Will Tax Cuts For the Rich Boost Economy?

Or help convince people to move to Wisconsin? What the data tells us.

100 Dollar Bill. Photo by Dave Reid.

The recent flurry of proposals to replace Wisconsin’s progressive income tax with a flat tax demonstrates once again the belief among many conservatives that the secret to a booming economy is to cut taxes for the wealthy. Part of this argument is that lower taxes will convince people to move to Wisconsin.

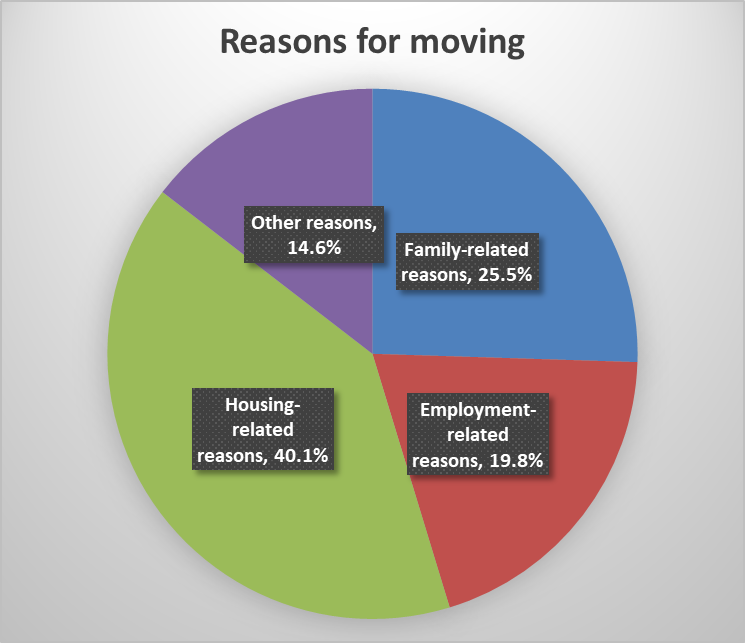

Two sets of data collected by U.S. government agencies help throw light on these claims. Every year the United States Census Bureau surveys a sample of taxpayers who have moved in the past year to ask why they moved. As the next chart shows, the Census groups the responses into four broad categories — whether the moves family-related, employment-related, housing-related, or for some other reason.

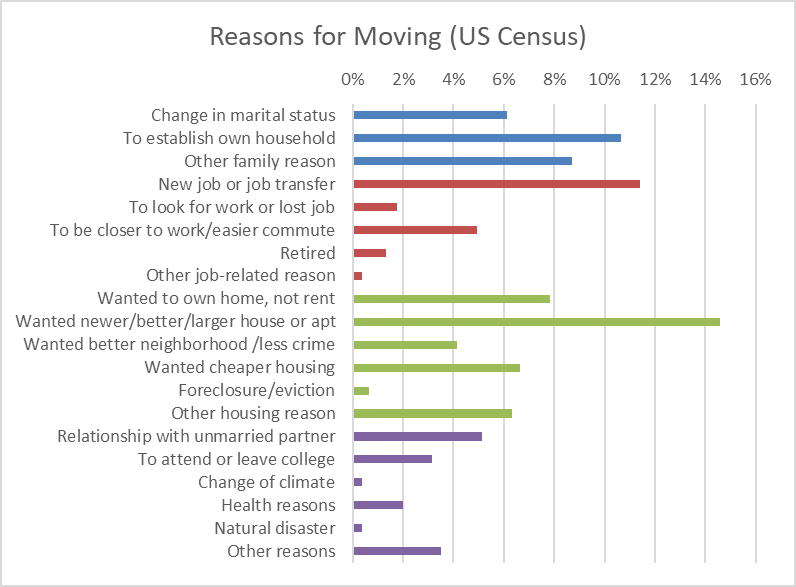

More specifically, the Census categorizes the reasons into twenty groups, as shown in the next graph. Notably missing from this graph are moving decisions driven by a search for lower state taxes. This doesn’t mean taxes were not a factor in the moving decision. But it does suggest it was not the prime consideration for many people.

If a significant number of respondents had pointed to state taxes as driving their move, it seems likely the Census would have added that category to its tabulation of the results.

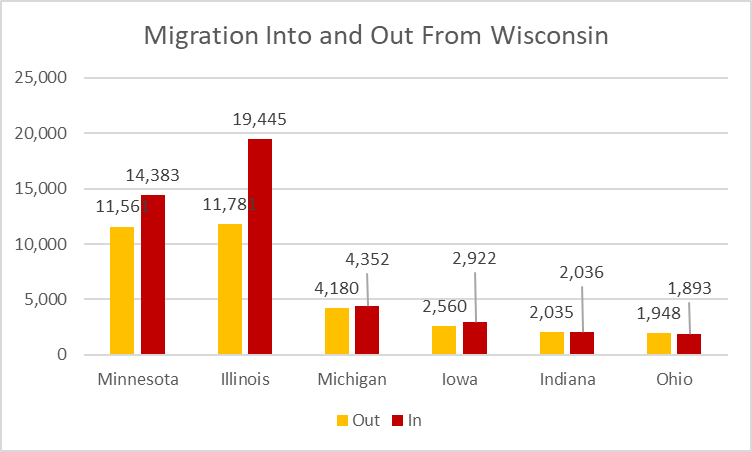

The Census Bureau is not the only federal agency collecting and publishing data on people moving from one state to another. The Internal Revenue Service also gets into the moving game. Every year it publishes data on the number of address changes from one state to another compared to the previous year.

Illinois and Minnesota are particular sources of new Wisconsin residents, but it should be noted that the US Census considers Kenosha County as part of the greater Chicago metropolitan area as well as two Wisconsin counties as part of Twin Cities. American cities tend to grow at the fringes where land is cheap, and houses are more affordable. Thus, part of the Wisconsin growth may reflect suburban growth.

Three of these states—Illinois, Michigan, and Indiana—already have flat income taxes and Iowa is scheduled join them in the future. The fact that Wisconsin’s flat tax neighbors lose more residents to Wisconsin than gain from Wisconsin suggests that flat taxes are not clear winners for their states.

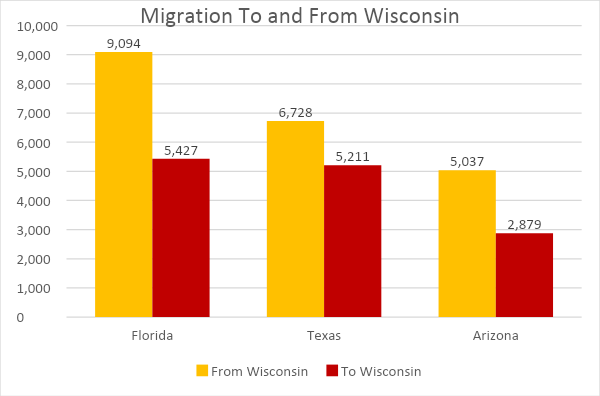

The next graph shows migration between Wisconsin and three Sunbelt states—Florida, Texas, and Arizona—where Wisconsinites traditionally choose to retire. As expected, the net flow is in the direction of the three Sunbelt states.

According to the IRS data, people moving from Wisconsin to Florida reported an average Adjusted gross income (AGI) of $125,000 per return. It is unclear to me why the AGI of those moving to Florida is substantially greater than that of the Texas movers ($78,000) or those going to Arizona ($75,000). Perhaps a higher proportion of those moving to Florida is made up of retirees.

Under the headline, “Former Wisconsinites bask in Florida’s low-tax climate,” the conservative Badger Institute’s Mike Nichols writes that “In high-income-tax states, people vote with their feet.” Nichols quotes Scott Manley, of Wisconsin Manufacturers and Commerce as claiming that: “If we can reduce and flatten our tax structure here and provide that economic opportunity for people, I think that it logically follows that we will see a significant influx of people voting with their feet and coming to live and work in our state, which has the dual benefit of solving our workforce shortage.”

Just in time for the flat tax debate, an organization called CROWE (for Center for Research on the Wisconsin Economy) issued a report claiming that the proposed flat tax would increase gross state product by 4.5%, increase household consumption by 4.4% and after-tax income by 5.27%, and lower tax revenue by 16.8%. Wisconsin’s nonpartisan Legislative Fiscal Bureau, however, forecasts a 21.5% reduction in tax revenue. The difference stems from CROWE’s assumption that increased economic activity would lower the loss in tax revenue.

I am skeptical of that for three reasons.

First, CROWE’s claims are in line with other claims that reducing taxes will result in increased economic activity, that haven’t borne fruit. These include the huge cut in Kansas taxes, resulting in schools closing when they ran out of funds and the Trump tax cut act, which had little impact on the economy, research has found.

Second, the model used by CROWE is tremendously complex, with 30 equations and numerous variables. Complexity can lead to errors.

Third, it appears that CROWE made no attempt to verify that the model accurately predicted the results of previous tax reductions.

I can see why the idea of replacing Wisconsin’s graduated income tax might be attractive to the major funders of Republican candidates. It is less obvious why other Wisconsinites would find the proposal attractive.

Data Wonk

-

Life Expectancy in Wisconsin vs. Other States

Dec 10th, 2025 by Bruce Thompson

Dec 10th, 2025 by Bruce Thompson

-

How Republicans Opened the Door To Redistricting

Nov 26th, 2025 by Bruce Thompson

Nov 26th, 2025 by Bruce Thompson

-

The Connection Between Life Expectancy, Poverty and Partisanship

Nov 21st, 2025 by Bruce Thompson

Nov 21st, 2025 by Bruce Thompson