Abele Battles Board on Budget

Once again. Even if it means swapping their old ideological positions.

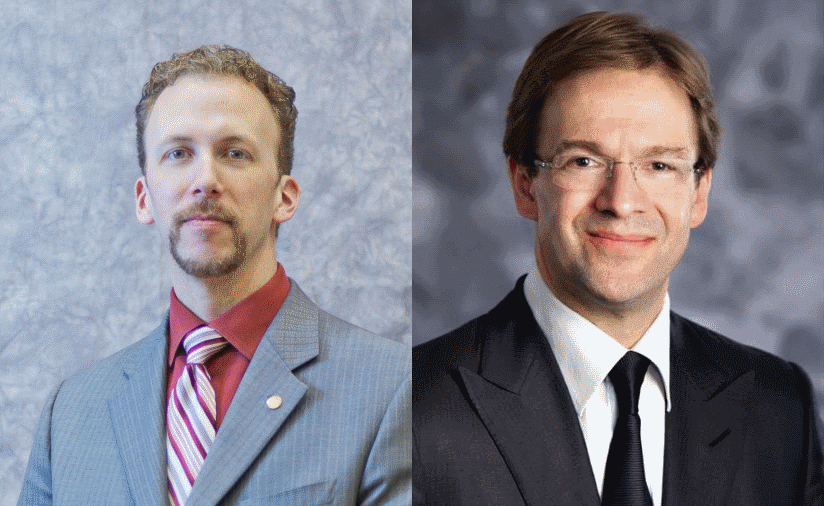

Remember the old Chris Abele? The county executive whom board members like Marina Dimitrijevic derided as “Walker lite” — a mere clone of his predecessor Scott Walker? Year after year board members, including Dimitrijevic’s successor as board chair, Theo Lipscomb, fought Abele’s budget cuts, charging him with a lack of compassion to county employees and not caring about the county parks or county transit.

But beginning with last year’s budget deliberations, in the fall of 2016, Abele and the board suddenly swapped positions. Abele took the fiscally liberal position, calling for the county to pass a $60 wheel tax, and board members derided the proposal. “This is so out of character and so contrary to everything he has said during his past budgets,” Board Chairman Lipscomb fumed, before reacting with a position that was so out of character and contrary to everything he and the board had stood for. Yep, Lipscomb and the board turned into fiscal conservatives, cutting Abele’s requested tax in half, to $30.

And so the fiscally liberal version of Abele has returned this fall, asking to increase the wheel tax by $30. Which meant the board chair had to respond with frosty fiscal conservatism. “County Executive Abele continues to ignore the will of the voters, who opposed his $60 wheel tax by a landslide 72 percent margin in April,” Lipscomb declared, in opposing the hike.

The reality is the county is squeezed by the high costs of pension payments, due to the infamous pension plan of 2000-2001, which made many county retirees wealthy, and by ever-declining state aid. Couple that with a state cap on property tax increases — counties and municipalities can only increase the levy in line with the value of any new construction — and you have a recipe for a “structural deficit,” as the non-partisan bean counters at the Public Policy Forum (PPF) have declared in their annual analysis of the county budget.

But Abele’s fiscal conservatism has helped chip away at the problem. He’s annually reduced the number of county employees, the number and square footage of county buildings, the county’s energy costs, and the cost of workers compensation with tighter management, while requiring more contributions to employees for their health care. This in turn enabled him to chip away at the county’s long-term debt and annual debt payments, from $51.6 million in 2013 to $33.6 million in 2017.

“The County’s impressive ability to reduce its capital-related debt” has realized savings that “can be used to address other operating and capital budget needs,” the PPF’s latest analysis concludes.

Abele has also opposed wild bouts of board spending like its idea of giving free bus rides to senior citizens and disabled riders, which cost millions more than board members had projected. The board finally ended the free program, imposing a financial means test on GO Pass users, charging $5 for new cards and swapping the unlimited free rides for a $1 all-day pass.

But Abele has lately had some fiscally liberal thoughts, embracing more service, including an innovative program to serve the chronically homeless, a new county Office of African American Affairs, and his 2018 budget proposal to add $1.1 million in funding to help two county agencies deal with the still growing problem of opioid addiction. The numbers of addicted people are “shocking,” Abele says, adding that “it would be very hard to justify not doing what we can.”

Even without these additions, the county would face a big budget shortfall: a $30 million budget gap for 2018, the PPF finds, of which the $30 million wheel tax increase would raise $14.6 million, while increases in county fees (like parking fees at parks and bus fares) would raise $11.3 million, with the rest coming from a debt service reserve withdrawal.

Lipscomb reacted to Abele’s budget by pushing board members at a Committee of the Whole to go back to the current base budget, and start over, but the proposal didn’t carry, failing on a tie vote.

He also pushed for department cuts rather than hiking the wheel tax. “I asked all county departments and divisions for recommendations for expenditure reductions that yield net savings totaling 2 percent and 5 percent,” Lipscomb says.

A 2 percent cut would equal an $8 million reduction in the proposed budget, while 5 percent equals a $20 million annual reduction.

Led by county Director of Administrative Services Teig Whaley-Smith, the Abele administration responded with a detailed list of possible cuts, with the repeated message that “Neither the County Executive, nor the Department Heads, recommend these changes.” Then Abele followed with a press release attacking Lipscomb for proposing to “Slash Funding for Parks, Public Safety, Transit, Senior Citizens.”

But Lipscomb remains uncowed, and says board members are still reviewing the budget. “There are numerous town halls scheduled by supervisors across the county in coming weeks. I expect County Supervisors will do their job and represent their constituents,” he says.

But Abele says the April 2017 referendum — paid for by taxpayers — was a waste of money: you could predict voters wouldn’t approve a wheel tax because the referendum didn’t explain what services would be funded. By contrast, he notes, when board members did the 2008 referendum calling for a sales tax increase, the language said the money would pay for parks, transit and paramedics and to reduce property taxes (and it barely carried, by 52 percent to 48 percent.)

So Abele paid for a privately done survey of county residents noting the wheel tax was voted down and asking if they would support “raising taxes and fees to maintain the County’s current level of investment in public transit, bus routes and fares, and to fund local infrastructure projects like repairing local roads and bridges.” The survey found 51 percent favored this, 45 percent opposed and 4 percent weren’t sure.

It’s easy to find fault with the wording of all three surveys of voters going back to 2008. But it’s worth noting that a wide range of groups and individuals favored the $60 wheel tax last fall, including independently elected county Comptroller Scott Manske, the Metropolitan Milwaukee Association of Commerce, Milwaukee Transit Riders Union, Hispanic Chamber of Commerce and Public Policy Forum.

But the reality is the battle between Abele and the board will continue no matter what voters or advocacy groups think. I wouldn’t be surprised to see the board again cut Abele’s request in half, approving a $15 increase in the wheel tax. And no doubt Abele will come back next fall asking for another hike in the tax. Call it sad, call it comic, call it tedious, but it’s the Milwaukee County way.

If you think stories like this are important, become a member of Urban Milwaukee and help support real independent journalism. Plus you get some cool added benefits, all detailed here.

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.

Murphy's Law

-

National Media Discovers Mayor Johnson

Jul 16th, 2024 by Bruce Murphy

Jul 16th, 2024 by Bruce Murphy

-

Milwaukee Arts Groups in Big Trouble

Jul 10th, 2024 by Bruce Murphy

Jul 10th, 2024 by Bruce Murphy

-

The Plague of Rising Health Care Costs

Jul 8th, 2024 by Bruce Murphy

Jul 8th, 2024 by Bruce Murphy

I’m surprised there’s no mention of the effect of the County’s annual payment for the Bucks stadium on the County budget. Are old bill collections covering much of the $4 million annual stadium commitment, or is that more “liberal” County spending that boosts the need incrementally for a higher wheel tax?

Chris Abele recently told Channel 4 reporters he has a very good relationship with Scott Walker. Abele has gotten the GOP-led Legislature to pass numerous initiatives at his request.

In his ongoing wheel-tax campaign, why doesn’t Abele expend any political capital (and clout in Madison) to request enabling legislation from the Legislature for a wheel tax indexed to car value, like many states have? It means people who drive more-expensive cars pay a higher registration fee. That could raise additional revenue without soaking people who can least afford to pay $155 a year in total wheel taxes. For someone earning minimum wage, $155 is more than a full week’s pay.

What sticks in the craw of most county taxpayers is that $4 mill a year for 20 years to fund something the owners of the Bucks on paper can afford easier than the county. That $4 mill would erase the need for a wheel tax, which Abele now says he loathes but has no choice. But he did have a choice when he made the deal. Would the Bucks really walk at frugality for taxpayers on public funding of private sports palaces that even the president said was wrong? The owners weren’t even put to the test.

Maybe your right DPN, who needs the Bucks? or for that matter the Brewers. Brown County had little resistance in helping the Packers.

Couple things:

Phil – Senator Larson removed the bill collection provision from the Bucks Arena deal leaving the obligation with no revenue to offset it, then promptly ran for County Executive.

4 Tax Equity – Speaker Vos was attempting to wipe out all wheel taxes except those approved by referendum in the last budget. It’s a miracle that revenue source is still available.

Mr Noth – the wheel tax will add $14.7 million in revenue to the budget. $4 million is something but nowhere near enough revenue.

How awesome will it be when Foxconn gets $3 billion from State of Wisconsin taxpayers and then uses some of that to buy the naming rights on a building paid for by taxpayers in which the owners keep all of the naming rights money?

I agree with Mr Noth regarding County money Abele threw on the table for new BUCKS Arena. Abele acted like he was at a casino. He felt compelled to ante-up with the hedge fund hustlers. Must of been a “low T” day. Except wasn’t his money. I beleive Abele must pay this debt himself!

tax tax tax abelee and barrett one thing they are good at, making money they fail at