Study on MAC Tax Credit Badly Flawed

Manufacturing and Agriculture credit goes to wealthy, not to job creation.

Governor Walker delivers remarks at Wisconsin Manufacturers and Commerce’s Business Day in Madison, 2013. Photo from the State of Wisconsin.

Last week, former Marco Rubio economic adviser Noah Williams released a paper on the Manufacturing and Agriculture Tax Credit (MAC), touting the success of the $654 million corporate tax giveaway that mainly benefits Wisconsin’s wealthy. Under the MAC, 88 percent of the multimillion dollar giveaway goes to people making more than $500,000, with 11 multi-millionaires making more than $30 million each receiving nearly $22 million in tax breaks. Wisconsin has consistently lagged behind the national average in terms of manufacturing job growth, sitting at 1.4 percent, compared to 2.1 percent nationally, and actually lost 4,000 manufacturing jobs in the last year (September 2015 – September 2016).

Illogically, Williams, whose analysis compares employment trends in counties along the Wisconsin borders with neighboring states, attributes all net manufacturing job creation in Wisconsin since 2013 to the MAC. Yet there are no job creation requirements tied to receiving the tax credit and there appears to be no other documented instances in state and local development literature of a business tax cut having an economic impact of similar magnitude.

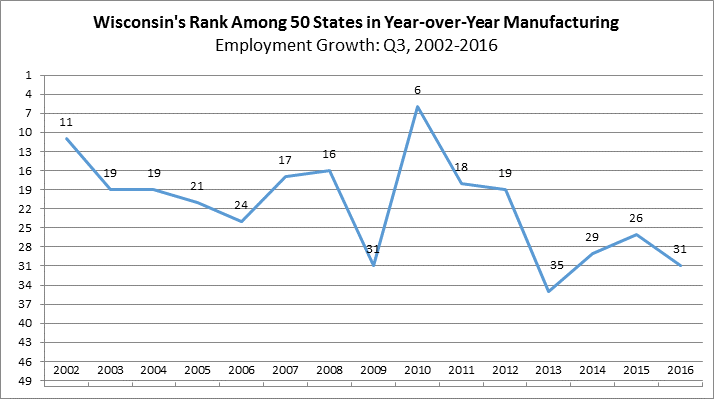

According to other economists who have examined the employment data, there is no evidence that the MAC has boosted Wisconsin’s standing among states in year-over-year manufacturing growth. There are significant flaws and critical analysis problems with Williams’ paper, as detailed below:

- Williams’ general conclusion is illogical. Williams essentially claims that MAC accounts for ALL net manufacturing in Wisconsin over a three year period, without taking into account other policies that have been implemented.

- Williams incorrectly applies “border county” analysis and compares apples to oranges. Williams’ report does not account for key differences between counties compared, including the size of the counties, their individual economic development policies, and the size and quality differences in their labor forces. Rather than examining aggregate data of border counties, the author pairs Wisconsin counties with neighboring state’s counties that are not similar. For example, one of his pairings consists of Pepin County and Wabasha County. Manufacturing employment in Wabasha is ten times greater than Pepin, with manufacturing wages 13 percent higher in Wabasha. Other than being geographically close to each other, there is no reason these two counties are comparable. This distorts and ultimately adds inaccuracy to his analysis.

- Empirical results do not support Williams’ conclusions. Williams own data indicates that Wisconsin has struggled to create manufacturing jobs since the implementation of the MAC. With the exception of one year, Wisconsin’s rank among 50 states in Quarter 3 year-over-year manufacturing employment growth was substantially higher under Governor Doyle’s administration than Governor Walker’s administration. (See chart below)

Other important notable facts that were left out of Williams’ analysis:

- Over the first seven years of MAC being enacted, the tax giveaway is estimated to cost more than $805 million more than GOP lawmakers originally anticipated. In 2019 alone, the cost for this tax break is projected to rise to $334 million.

- The average weekly wage in manufacturing in the Minnesota border counties in Quarter 3 of 2016 was 27 percent HIGHER than manufacturing wages in WI border counties.

- Since 2013, the Minnesota border counties have generated jobs at over triple the rate of Wisconsin border counties. Minnesota has seen an increase of 11.5 percent, while Wisconsin has experienced just 3.4 percent growth.

At a time when President Trump and my Republican colleagues are obsessed with “fake news” they should be more concerned with this “fake study” they’ve been touting. This study provides no evidence the MAC tax credit has boosted Wisconsin’s economy.

Chris Taylor, D-Madison, represents District 76 in the Wisconsin Assembly.

This article is a great illustration of how to lie with statistics. Kudos to the author for exposing these lies. Walker’s policies have hurt the Wisconsin economy, and it will take years to recover if and when we invest in the real growth factors that could bring jobs instead of handing of tax credits to campaign contributors. Chief among the examples of how to move forward: invest in high speed rail along the lake shore corridor and west through Madison and the Twin Cities. Allow the health care sector to create a WI health network under the Affordable Care Act. Stimulate start ups by keeping the promised infusion of investment resources at Innovation Park and others. Increase investment in sustainable energy.