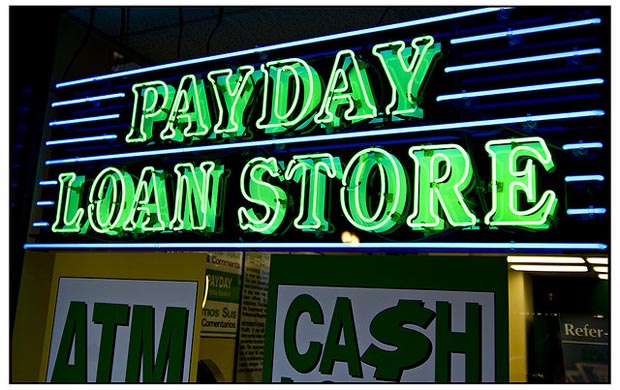

Bipartisan Proposal Would Cap Payday Loan Interest in Wisconsin

State report found some payday lenders charge as much as 850% interest.

Payday loans. Photo by Aliman Senai / (CC BY-SA).

A pair of bipartisan bills in the state Legislature would cap interest rates on payday and installment loans and implement new restrictions on short-term lending.

State Sen. André Jacque, R-New Franken, as well as state Reps. Scott Allen, R-Waukesha, and Amaad Rivera-Wagner, D-Green Bay, are circulating the legislation for co-sponsorship.

The bills would cap the annual percentage rate for payday and installment loans at 36 percent, according to a memo from the lawmakers. An annual percentage rate, or APR, measures a loan’s interest rate and additional fees.

The APR cap comes as the lawmakers say a state Department of Financial Institutions report found some payday lenders charge as much as 850 percent interest.

“Too many people get trapped in an endless cycle of debt after taking out short-term loans,” Allen said in a statement. “These bills would remove the worst aspects while still leaving a viable business.”

The 36 percent cap also matches a federal limit on APR for short-term loans for veterans, the memo states. Over the last decade, Arizona, Colorado, Montana, Ohio and South Dakota also instituted a 36 percent rate cap.

Rivera-Wagner said many lenders often have licenses for both payday loans and installment loans. He said both offer very similar “predatory” terms and conditions.

“We want to ensure that this type of product is being regulated because just regulating a single license may not actually meet the needs that we are struggling with, which is that people are changing their (loan) category even though they’re not changing their type of loan,” he said.

Under one bill, installment loan lenders would be required to report the average APR of their loans, the number of loans refinanced or results of money judgments or vehicle repossessions, according to the memo. The lawmakers said those requirements will improve transparency in short-term lending.

The other bill would limit payday loans to terms between 90 days and six months “with equal payments that must have a portion going to principal,” the memo states.

“This short length would still have payday loans playing a unique role in the market, while allowing consumers to be consistently paying down debt and thus freeing themselves from a poverty trap,” the lawmakers wrote in the memo.

The bill would also require payday lenders to tell borrowers the amount of interest that will be paid over the loan’s duration and the amount of each payment. Additionally, payday lenders would be required to tell borrowers about basic financial literacy courses that would be made available by the state Department of Financial Institutions.

In the memo, the lawmakers described the financial education piece as perhaps the most consequential part of the legislation because financial literacy is “key to getting people out of poverty.”

“By requiring that there is this financial education made available to every borrower who’s getting these loans, we ensure that folks have a good shot of making the best decision for their circumstances,” Rivera-Wagner said.

Jacque said the legislation would add guardrails to protect consumers while allowing lenders to continue to operate. He said the goal is to eliminate predatory lending, not short-term lending.

“I think this is going to funnel folks towards more responsible lending options, but it’s absolutely something that people should be able to operate within and still make a profit,” he said.

Rivera-Wagner and Jacque both said they’re hopeful the bipartisan legislation would be able to reach Gov. Tony Evers’ desk.

“The vast majority of states do already have much stronger regulations in place,” Jacque said. “This is something that I think is certainly very popular with the public, and I would hope that we can put these protections in place.”

Bipartisan state bills would cap interest on payday loans, increase regulation was originally published by Wisconsin Public Radio.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

This bill appears to be several years late. Most of the PayDay loan shops around Milwaukee have closed. The new predators are found online. All you need is a cell phone with a data plan.

Why did this take so long?

Simply wrong to take advantage of the poor!