Department of Revenue Analysis: Typical Family of Four in Wisconsin to See a $2,508 Tax Cut Under Federal Tax Cuts and Jobs Act

"In Wisconsin, we proved you can provide tax relief for the hardworking taxpayers and invest in your priorities at the same time."

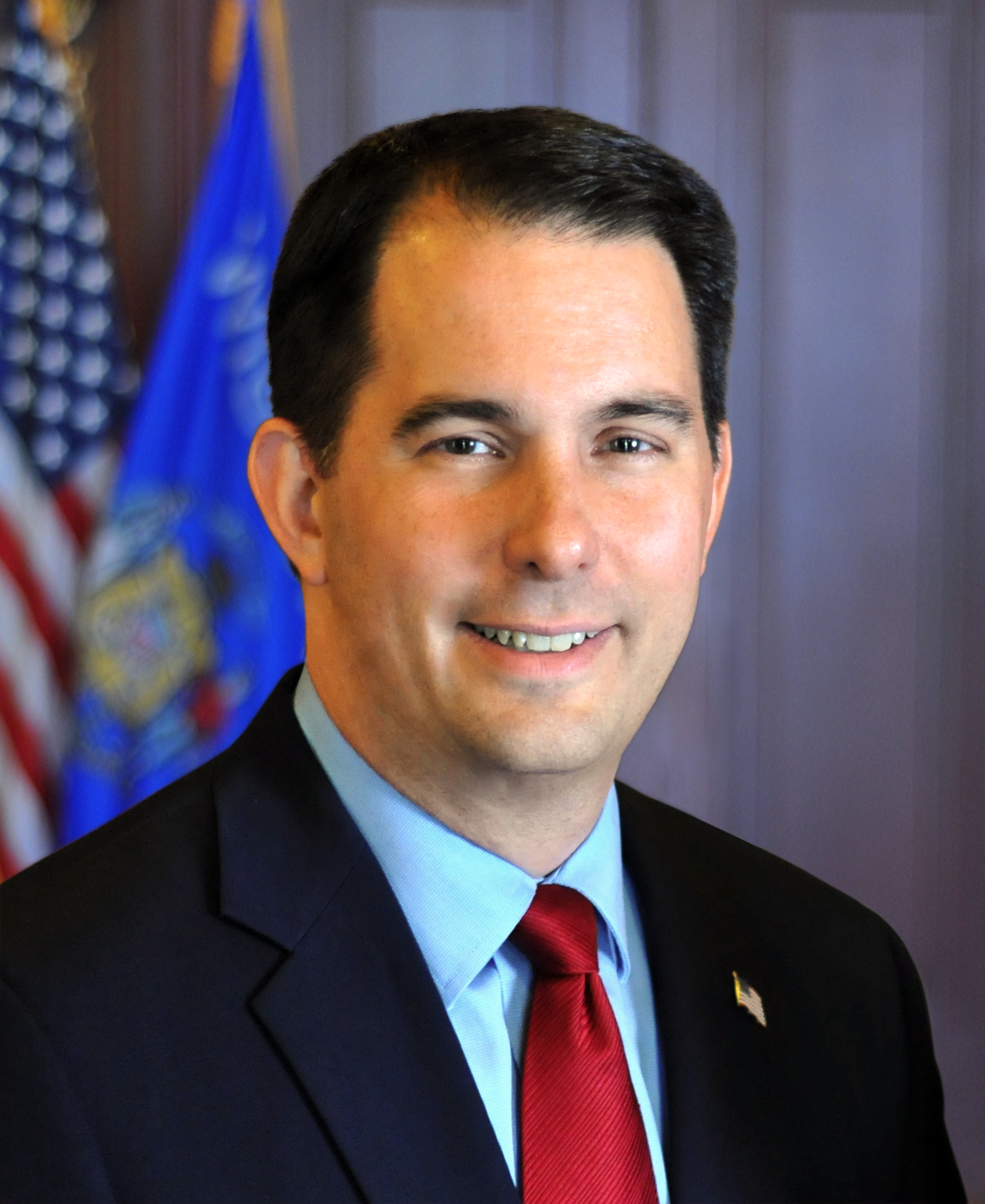

MADISON – Following passage of the Tax Cuts and Jobs Act by both the U.S. House of Representatives and Senate, Governor Scott Walker today released information from the Wisconsin Department of Revenue which shows the typical family of four in Wisconsin will see a $2,508 tax cut.

“In Wisconsin, we proved you can provide tax relief for the hardworking taxpayers and invest in your priorities at the same time,” Governor Walker said. “A typical family of four in our state will see an annual tax cut of $2,508. That’s $200 a month more in the pockets of the typical Wisconsin family. That’s real money.”

While the Wisconsin Department of Revenue is still analyzing the full impact of the bill on state taxpayers, it has determined that married joint filers with two children at home and a median adjusted gross income for a family of four will see an annual tax decrease of $2,508.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Recent Press Releases by Gov. Scott Walker

Governor Walker Orders Flags to Half-Staff Honoring Master Sergeant Jonathan Dunbar

Apr 13th, 2019 by Gov. Scott WalkerGovernor Scott Walker ordered flags to half-staff on Saturday, April 14, 2018.

Governor Walker Orders Flags to Half-Staff as a Mark of Respect for Captain Christopher Truman of the Lake Mills Fire Department

Jan 3rd, 2019 by Gov. Scott WalkerCaptain Truman died on December 31, 2018, while selflessly assisting a driver of a crashed vehicle on Highway 12 near the Yahara River Bridge in Monona, Wisconsin.

Governor Walker Appoints St. Croix County Judge and Ashland County District Attorney

Jan 2nd, 2019 by Gov. Scott WalkerGovernor Scott Walker today appointed Attorney Scott J. Nordstrand to serve as a judge on the St. Croix County Circuit Court and Attorney David Meany to the position of Ashland County District Attorney.

Yeah right, and Walker’s FoxCON job was “only” going to cost state taxpayer’s 3 Billion dollars, now it’s already up to over 4 Billion dollars! Never believe a word out of lying, career politician Scott Walker’s mouth! He’s a Trump toady and the biggest Big Government moocher in the state that now wants to be “Governor for Life.” Time to tell Walker to take a hike!

https://www.realclearpolitics.com/video/2017/12/22/cbs_how_will_tax_cuts_affect_your_family.html

” A median adjusted gross income for a family of four” ? Want do Walker’s stooges at the department of Revenue think ” A median adjusted gross income for a family of four” actually is? According to independent analysis of the actual effects of this bill on working families, the figures are somewhat different. Hard working middle class professionals will certainly pay more because of the double taxation of their state income taxes, and loss of charitable and medical deductions. One thing is absolutely true: That families grandkids will have an additional 1.5 trillion dollar debt to pay on with their income taxes, which will narrow their options and the nations options going forward. The recent barrage of Koch funded ads telling us how good this tax bill is would not be necessary if that were the actual truth.

Why is Walker declaring victory on a tax cut he didn’t design or vote for?

Amuses me that the Walker Derangement Syndrome is so strong, that arguments will be made that the IRS-published tax tables and deduction changes are actually now LIES. Good for the Walker Administration, for getting this out there. Plenty of tax calculators out there, not too hard to figure out how the new tax bill will affect your personal family situation if you’re capable of simple math and accurate inputs.

The tax cut is paid for with debt.

The middle class tax cut expires in a few years.

The tax cut for the rich does not.

Next year we’ll hear about cutting Social Security & Medicare (grandma’s healthcare) to make up the cash for this tax cut.

How about some more facts on how they arrived at this! Do a comparison of years so we can see reality. Did this family itemize in the past and now can’t? Let’s see all the scenarios. You Know for a fact Walker will cherry pick this stat to the Republican side, as would any Democrat do the same. What about the added debt to pay for this? Pay me now or pay me later, but you will pay.

” Walker Derangement Syndrome ” is most prevalent among those of us capable of CRITICAL THINKING & QUESTIONING.

– The rest of you —-Not So Much .

-THE FEDERAL TAX CUT IS PAID FOR WITH DEBT; Much like the governors consistent borrowing-the state budget is always “balanced” even though outstanding debt exists . Is that so hard to understand ???

WashCoRepub, funny you should use the word “lies” because that’s exactly how they’re marketing this thing. The biggest middle-class selling point was “We doubled your standard deduction.”

That, of course, was a lie; for starters, the actual increase was less—about 85%.

And the standard deduction can’t be considered in a vacuum, because it worked hand-in-glove with personal exemptions (which were repealed). After you factor in the loss of personal exemptions, the actual effective increase is under 13%, a far cry from the promised “doubling”.

And a couple with an adult dependent (a parent or a disabled adult child) actually sees a 6% reduction in their total exclusion (personal exemptions plus standard deduction).