?” Or, more precisely, “Who is your favorite Melendez brother?”

There have been two waves of social progress in our country in the past century. The first was the New Deal and later related legislation, which said that you don’t let people die in the street, or in total poverty after having worked all their life, or because they can’t afford health care. (Social Security, Medicare, Medicaid). The second wave was extending those and other basic rights to previously excluded groups: women, black people, handicapped people and lgbt people.( Civil rights and related laws)

Each of these waves of progress has triggered a powerful reaction, first to the New Deal, and then, beginning with “white backlash” to the second “inclusive” wave. These reactionary forces are now the most powerful political movement in our country and control all three branches of the federal government. They combine racial animus, nativism, the enormous power of corporations and the greed of the wealthiest Americans.

As is now clear, this tax bill is being written for these groups. Probably even by them. They are the financial engine of the reactionary movement. Having succeeded in achieving power through the eternal search for scapegoats, they will now move on to phase two, which is to eliminate the country’s basic social safety net programs. This has always been the focus of the Ayn Rand fan from Janesville and his donors and supporters.

So, somewhere around 2020, as the growth projections are proven to be a fraud, deficits spiral out of control, and the need to spend trillions on high tech and thermonuclear weapons to chase terrorists around the world becomes more urgent, there will be a new deficit crisis. And, Voila, the urgent need for “entitlement reform,” which will bring back drastic cuts to Medicaid, proposals for Paul Ryan’s favorite, Medicare vouchers of declining value, and the conversion of social security to a privatized program, like the one in Chile.

If they are successful, so much for a century of social progress.

Note: “Who is your favorite Melendez brother?”

@Frank Schneiger: Are you black and are you from Milwaukee?

RB: That depends. What are the right answers?

@ Frank Schneiger-

Apparently @RB did not much care to hear your well though out and realistic analysis of America’s “Grand Old Party’ and our current political winds. When you can’t debate, attack.

In my estimation the greatest internal threat to our countyr is the transformation of our democratic republic government to a plutocracy. This threat is very real and growing by the day.

@Adam

@Frank Schneiger:

That’s where you stand corrected. I agree 100% with what both of you say

I’m a leftist black male from the North Side of Milwaukee who believes that America has been a capitalist white hegemonic society since 1776, and believes that both Tom Barrett & Scott Walker are complicit in the oppression of African Americans & Latinos in Milwaukee.

I assumed by your last name, you were probably white and I was shocked to hear a comment from a white person in a racially divisive city like Milwaukee, who actually knows the root problems in our country.

Which federal tax plan is better? That’s easy,

Bernie Sanders!

RB, thanks for the compliment. Yes, white and from Milwaukee, but now live in New York City. A follow-up thought on your comment, in most places in this country, but even more in Milwaukee and Wisconsin, when they say, “it’s not about race,” it’s about race.

@Frank Schneiger:

I agree. Often times race is neglected both on the left and right.

How do you feel about Barrett? You seem very well read.

RB: Whenever someone asks, what do you think about (fill in the name), I always get nervous because I know, if I say something ether good or bad, the response will be, “But what about….?” So I start with two thoughts: first, that we are talking about an elected official, who is human and makes mistakes, and not the second coming of Jesus or Mother Theresa. And, second, to ask: what would I do in his or her place, realizing that in a diverse and fractious jurisdiction, this person has succeeded in being elected to office.

That a being said, in my judgment, being Mayor of Milwaukee is not such a hot job compared to being mayor of a lot of other cities. First, you don’t have much real power. You don’t control the police, fire, schools or many jobs. Then you have the Common Council and other bodies with parochial interests. Next, the city is just recovering from deindustrialization, the loss of many good jobs, erosion of its tax base, and, more recently, the Great Recession. So there isn’t much money to do a lot things that define being “good” as a public official. Then, you have to navigate Milwaukee’s racial dynamics, which are no longer just black and white, which was hard enough. Then, in these times you have a state government that is in the hands of extreme reactionaries and plutocrats, most of whom hate cities and their diverse residents. Finally, you have a local power structure that tends to be conservative and risk averse. Not many levers that you control, but lots of annoying people trying to stop you from doing things.

With those things being said, I think Mayor Barrett has been a good mayor in a very difficult time. Downtown and the Valley are big development successes, as are many of the city’s other thriving neighborhoods. He has managed social relations well in a difficult and threatening environment. And, in our times, and something that should not be undervalued,, he has governed with a sense of dignity, honesty, and respect for others.

In the long-term, I believe that Mayor Barrett’s legacy, assuming another term, will be partly defined by what happens to the neighborhoods on the North Side. In those neighborhoods, I think there needs to be a major effort, comparable to downtown, one that builds healthy, peaceful communities with dramatically reduced levels of violence, without gentrifying the people living in them out of their communities. That will, I think, be the big challenge in the future. It can be done because it has been done in other places.

@Frank:

Fair enough. You bring up valid points. I don’t think Barrett has been progressive as a Mayor in the way an Aja Brown with. In my opinion he is a mayor beheld to corporations who has spent the same amount of money revitalizing Downtown that would go towards solving lead poisoning on the North & South Sides.

@Frank:

I feel if elected. Mike McGee or Ashanti Hamilton may/may’ve been our greatest mayors.