82 Wisconsin Clean Energy Projects Eligible for Federal Tax Incentives

National report says Wisconsin projects invested $18 billion, will gain from IRA law.

Solar panels at Huntsinger Farms in Eau Claire help meet 20 percent of the operation’s energy needs, according to president Eric Rygg. Members of President Joe Biden’s cabinet toured the farm on Wednesday, Nov. 8, 2023, as part of the administration touting investments in rural America. Danielle Kaeding/WPR

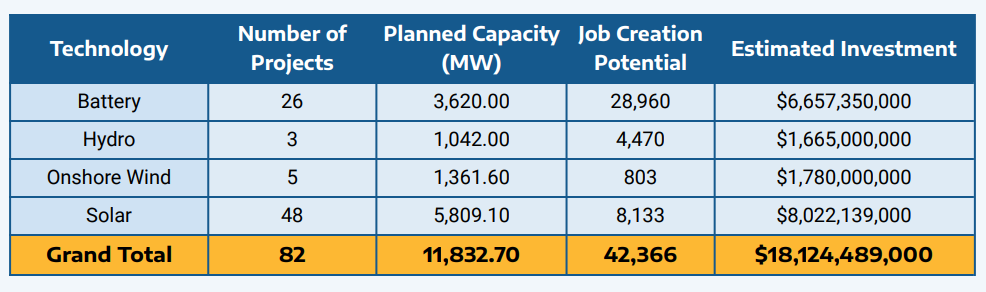

An estimated 82 clean energy projects in Wisconsin — totaling $18 billion in expected investment — could be eligible for labor-related tax incentives from the Inflation Reduction Act, according to a new national report.

The report, released by the Climate Jobs National Resource Center, looked at how the Inflation Reduction Act, or IRA, could boost the clean energy sector while creating union jobs.

According to the report, the 82 utility-scale clean energy projects identified in Wisconsin — either planned, being built or recently completed — account for an estimated 42,000 jobs and 11,833 megawatts of power. Those are broken down into 48 solar projects, 26 battery projects, five wind projects and three hydro projects.

Amy Barrilleaux, a spokesperson for Clean Wisconsin, said it’s an exciting time for the clean energy industry in Wisconsin, fueled by the IRA.

“When you look at these 82 clean energy projects in the pipeline, that’s a huge deal. That’s changing how Wisconsin gets its energy,” she said. “Right now, we import most of our energy. We pay a lot of money to do that, but this is a change to a homegrown clean energy future for us.”

The state’s trade unions are playing a major role in that clean energy transition — due to labor standards tax credits for things like paying workers prevailing wages and using registered apprentices, said Barrilleaux.

This table shows the breakdown of Wisconsin clean energy projects in various stages of development and their economic impact. Graphic courtesy of the Climate Jobs National Resource Center

Emily Pritzkow, executive director of the Wisconsin Building Trades Council, said those labor standards tax credits help tie industrial expansion to pro-worker policies, helping to lift the pay and the quality of jobs and training throughout that clean energy industry.

Earlier this year, Wisconsin’s four major utilities made a pledge to hire union workers for all solar, wind and battery projects moving forward. At the time, the utilities said the move would help ensure they meet competitive labor standards.

Pritzkow called the agreement between the utilities and trades unions historic, saying it provides more certainty to union workers.

“We’ve had a long relationship with the state’s major utilities, and are very often working on their projects,” she said. “That is not a new development, but the commitment to enshrine this in a partnership moving forward on renewable projects is a new one, and I think it really is a reflection of the quality of work our members provide.”

The report pointed to a few case studies, including two in the Badger State.

Another project listed is the Menasha Joint School District’s Maplewood Middle School construction project in the Fox Cities.

According to the report, the school will have rooftop solar panels, battery storage and other energy-efficient features that are estimated to save the district $135,000 annually on energy costs. The district is also expected to utilize direct payments included in the IRA for nonprofits and local governments.

Barrilleaux said the Inflation Reduction Act incentives in the law — for businesses, nonprofits, local governments and homeowners — help build clean energy projects, boost electric electric transportation and assist families to weatherize their homes and save energy.

She called the law “the most ambitious investment to fight the climate crisis” in American history.

“It’s really hard to overstate the impact that the IRA is having in Wisconsin right now, and it’s only been here for a couple of years,” she said. “I think everybody understands that big action needs to happen because we’re in a really critical situation. We need to cut greenhouse gas emissions from every sector of society, and the IRA is helping us do that.”

82 Wisconsin clean energy projects eligible for IRA incentives, report says was originally published by Wisconsin Public Radio.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.