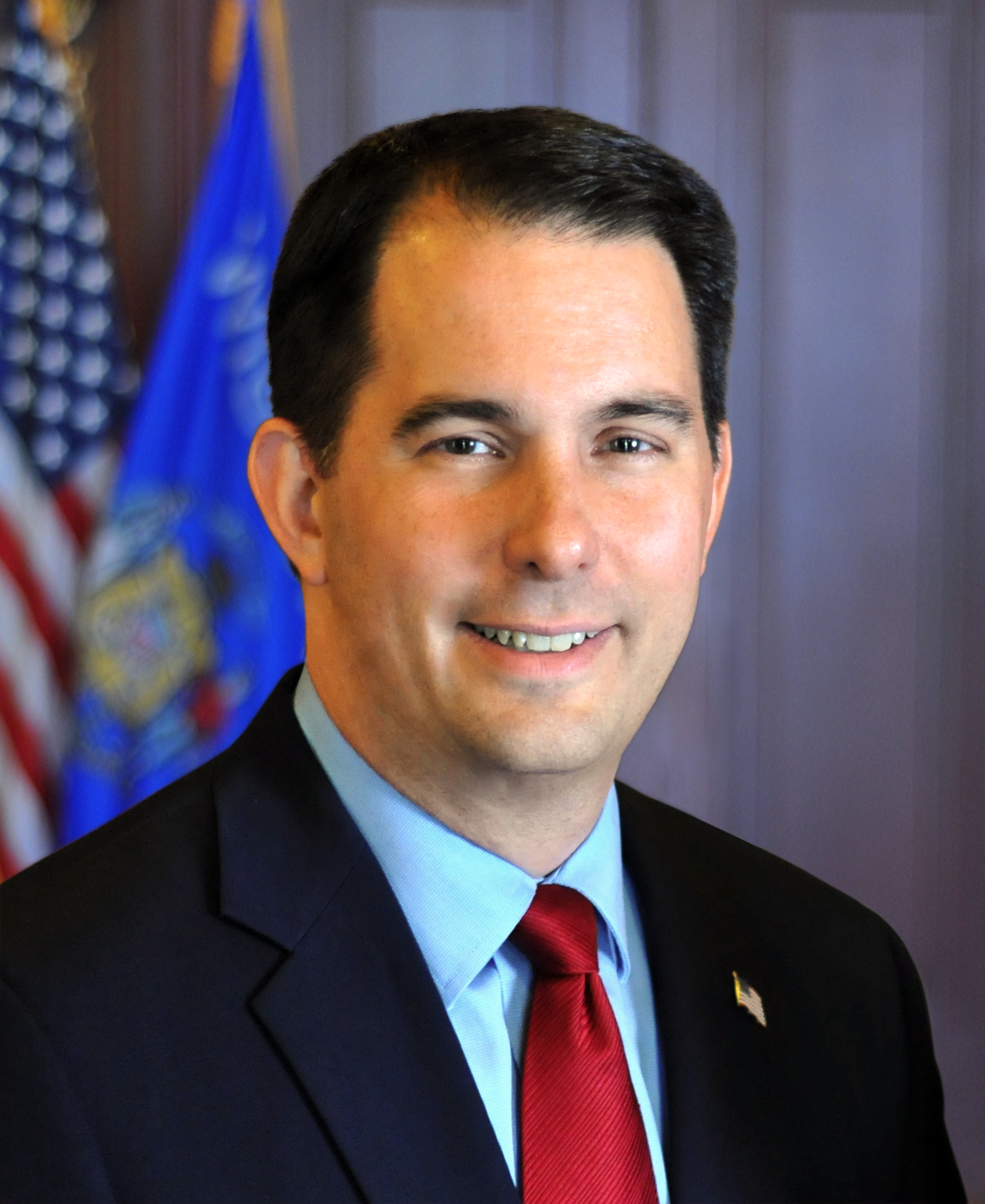

Governor Walker Promotes Child Sales Tax Rebate and Sales Tax Holiday Package in Ashwaubenon

According to the Wisconsin Department of Revenue, the child tax credit rebate is estimated at $122.1 million in fiscal year 2018.

ASHWAUBENON – Governor Scott Walker visited Shopko in Ashwaubenon today to highlight his plan for a child sales tax rebate and sales tax holiday package. Under the proposed legislation, Wisconsin families would receive $100 for every child living at home under 18 through a check in the mail this year, and all Wisconsinites would reap the benefit of a sales tax holiday planned for the first weekend in August.“Thanks to a larger than expected budget surplus this year, we are able to propose tax relief that will help all of Wisconsin’s families,” said Governor Walker. “Our tax relief proposal is one of the easiest and fastest ways to get money back to the hard-working taxpayers of Wisconsin. This plan will be welcome news to many parents and grandparents across the state who have a hard time affording all the school supplies, shoes, and clothes that kids need before heading back to school in the fall.”

The legislation sets the new sales tax holiday for August 4-5, 2018. Consumers would be exempt from paying state sales tax on all retail “off the shelf” items up to $100. The exemption would not apply to the sale of taxable services, prepared food, motor vehicles, motor vehicle parts, tangible or intangible property used to access telecommunications services, tangible or intangible property provided by a utility, or alcohol and tobacco products.

According to the Wisconsin Department of Revenue (DOR), the child tax credit rebate is estimated at $122.1 million in fiscal year 2018. DOR also estimates that the one-time sales tax holiday will provide approximately $50 million in tax relief in fiscal year 2019.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Recent Press Releases by Gov. Scott Walker

Governor Walker Orders Flags to Half-Staff Honoring Master Sergeant Jonathan Dunbar

Apr 13th, 2019 by Gov. Scott WalkerGovernor Scott Walker ordered flags to half-staff on Saturday, April 14, 2018.

Governor Walker Orders Flags to Half-Staff as a Mark of Respect for Captain Christopher Truman of the Lake Mills Fire Department

Jan 3rd, 2019 by Gov. Scott WalkerCaptain Truman died on December 31, 2018, while selflessly assisting a driver of a crashed vehicle on Highway 12 near the Yahara River Bridge in Monona, Wisconsin.

Governor Walker Appoints St. Croix County Judge and Ashland County District Attorney

Jan 2nd, 2019 by Gov. Scott WalkerGovernor Scott Walker today appointed Attorney Scott J. Nordstrand to serve as a judge on the St. Croix County Circuit Court and Attorney David Meany to the position of Ashland County District Attorney.