Even Before Tariffs, Value of Wisconsin Exports Is Declining

New Wisconsin Policy Forum report examines importance of exports to state's economy, and a multi-billion decline.

Wisconsin manufacturers and farmers rely on exports, but the value of the goods they sell abroad has fallen over the last decade. And new U.S. tariffs could make it harder for them to reverse that trend, especially in the short term.

That’s according to a new report released Thursday by the Wisconsin Policy Forum looking at state exports in the wake of what it calls the “most expansive U.S. tariffs in generations.” The report examined what goods produced in Wisconsin sell to international markets, who buys those products and where in the state they come from.

Last year, Wisconsin exported $27.5 billion worth of goods, roughly 7.8 percent of the state’s GDP, according to the report. That was down by about $4.2 billion from what was sold in 2012, when inflation-adjusted exports peaked, the report said.

Over the last decade, Wisconsin fell from the 19th top export state in 2013 to the 21st in 2024, according to the report. Tyler Byrnes, a researcher at the Wisconsin Policy Forum and the report’s author, said the decline can be attributed to a “long-term trend of de-industrialization.”

The state’s two biggest export categories last year were industrial and electrical machinery, which combined for nearly 40 percent of Wisconsin’s total exports, the report noted. Wisconsin’s agricultural products — like dairy, vegetables and meats — combined to make up about 14.4 percent of Wisconsin exports last year.

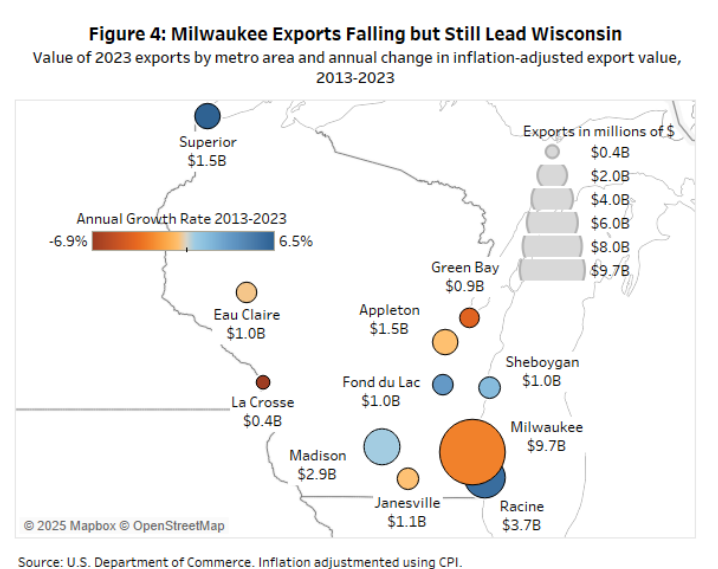

The Milwaukee area is Wisconsin’s largest exporting region and has been for many years, the report said. Its exports in 2023 were valued at $9.7 billion.

But that was down roughly 19 percent from a decade earlier and mirrors similar drops in exports seen in other industrial cities. For example, export declines in Pittsburgh and the Twin Cities outpaced Milwaukee’s declines.

“The Twin Cities has seen a much bigger drop in exports than Milwaukee,” Byrnes said. “But the Twin Cities, I wouldn’t say, is a declining area economically. Exports are important to the economic health of an area, but they aren’t the sole determining factor.”

Racine and Madison were the state’s second- and third-best exporting regions, the report said. The Racine area’s exports have grown by about 5.8 percent per year over the last decade, while the Madison region’s exports have grown by around 0.6 percent each year.

This map of Wisconsin shows how the annual growth rate in Wisconsin exports has changed over time. It shows the Milwaukee-area has seen a decline, while the Racine area has seen export growth. Photo courtesy of Wisconsin Policy Forum

Of the 190 countries and territories Wisconsin sold products to last year, Canada was the biggest buyer of state products, accounting for $8.5 billion worth of state exports. It was followed by the European Union at $4.5 billion and Mexico at $4.4 billion. According to the report, China was another “major destination for Wisconsin products.”

Those four markets together accounted for approximately two-thirds of all Wisconsin exports, according to the Policy Forum.

Byrnes said Wisconsin’s strong exports to Canada and Mexico in particular are driven, in large part, by the types of products the state sells abroad and their close proximity compared to other foreign markets.

But the report also noted the Trump administration has imposed and changed new tariffs on imports from the state’s four top trade partners. Those tariffs are a tax on goods that American businesses buy from those countries.

The report warns tariffs could negatively affect Wisconsin exporters by forcing trade partners to respond with their own tariffs on American products, making them more expensive.

“When we think about what it is we’re exporting, a lot of these heavy machines are long-term investments that are very expensive,” Byrnes said. “When you change the price by 10 or 20 percent, that may be millions of dollars. That’s something that a purchaser on the other side of the tariff barrier will have to consider.”

The tariffs could also raise the cost of raw materials and components Wisconsin businesses need to make their products, the report noted.

“If the cost of steel or aluminum needed to produce heavy machinery rises, then Wisconsin producers would need to account for that by raising the price of their products, cutting costs elsewhere, or reducing their profits,” the report states.

While tariffs pose risks to Wisconsin exporters, Byrne said those import taxes could lead to a decline in the value of the U.S. dollar, which would make American goods cheaper on the international market. But a strong U.S. dollar helps keep imports cheap, gives American tourists more spending power abroad and makes government bonds a safer investment.

The U.S. dollar value has fallen by more than 8 percent since Jan. 1.

“They can do what they can in terms of building relationships or trying to find tax policies or regulatory policies that allow businesses to work a little bit more efficiently,” Byrnes said. “But at the end of the day, the trade policies make a big difference in the cost of our goods, both what we import and what we send overseas.”

New report highlights importance of exports for Wisconsin manufacturers, farmers was originally published by Wisconsin Public Radio.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.