Tax Credit Helps Rural Working Families

More than 1 in 10 families in 27 mostly rural counties benefit from earned income tax credit.

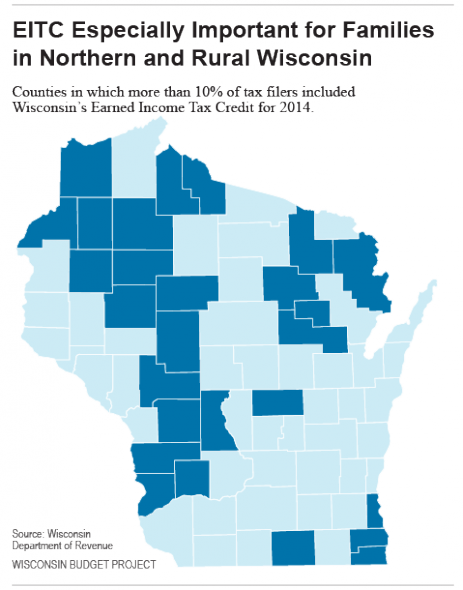

The Earned Income Tax Credit helps working families all across the state, and gives an especially large boost to families in northern and rural Wisconsin, according to recently-released information from the state’s Department of Revenue.

The EITC is a tax credit that benefits working parents who are struggling to make ends meet. Receiving the credit is associated with a whole host of positive outcomes for children and families, including helping children do better in school, raising college attendance rates, and improving the health of family members.

The number of families in Wisconsin that are strengthened by the EITC is substantial. In 2014, 253,000 of the total 2.9 million tax returns filed in Wisconsin included the EITC. That translates to 753,000 people in Wisconsin living in families that received the EITC. Those families received $99.6 million in EITC credits for 2014 – money they could use to make investments that help them keep working and improve the economic security of their family, such as paying for car repairs or saving for their children’s college educations.

The average credit amount in 2014 was $394 per tax return.That’s down 22 percent from the $502 average in 2010, after taking inflation into account. That decline stems from the fact that Gov. Scott Walker and state lawmakers cut the EITC in 2011, decreasing the credit amounts for working families with more than one child. That cut increased the amount of taxes that working families with low incomes are paying.

Statewide, 8.7% of tax returns in the state claimed the EITC. But in 27 Wisconsin counties, more than 10% of tax returns, or one out of every ten tax returns, included the EITC. Counties with the highest share of tax returns claiming the EITC were clustered in northern, rural Wisconsin, where incomes are lower than in more urban areas of the state.

Counties with the highest share of tax returns claiming the EITC are shown below. Except for Milwaukee County, the other counties in which tax filers are the most likely to claim the EITC are all located in northern Wisconsin:

- Menominee County, 36.6%;

- Milwaukee County, 13.8%;

- Ashland County, 13.4%;

- Sawyer County, 12.8%;

- Rusk County, 12.7%; and

- Forest County, 12.7%.

The EITC plays an important role in helping many working families make ends meet, and is an especially important support for families in northern Wisconsin. We should protect this important tax credit and make sure it can continue to help strengthen Wisconsin families.

The KIDS COUNT Data Center includes information on the share of population benefitting from the EITC in each county for past years.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock