Tax Cuts Do Little to Spur Job Growth

Cuts skewed toward wealthy and haven't created jobs, statistics show.

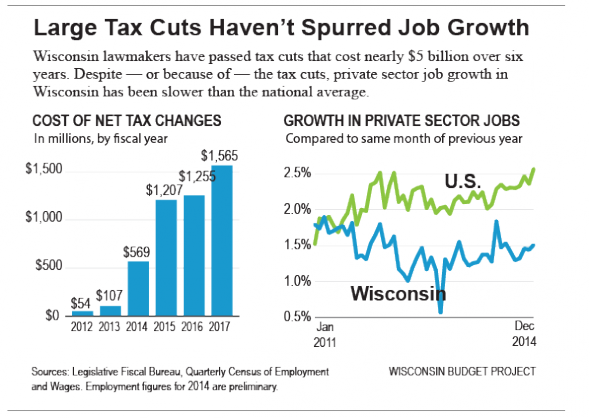

Wisconsin lawmakers have passed tax cuts totaling $4.8 billion over six years, according to a new memo by the non-partisan Legislative Fiscal Bureau released this week. These tax cuts have done little to boost job growth and have forced damaging cuts to Wisconsin’s public schools, universities, and health care system.

Lawmakers have passed dozens of tax cuts since January 2011, including millions of dollars in tax cuts that primarily benefit people with high incomes. And lawmakers aren’t slowing down – the total value of tax cuts has increased each year since fiscal year 2012, and is slated to go even higher, to nearly $1.7 billion per year in the two-year budget period that starts in July 2017.

Among the tax cuts passed since January 2011, according to the memo:

- A 2013 income tax rate reduction that gave an average tax cut of $1,440 to taxpayers earning over $300,000 but an average of just $86 for taxpayers who earn under $100,000. This tax cut cost the state $1.3 billion over six years, starting with fiscal year 2012.

- A tax cut that will wipe out nearly all income tax liability for manufacturers and agricultural producers when the tax cut is fully phased in next year. Qualifying companies receive this tax break regardless of whether they are creating jobs. This tax cut reduces state revenue by $751 million over six years.

- A tax cut for multi-state corporations, making it easier for these companies to shift their income between different states to avoid taxation. This tax cut costs $206 million over six years.

- A provision that allows people to avoid paying taxes on income from capital gains if the gains are reinvested in a Wisconsin business. About $6 out of every $10 in capital gains income in Wisconsin is earned by taxpayers with incomes of at least $100,000 – even though those taxpayers make up less than a quarter of the total. This tax cut costs $117 million over six years.

The tax-cut tally doesn’t fully capture the cost of three tax cuts that are being phased in over a period of time and for which the full tab doesn’t come due until after the 2017. Those tax cuts include:

- Another tax cut for capital gains income, this one for capital gains from certain Wisconsin-based assets. That provision is phased in starting in 2017 and will reach its full annual cost of $79 million in 2021 and subsequent years.

- A near-elimination of the Alternative Minimum Tax, which is aimed at insuring that people with high incomes pay at least some income tax. This tax cut will cost the state just $6 million in 2017 but then rise to $30 million in 2019.

These tax cuts haven’t done much to spur job growth in Wisconsin. Private sector job growth in Wisconsin has consistently lagged the national average; between December 2010 and December 2014, the number of jobs in Wisconsin only grew at about 60% of the national rate. If Wisconsin had added jobs at the same pace as other states, Wisconsin would have an additional 113,000 jobs over our current level.

The tax cuts didn’t have much effect on Wisconsin’s ability to create jobs, but they did do a great deal of harm to our ability to make investments in the fundamentals of our state’s economy. Wisconsin has had to make deep cuts in state support for public schools, our university system, and our health care system in order to pay for the tax cuts. Those cuts are doing long-term harm to Wisconsin’s ability to build a well-educated, healthy workforce and to compete in a global economy.

Regardless of your position on tax policy, can people please stop calling tax cuts a “cost??”

Then again… maybe that gives us a pretty deep insight into why some people think the way they do regarding tax policy.

How would you define something that ends up resulting in $250,000,000 slashed from the UW system to maintain solvency? Cost is probably not the right word, but as Wisconsin and Kansas has shown, there are real effects on the majority of State taxpayers.

In agreement with AG about the use of the term “cost”, but the facts remain: Wisconsin’s recent tax reductions have skewed toward benefiting higher income tax-payers and corporations, while the resulting State revenue reductions have been offset by funding reductions to State services which benefit all Wisconsin tax-payers, such as public schools, the University of Wisconsin system and municipal services(State Shared Revenue and State grants). And as the article highlights, it’s difficult to point to any benefit of these skewed tax reductions, other than to high income tax payers and corporations. It certainly has not been in the form of job growth with Wisconsin lagging behind most states ranking 13th with a job growth percentage of of 3.5% since 2009, approximately half of the median growth rate of 5.9% for all 50 states.