State Near Average In Taxes, Spending

24th in taxes and fees, 25th in spending, latest data shows.

Despite claims that Wisconsin is a high-spending state, it is actually close to average in many measures of revenue and spending among the states, according to new figures from the Census Bureau.

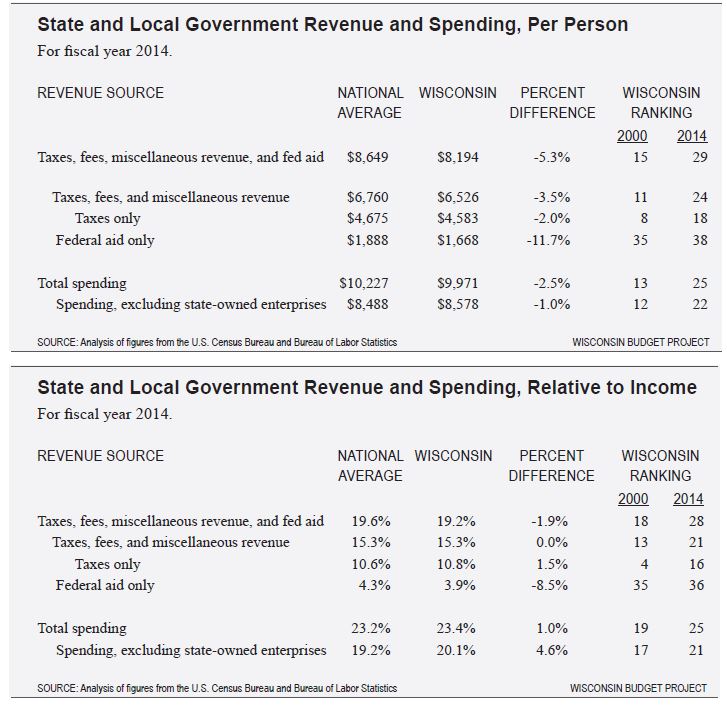

Wisconsin ranked 24th out of the 50 states in the amount of state and local taxes, fees, and other revenue collected per person in fiscal year 2014. Measured as a share of personal income, Wisconsin ranks 21st among the states in taxes, fees, and miscellaneous revenue.

Some policymakers focus on Wisconsin’s ranking on taxes alone when evaluating its revenue compared to other states. But focusing just on taxes means that fees and other charges, which come from residents’ pockets much like taxes do, are not taken into account. Combining taxes with fees and other revenue gives a broader and more complete measure of the money that governments in Wisconsin collect from their residents.

The average amount state residents paid in taxes and fees is slightly below the national average. In 2014, Wisconsin residents paid an average of $6,526 in taxes, fees, and other charges to state and local governments, $234 less than the national average. State residents paid 15.3% of personal income in taxes and other revenue, the same as the national average.

In nearly every measure of revenue and spending, Wisconsin’s rank has dropped significantly over the last decade:

In 2000, Wisconsin ranked 11th among the states in taxes, fees, and other revenue per person, before dropping 13 places by 2014. Wisconsin ranked 13th in total spending per person in 2000, before falling to 25th in 2014.

Wisconsin’s rankings in revenue and spending as a share of income have fallen as well. Measured relative to income, the state ranked 21st in taxes, fees, and miscellaneous revenue in 2014, down from 13th in 2000, and 25th in total spending, down from 19th.

Because per capita income in Wisconsin is well below the national average, we typically rank higher when revenue and spending are measured on that basis.

Wisconsin policymakers who advocate for tax cuts should know that Wisconsin governments are already close to the national average in the amount of taxes and fees they collect from residents. Additional tax cuts could jeopardize Wisconsin’s public investments in high-quality education and health care, and make it more difficult to invest in public safety and transportation in our communities. That would hurt our economy in the long run, since those are the very things our businesses and families need to thrive.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock