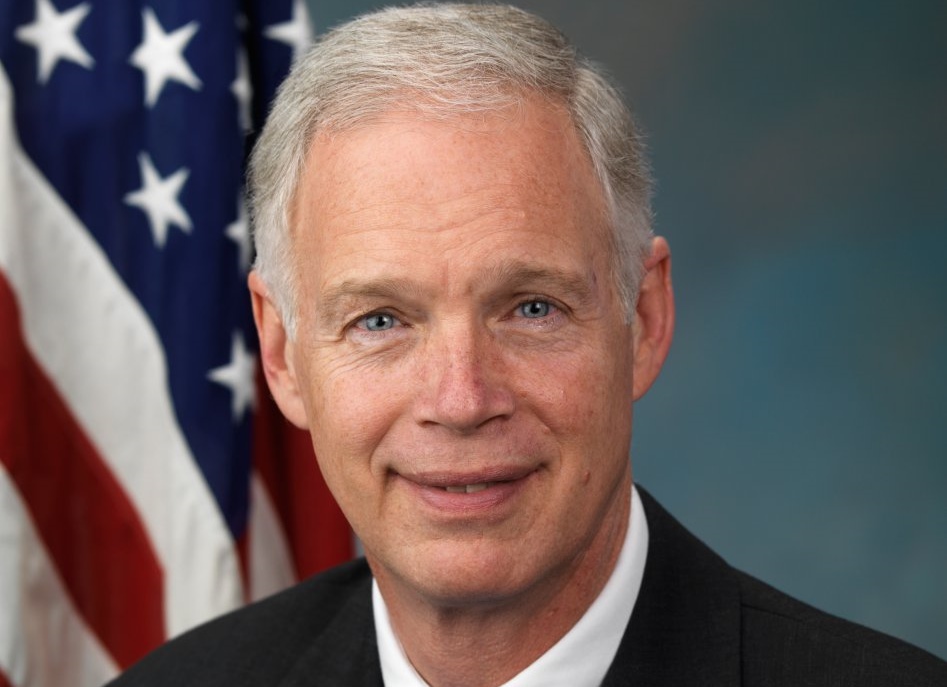

Economic Experts Say Senator Johnson’s Offshore Tax Haven Raises Serious Ethical Questions

Comes after revelations that Senator Johnson invested in an offshore tax scheme in Ireland

MADISON — In a press call this morning economic experts spoke out about Senator Johnson’s decision to profit off overseas tax havens that he helped protect in Washington. A bombshell report in the Huffington Post last Friday revealed that Senator Johnson owns a 9.9% stake in an Irish company, DP Lenticular, which he claims is Pacur’s “European distributor.” The truth? DP Lenticular has one employee, is based out of a coworking space, and is owned by a Spanish company that paid no taxes. There’s no evidence DP Lenticular distributes anything, including Pacur products.

As Senator, Johnson has opposed legislation that would make it more difficult for companies to ship profits overseas. The result is that for nearly six years, Senator Johnson has actively protected a system that may have enriched his bottom line. Participants on the call highlighted Senator Johnson’s hypocrisy for calling for cuts to women’s health and Medicare, while failing to pay his fair share of taxes.

Here are some excerpts from the call:

Kimberly Clausing, Thormund A. Miller and Walter Mintz Professor of Economics at Reed College

“Senator Johnson appears to have a vested financial stake in keeping these loopholes open, given these news stories about his investments…And I do think this raises issues of conflicts of interest if Senator Johnson is in fact involved with this tax shelter…His proposed solution is to lower companies’ taxes further, but they already have very generous tax treatments. This opposition to common sense solutions that would stem profit shifting and corporate inversions is likely a result of his own financial interests. It’s hard to have the political will to solve problems if you yourself have a stake in not solving them.”

Brendan Duke, Economic Expert at the Center for American Progress Action Fund

“[This] hurts small business, because they can’t compete with big companies that are using their overseas profits to reduce their tax burdens. Now, Senator Johnson is one of Washington’s strongest advocates for not only protecting this loophole, but actually making it bigger…Senator Johnson’s record in Washington is saying we need to give a giant tax cut to big business and the wealthiest Americans, but we can’t afford funding women’s health or making college affordable. That’s bad policy. It’s one thing to advocate for bad policy, but it’s quite another to advocate for bad policy that benefits yourself. And it’s then quite another thing to advocate for bad policy and not tell anyone that it would benefit you personally, and that’s exactly what Ron Johnson’s been doing here.

Kory Kozloski, Executive Director of the Democratic Party of Wisconsin

“He’s [Sen. Johnson] getting rich off of very questionable tax schemes. You know the sad part is that it’s middle and working class Wisconsinites who end up footing the bill for Senator Johnson’s decision to skirt these federal taxes…We just think it’s the height of hypocrisy that Senator Johnson has made himself rich and richer by ballooning the deficit and then turns around and passes off the cost to regular working class Wisconsinites, passes off the cost to women, passes of the cost to individuals who shouldn’t have to bear the brunt of his decision, and his attempts, to get rich off of gaming the system.”

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.