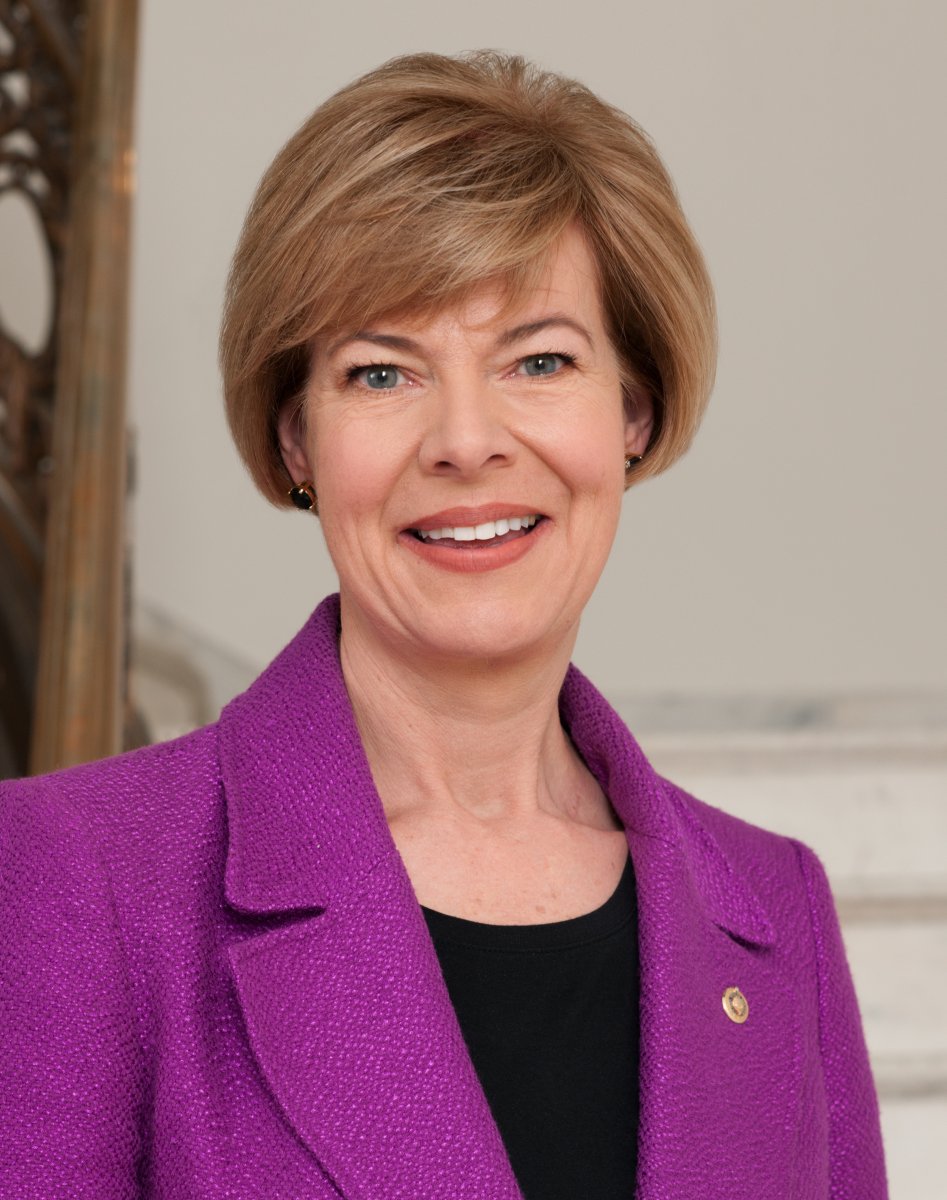

Baldwin Joins Bipartisan Push for Answers on Administration’s Implementation of the Payroll Tax Deferral for Federal Employees, Service Members

“Federal workers and service members should not be used as pawns for a payroll tax scheme that many private sector employers are unlikely to join and where key questions remain unanswered.”

WASHINGTON, D.C. – U.S. Senator Tammy Baldwin (D-WI) and a bipartisan group of her colleagues, led by Senator Chris Van Hollen (D-MD), urged Treasury Secretary Steven Mnuchin and Office of Management and Budget Director Russell Vought to make the payroll tax deferral outlined by President Trump last month optional for federal employees and service members. In their letter, the Senators also push for answers on how the administration plans to implement this deferral.

“We urge you to let federal workers and uniformed service members choose whether to defer their payroll tax obligations under IRS Notice 2020-65, rather than forcing them to participate. Federal workers and service members should not be used as pawns for a payroll tax scheme that many private sector employers are unlikely to join and where key questions remain unanswered,” the Senators begin.

They go on to highlight several unanswered questions on the tax deferral, writing,“Federal employees and service members lack basic information about how agencies will implement the payroll tax deferral.”The Senators urge Secretary Mnuchin and Director Vought to clarify these key details before the deferral begins on or around September 18.

In addition to Baldwin and Van Hollen, the bipartisan letter was also signed by Senators Susan Collins (R-ME), Chuck Schumer (D-NY), Tim Kaine (D-VA), Sherrod Brown (D-OH), Elizabeth Warren (D-MA), Jeff Merkley (D-OR), Ben Cardin (D-MD), Dick Durbin (D-IL), Sheldon Whitehouse (D-RI), Richard Blumenthal (D-CT), Bernie Sanders (I-VT), Ron Wyden (D-OR), Angus King (I-ME), Tom Carper (D-DE), Patty Murray (D-WA), Mazie Hirono (D-HI), Tammy Duckworth (D-IL), Jack Reed (D-RI), Mark Warner (D-VA), Kyrsten Sinema (D-AZ), and Amy Klobuchar (D-MN).

The full letter is available here and below. An online version of this release is available here.

Dear Secretary Mnuchin and Director Vought,

We urge you to let federal workers and uniformed service members choose whether to defer their payroll tax obligations under IRS Notice 2020-65, rather than forcing them to participate. Federal workers and service members should not be used as pawns for a payroll tax scheme that many private sector employers are unlikely to join and where key questions remain unanswered.

Federal employees and service members lack basic information about how agencies will implement the payroll tax deferral. In addition to clarifying whether federal employees will be forced to participate, please answer the following questions:

- If an employee or service member separates from their job prior to repaying deferred payroll taxes in their 2021 withholdings, will their employing agency or the IRS seek to collect unpaid payroll taxes from that employee? If so, how will they do so?

- Please provide us with a cost estimate for federal agencies to pay the employee payroll taxes that they are unable to withhold or otherwise recoup as a result of the deferral.

- How will federal agencies communicate key information about the payroll tax deferral to their workers, particularly regarding the reduction in take-home pay in 2021? As KPMG stresses, “It is important to manage employee expectations and keep employees informed of their obligations prior to making the election to defer.”

Reports indicate that federal employee paychecks may be affected by the payroll tax deferral on or around September 18. Please respond to these questions as soon as possible so that federal workers and service members have some clarity on these issues before their paychecks are changed.

Sincerely,

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

More about the Coronavirus Pandemic

- Governors Tony Evers, JB Pritzker, Tim Walz, and Gretchen Whitmer Issue a Joint Statement Concerning Reports that Donald Trump Gave Russian Dictator Putin American COVID-19 Supplies - Gov. Tony Evers - Oct 11th, 2024

- MHD Release: Milwaukee Health Department Launches COVID-19 Wastewater Testing Dashboard - City of Milwaukee Health Department - Jan 23rd, 2024

- Milwaukee County Announces New Policies Related to COVID-19 Pandemic - County Executive David Crowley - May 9th, 2023

- DHS Details End of Emergency COVID-19 Response - Wisconsin Department of Health Services - Apr 26th, 2023

- Milwaukee Health Department Announces Upcoming Changes to COVID-19 Services - City of Milwaukee Health Department - Mar 17th, 2023

- Fitzgerald Applauds Passage of COVID-19 Origin Act - U.S. Rep. Scott Fitzgerald - Mar 10th, 2023

- DHS Expands Free COVID-19 Testing Program - Wisconsin Department of Health Services - Feb 10th, 2023

- MKE County: COVID-19 Hospitalizations Rising - Graham Kilmer - Jan 16th, 2023

- Not Enough Getting Bivalent Booster Shots, State Health Officials Warn - Gaby Vinick - Dec 26th, 2022

- Nearly All Wisconsinites Age 6 Months and Older Now Eligible for Updated COVID-19 Vaccine - Wisconsin Department of Health Services - Dec 15th, 2022

Read more about Coronavirus Pandemic here

Mentioned in This Press Release

Recent Press Releases by U.S. Sen. Tammy Baldwin

Baldwin Statement on House Passage of Republicans’ Budget Bill That Guts Medicaid, Raises Costs for Families

Jul 3rd, 2025 by U.S. Sen. Tammy BaldwinIn Wisconsin, the bill will terminate at least 250,000 people’s health care, reduce or eliminate 90,000 Wisconsinites’ food assistance, and threaten to close rural hospitals

Senator Baldwin Votes Against Republicans’ Catastrophic Budget Bill

Jul 1st, 2025 by U.S. Sen. Tammy BaldwinIn Wisconsin, the bill will terminate at least 250,000 people’s health care, reduce or eliminate 90,000 Wisconsinites’ food assistance, and threaten to close rural hospitals