Raising the federal minimum wage to $15 by 2025 would lift wages for over 33 million workers

The increase would boost total annual wages for these low-wage workers by $92.5 billion, lifting annual earnings for the average affected year-round worker by $2,800.

On Thursday, July 18, the U.S. House of Representatives is set to vote on a proposal to gradually raise the federal minimum wage to $15 per hour by October 2025. As shown in the tables below, such an increase in the federal wage floor would lift wages for 33.5 million workers across the country by 2025—more than one-fifth of the wage-earning workforce. The increase would boost total annual wages for these low-wage workers by $92.5 billion, lifting annual earnings for the average affected year-round worker by $2,800.

Who would benefit if the federal minimum wage is raised to $15 by 2025?

A total of 33.5 million workers would benefit, including:

- 30.1 million adults ages 20 or older

- 19.6 million full-time workers

- 19.5 million women

- 9.4 million parents

- 4.6 million single parents

- 6.2 million workers in poverty

More details on the schedule of increases, the affected workforce, the effect on workers’ wages, and the estimated impact by state can be found in the tables at the end of this fact sheet.

The proposal being voted on is similar to one that we analyzed in February, which would have raised the federal minimum wage to $15 by July 2024.1 In that analysis, we estimated that nearly 40 million workers would have gotten a raise from that proposed increase. The biggest difference between the estimates in that analysis and the estimates presented here are changes in state minimum wages that have been enacted since February. EPI’s Minimum Wage Simulation Model, which we use to produce these estimates, accounts for all existing state and local minimum wage laws so that the results describe only the impact of the proposed federal minimum wage change.2 Since our February analysis, New Jersey, Illinois, Maryland, and Connecticut all enacted $15 state minimum wages, thus significantly reducing the number of workers who would be impacted by the change in the federal minimum wage, as these workers will already have received raises from their rising state minimum wages.3 Phasing in the increases over one additional year also reduces the number of workers affected and the wage impact of the proposal—as some workers who would have been paid wages in the affected range in 2024 will likely be paid wages above the affected range by 2025.

In a recent report, the Congressional Budget Office (CBO) estimated that a $15 minimum wage in 2025 would raise the wages of up to 27.3 million low-wage workers.4 As best we can tell, our estimates differ from theirs for two reasons:

- CBO is more restrictive than we are about including workers who report wages below the existing minimum wage. There is considerable measurement error in the hourly wage values reported in the Current Population Survey—the data source for both CBO’s and our analyses—particularly because some wage values must be imputed from nonhourly workers’ reported weekly wages and their reported usual hours worked. For this reason, EPI assumes that reported or imputed hourly wage values as low as 80 percent of the existing binding minimum wage are likely the result of measurement error and that these workers will benefit from a rising minimum. CBO assumes that wage values more than 25 cents below the existing minimum are the result of employer noncompliance and those workers will not be affected by the rising federal wage floor.

- CBO also assumes noticeably stronger baseline wage growth for low-wage workers than we do—i.e., wage growth occurring without any change in the federal minimum wage. This assumption means that CBO believes many more workers will experience sufficient wage growth to put them above the level at which they would be affected by the rising federal minimum wage.

The CBO report assumes baseline nominal wage growth averaging 3.5 percent annually for the “low-wage” workforce. This strikes us as very optimistic. CBO’s own projections for inflation (as measured by the Consumer Price Index) are an average of 2.4 percent annually over the next six years—meaning that CBO believes low-wage workers will experience wage growth faster than inflation by 1.1 percent every year through 2025 without any change in the federal minimum wage.5 For comparison, that since 1973, there have only been 13 years in which the 10th percentile wage rose by 1.1 percent or more (after inflation), and this has never occurred for more than three years consecutively.6 The period from 1996 to 1999 is the only three-year span when this occurred, a period with an exceptionally strong labor market which also happened to coincide with an increase in the federal minimum wage. In fact, if the 10th percentile wage had grown at 1.1 percent above inflation annually since 1979, it would be $14.68 in 2018 instead of the $9.97 it actually was.7 In short, the failure of this group of workers to see wage growth as fast as that currently forecast by CBO is essentially the entire reason why we need a robust federal minimum wage.

To be clear, it would be a wonderful thing if the low-wage workforce did experience real wage growth of 1.1 percent (or more!) annually for the foreseeable future. We are just skeptical that we can expect this to happen, especially in the absence of a rising wage floor.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by Economic Policy Institute

Raising the federal minimum wage to $15 by 2025 would lift wages for over 33 million workers

Jul 17th, 2019 by Economic Policy InstituteThe increase would boost total annual wages for these low-wage workers by $92.5 billion, lifting annual earnings for the average affected year-round worker by $2,800.

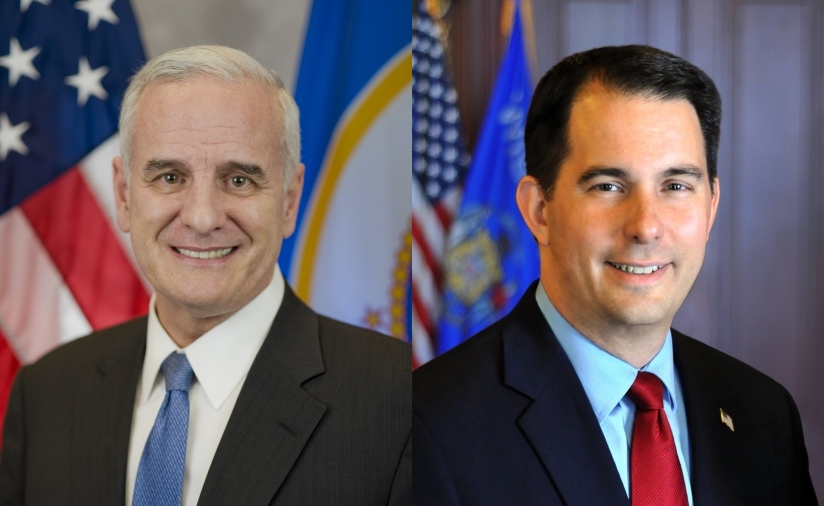

Since 2010, Minnesota’s economy has outperformed Wisconsin’s by virtually every available measure

May 8th, 2018 by Economic Policy InstituteSince taking office in 2010, Governors Dayton and Walker have pursued vastly different state economic policy agendas