Tax Plans Reveal Very Different Values

Evers and Republicans each offered a helping hand. But to whom?

This year, two radically different plans were proposed for Wisconsin taxes. One came from Wisconsin Governor Tony Evers and was rejected ty the Republican state legislators, who instead included their own proposal in the state budget bill, which Evers then gutted with his partial veto power. Evers has challenged legislators to return with a bill more to his liking. So how did their two proposals differ and what are the values underlying each?

The GOP Proposal

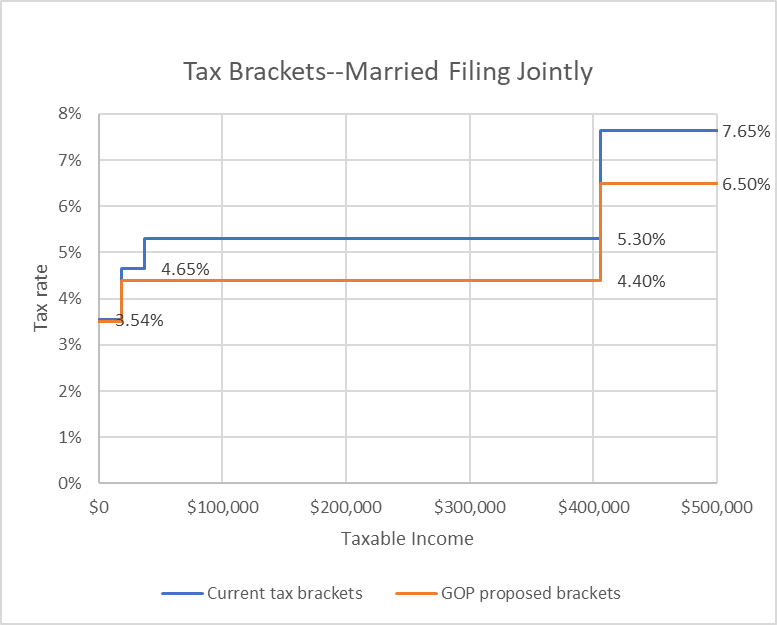

The Republican proposal was constructed around adjusting Wisconsin tax brackets. The graph below shows the operation of the brackets for married taxpayers who file jointly. The current brackets are shown in blue; the GOP proposal is shown in orange.

The GOP proposal, which was incorporated into the bill sent to the governor, merged the two middle brackets and lowered the tax rate on each.

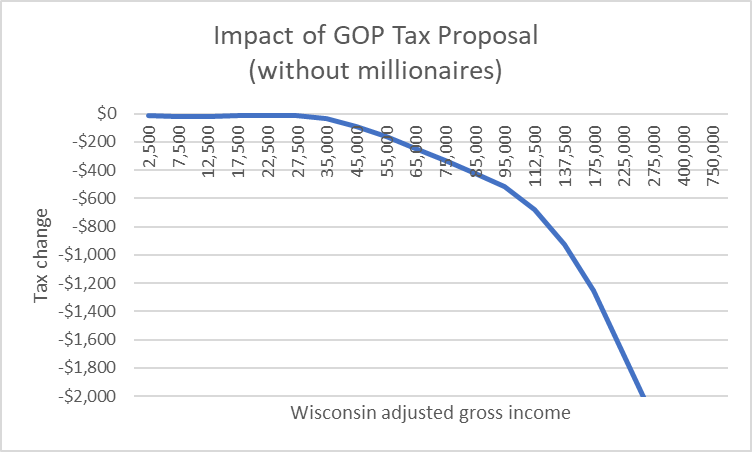

Based on a simulation of tax year 2023 by the Department of Revenue, the nonpartisan Legislative Fiscal Bureau estimated the distribution of the lower taxes under the GOP proposal. The LFB divided the population of taxpayers into 21 increments based on taxable income. The result is summarized in the graph below.

For example, the 220,000 people with incomes between $60,000 and $70,000 would receive an an average estimated tax reduction of $249. The horizontal axis shows the midpoint of each of these income increments. Note that for the top increment, for people with taxable income over one million, I assumed a midpoint of $1.5 million.

The next graph shrinks the vertical scale in the above graph to a tax cut of $2,000 and under, in order to better show tax reductions for people with lower taxable incomes. As income rises, the benefit of the tax reduction in the GOP proposal also rises.

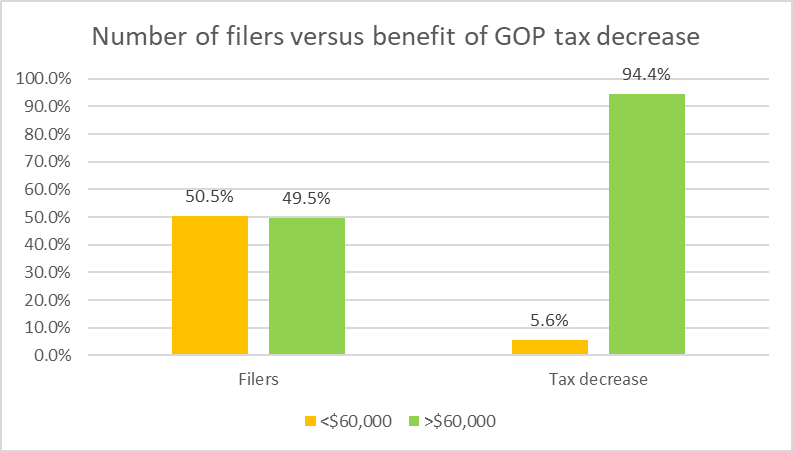

The number of people with taxable incomes below $60,000 (shown in the left-hand yellow column in the graph) is approximately equal to the number with incomes above $60,000 (the left-hand green column). However, as the next graph shows, about 94% of the benefit under the GOP plan goes to those making more than $60,000 (the right-hand green column) under the plan, compared to 6% to those making incomes under $60,000 (the left-hand yellow column.

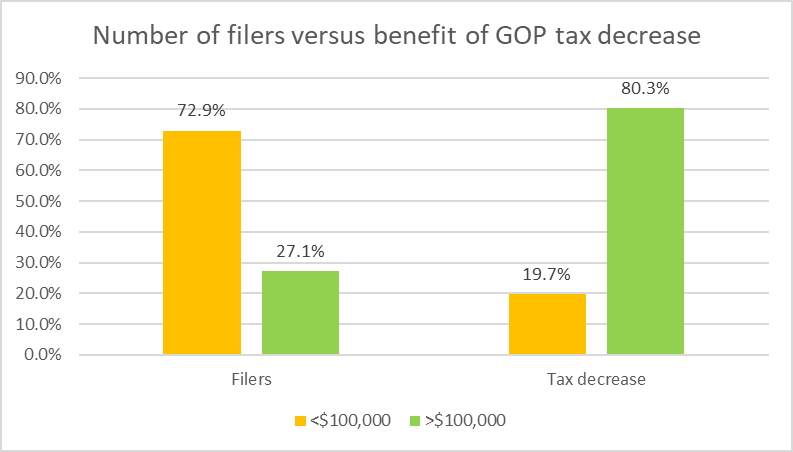

A similar story is told if $100,000 income is used as the cut point. As the next graph shows, the bottom 73% of the population would receive 20% of the benefit. The 27% making more than 100,000 would receive 80% of the benefit.

Governor Evers’ Proposal

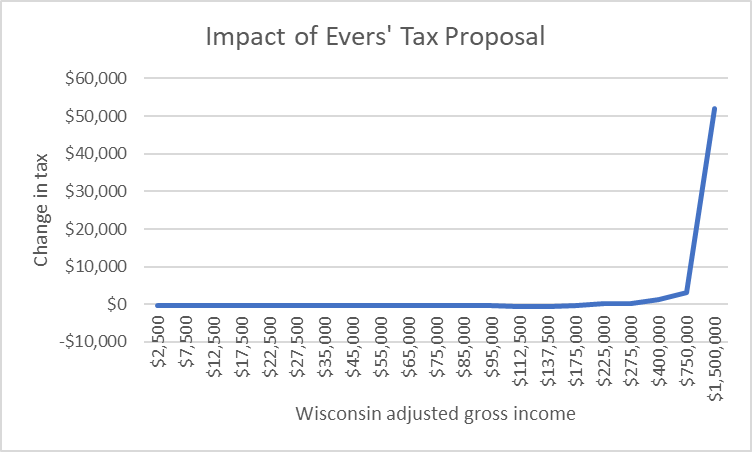

As with the GOP proposal, the LFB analyzed the distributional effects of the governor’s tax proposal. The result is shown in the next graph. In contrast, to the GOP proposal, under Evers’ proposal, the highest earners would have paid more in taxes—an average of $52,000 more for those making more than one million.

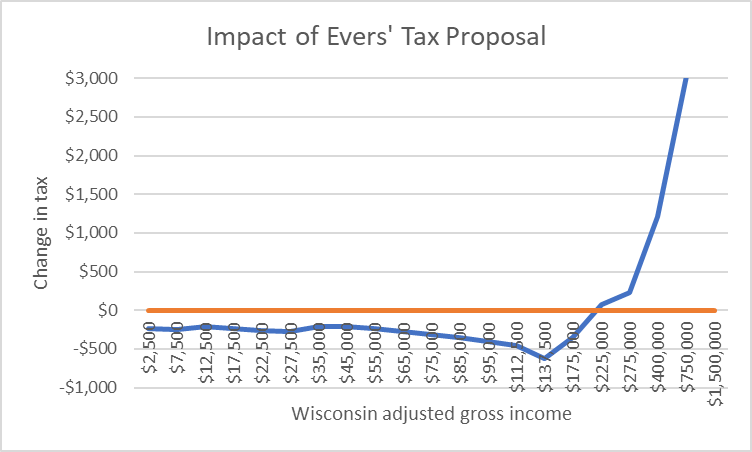

While it is clear that under Evers’ proposal those making the most money would pay more taxes, it is less clear what would be the effect on those less prosperous.

By cutting off the vertical scale at $3,000, the next graph allows us to view the Evers plan’s effect on people over the whole range of taxable income. Taxes on those making less than approximately $200,000 would decrease by several hundred dollars. Above an income of about $200,000 taxes, taxes would rise.

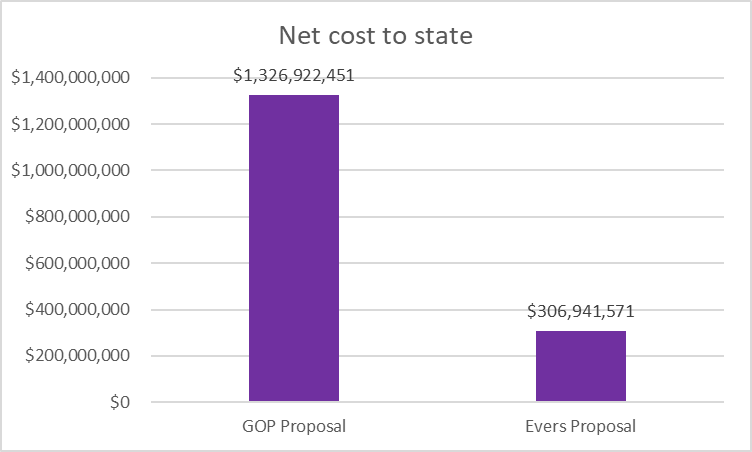

The next graph compares the cost of the two plans. Partly because higher taxes on wealthier people in the Evers proposal partially offset tax reductions on lower income people, the Evers plan is approximately one billion dollars less costly to the state than the GOP proposal.

Taxes After Vetoes

While both the GOP-controlled Legislature and Gov. Evers aimed at decreasing taxes, it should be clear that their goals had nothing in common. Evers envisioned tax reduction as a way to help people who are struggling financially.

The Republican approach is based on what’s been dubbed trickle-down economics, which has dominated GOP policies since the Reagan administration. It is hard, however, to point to examples in which it has clearly worked. Nevertheless, the Republican legislators’ tax plan makes it clear the theory is alive and well in Wisconsin.

The one exception to his veto pen was to leave in place the Legislature’s reduction of the tax rate in the lowest bracket from 3.54% to 3.50%. For most joint married taxpayers, this would result in a savings of $5.52.

Data Wonk

-

Life Expectancy in Wisconsin vs. Other States

Dec 10th, 2025 by Bruce Thompson

Dec 10th, 2025 by Bruce Thompson

-

How Republicans Opened the Door To Redistricting

Nov 26th, 2025 by Bruce Thompson

Nov 26th, 2025 by Bruce Thompson

-

The Connection Between Life Expectancy, Poverty and Partisanship

Nov 21st, 2025 by Bruce Thompson

Nov 21st, 2025 by Bruce Thompson

Trickle down does not work. It has only made the wealthy wealthier and widened the gap between haves and have nots. Republican economic proposals lack any empathy, heart, or soul. In their rush to help wealthy donors, they forget there are living people that are supposed to be served by the legislature.