Bill Hikes Taxes on Low-Income People

Estimated 11,400 households will get tax hikes averaging $614.

Despite the claims of state lawmakers that the biennial budget bill cuts property taxes, the actions of those policymakers will increase property taxes for thousands of low-income Wisconsin households. The budget bill does that by significantly reducing funding for the Homestead Tax Credit, which was designed to provide targeted property tax relief to low-income homeowners and renters.

A new Wisconsin Budget Project summary of tax changes in the budget bill describes some of the major items, which include more than $400 million of tax cuts. But the bill cuts funding and eligibility for the Homestead Credit, and the Joint Finance Committee (JFC) rejected the Governor’s proposal to increase the state’s Earned Income Tax Credit.

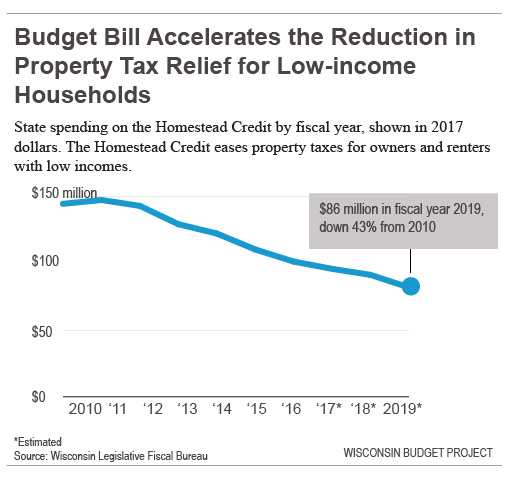

Funding for the Homestead Credit is reduced by about $10 million over the next two years, which is part of a long drop in the amount of this tax relief since 2011. As the following graph illustrates, the spending for the credit in 2019 is expected to be 43% below the level in 2010, after adjusting for inflation.

There are two reasons for the drop in this property tax assistance. Most of the decrease since 2011 can be attributed to the fact that this credit is no longer adjusted for inflation, unlike nearly all of the rest of the state tax code. Governor Scott Walker’s first budget repealed those annual adjustments, and the effect has been steady erosion in both the number of people who qualify for the credit and the amount they receive.

As inflation gradually raises incomes, more people exceed the income eligibility ceiling, which since 2011 has been frozen at $24,680. That’s an important reason why the number of households getting the credit fell by about 49,000 from 2010 to 2015, a drop of 24%. In addition, the sliding scale structure of the credit means that as incomes gradually rise, those who remain eligible receive smaller amounts.

A more immediate factor that will boost property taxes for low-income Wisconsinites is a provision in the budget bill that makes non-elderly, non-disabled people ineligible for the Homestead Credit if they have no earned income from employment. According to the Legislative Fiscal Bureau, that change will mean that about 11,400 households will lose $7 million during the second year of the budget period, or an average of $614 each.

This provision radically changes the Homestead Credit, which formerly provided the most property tax relief to people with annual income between zero and about $8,000. It will be a harsh economic blow to many Wisconsinites who have lost their jobs or who face barriers to work. For example, someone who gives up their job to care full-time for a sick relative is likely to lose their Homestead Credit.

The Joint Finance Committee amended the Governor’s Homestead Tax proposals in two respects. The committee narrowed the scope of the cut in the credit for people with little or no earned income, so it cuts property tax relief for those low-income households by $7 million per year, instead of $12 million. Unfortunately, JFC rejected the Governor’s proposal to adjust the credit for inflation each year for seniors and people with disabilities. As a result, inflation will continue to fuel the decline in this property tax assistance, which is illustrated in the graph.

In other bad news for low-income Wisconsinites, the Finance Committee rejected the Governor’s proposal to increase the Earned Income Tax Credit (EITC) by about $20 million for 130,000 low-income working families. That proposal would have gotten funding for the EITC back to roughly where it was before Governor Walker and the legislature cut the credit in 2011.

The tax changes in the budget bill are more favorable for wealthy Wisconsinites. The bill completely repeals the Alternative Minimum Tax, which insures that people with high incomes and large deductions or credits pay at least some level of income tax. This tax was largely eliminated in the 2015-17 budget, and the remainder of the tax is being repealed by this budget, starting in tax year 2019. This change, which takes effect in 2019, is expected to cut taxes for about 1,850 well-off Wisconsinites by $7.0 million per year, which happens to be the same amount as the property tax increase for the 11,400 households who will lose eligibility for the Homestead Credit

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Sounds like a good way to help pay for improvements to a Wisconsin Rapids airport.

In the age of reaction, which gained full force in the Reagan years, some basic “principles” became entrenched in American life: (1) government is bad, your enemy; (2) Taxes are theft, taking from the deserving and giving to welfare queens; (3) Getting rich is what makes America great; (4) Only businessmen know what they are doing; everyone else is stupid, and (5), white people are the best race, still #1 despite being victimized by the “others.”

Over time, these notions morphed into a powerful reactionary force, the one that now dominates Wisconsin and the United States as a whole. A significant portion of those white Americans now define themselves as victims, historically a very dangerous development (see Serbs, Israelis, Palestinians). The term “the American People” has come to be narrowly defined to include only those who can be defined as Trump/Walker constituents (white, suburban, right-wing, reasonably well off, Christians + David Clarke to prove that we’re not racists).

Everyone else has been “other-ized,” including not only black people, poor people, Muslims and immigrants, but most notably, the hated liberals.The worship of wealth reached new heights in the most unequal/least upwardly mobile society in the developed world.

And, to support this narrative, the need to believe lies, or as George Constanza would say, “It’s not a lie if I believe it,” became an ever more important part of the picture, making outlets like Fox News central to keeping the music playing.

The United States is not a cruel country, but like any country, it has cruel people. This legislative act and the budget are just part of the picture that demonstrates that cruel people are, for at least the present, in the driver’s seat.

Frank, you stipulate that common American folk believe that white people themselves are the “best race”. Few Americans think that way. We see in cities like Miamii, Tampa Bay and Houston all lots of life helping each other. Your point may be valid a different way by other races actions. We see by large numbers mass migrations of Asians, Arabs, and Africans to nations that were established historically by white men. Europe and North America (excluding Latin America) are desirable destinations to find job, and raise a family. Maybe these minorities feel that that countries set up by a white race is far superior than the lot that they were given.

Troll white supremacists are flourishing right now. They are recruiting like never before. The number of hate groups is skyrocketing. Your anecdotes do nothing to change those facts. And your last sentence? Something only a white supremacist would say. Textbook white supremacy. So at least you let your true colors be known. A Troll and a White Supremacist.

Jason your reply to Frank is proof of what he is saying. Your understanding of history is tainted. This country was not built by white men. Wealth was created here by buying, selling and propagating African slaves. Our nation’s capital was constructed using the labor of African slaves. Chinese laborers were imported to build the railroad. However, Chinese women were forbidden because the we didn’t want Asians settling in the US. Of course there are the many broken promises made to the Hispanic populations of the Southwest so we could keep the cheap labor coming without really accepting them as neighbors. Then there are the peoples who actually lived in this country before the white man came. Contrary to popular myth, these were thriving communities before the white diseases decimated them. History is far more complex than the jingoistic Fox News would have you believe. There is no superior race among humans. We are all of one race.

“Jason your reply to Frank is proof of what he is saying.”

Truer words have never been spoken here.

white supremacy is alive and well in AMERIKKKA Jemele Hill spoke the truth about tRUMP ,A RACIST WHITE SUPREMACIST ,

Frank, well written commentary. Ditto.

“There is no superior race among humans. We are all of one race.”

These words are the truest spoken here.

Thanks mkwagner.

No one one disagrees the trail of tears didn’t happen or that Jim Crowe is a stain on our country but how long will you Liberals cry about the sins of past generations. Is it really productive to tell a person of color that they are a victim of this society and that they cannot make it here because racism is everywhere. Current history seems to provide the opposite of your beliefs. Asians , Latinos and Arabs are increasing their migration numbers in our country. There is only so many of you lefties. How will you tell them all that they cannot make it here because of racists whites. Hopefully, they will laugh at you and vote conservative. They recognize that a society built by our founders is better than their current circumstances.

Jason Troll: Let me respond to your comments. First, it is interesting that in comments that were mostly about shifting the tax burden to poorer people, across racial groups, you seem to have a profound interest in the racial dimension, in particular the innocence and greatness of white people, which was kind of one of my points.

Let’s start with language. You say that I talk about “common American folk.” I would never use such condescending language in describing my fellow citizens. Across all races and groups, there is a continuum from brave/courageous people to good people to indifferent people to bad people who let others do the dirty work to bad people who organize the dirty work to those who carry the dirty work out. You seem to imply that “common American folk” are white, the hardworking, taxpaying family people. Well, there are lots of such people who are not white, who work like hell, keep a family together and help others. Who do you think those people in our hospitals, nursing homes and home health care agencies are? Everything you say contradicts your self-perception as the fair-minded white conservative.

Then, let’s take history, which seems to be another of your favorite subjects. You mention the “Trail of Tears and Jim Crow (one “e,” not two) and take the standard right-wing white position: “get over it”/ancient history. Well, exactly what do you know of the Vail of Tears and the related genocides? Do you know that 90% of the native population of this country was exterminated. Do you know the book “Murder State” by Brendan Lindsay about he state organized genocide of Indian groups to make California white? Do you think that Jews should “get over it”? Like the right-wing view of the Holocaust, are slavery, racial oppression and genocide just “trifles of history”?

Then we come to what appears to be your favorite group: black people. What exactly do you know about Jim Crow? Do you know a book titled “Slavery by Another Name”? it makes a strong case that semi-slavery and racial terror continued in much of the South up until the 1960s. Do you think that the history of your family has affected your life and prospects? But in Jason-land, black people, victimized for 400 years, should not fall into the trap of seeing themselves as victims. Do you know that the Great Migration of black people from South to North was one of the greatest mass movements in history of people fleeing oppression and violence. Only to arrive in the welcoming arms of Milwaukee, Chicago, Detroit.

People migrate to this country for several reasons, only one of which is that they see it as a land of opportunity. Many are fleeing violence and destitution in their countries. One thing that is interesting, especially among Latino people is that, when they first arrive, they often ask, “why are black people so angry and hostile”? After a couple of years, they say, “Now I know why.”

Finally, again not to lose sight of the unfairness of shifting the tax burden from Diane Hendricks to poor property owners (0f all races), there is a subtext to much of the white-identity stuff that you represent. It is the misplaced demographic fear of whites “losing control.” When you look just below the constant professions of innocence and attacks on black racism, there is a fear. It is a fear of what “they” would do to “us” if they ever got power. That fear, despite all of the protestations of innocence, is driven by some understanding of what “we” did to “them.” And it makes continuing to believe the lies that you believe all the more important.

Jason Troll: Final thought on the laughable liberals. Here is a very partial list of liberal achievements in the past century:

Progressive income tax

Social Security

GI Bill

Aid to education

Medicare

Medicaid

Civil Rights Acts

Voting Rights Acts

Clean Air Act

Clean Water Act

Worker Safety Acts

Here is what I believe is the list of “conservative” achievements over that period:

Tax cuts for the rich

Corruption of electoral processes at every level of government/driving down incomes

Gutting environmental protections

Corporate control over most sectors of American life

Guns, guns, guns

Donald Trump

Jason, you may wish to call your Senator to make sure he supports the pending Republican legislation that will make it much easier for people, including crazy people, to get silencers for the high powered weapons.

A lot of rage, Frank. I question how many times Latinos actually approach you “angry Frank”. and state you know all these blacks are angry and after a year or two around white people I understand. Thank you, Frank the Hispanic whisperer. On the article its a joke the author whines we should index poverty credits. The top 10 percent pay 80 percent of all taxes. The bottom 10 percent “Frank’s kids” get paid to sit on their asses.