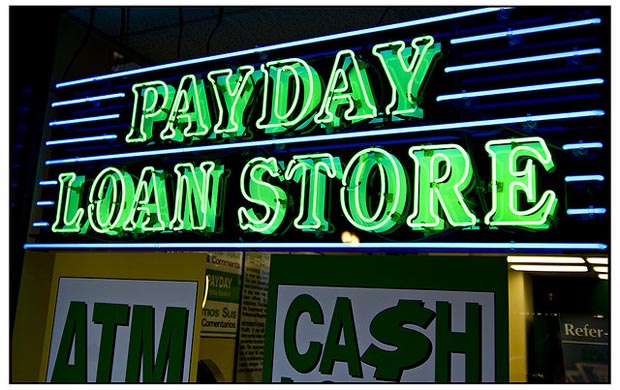

Bipartisan Bills Reform Payday Loans

Average annual interest rate for payday loans in Wisconsin topped 850% in 2022.

A pair of bipartisan bills circulating in the state Legislature would try to redefine and reform short-term, high interest loans.

The loans have to be paid back in full by the end of the short term. Experts and advocates say the interest rates attached to these loans are so high that consumers get trapped in a cycle of debt.

The average APR for a payday loan in Wisconsin topped 850 percent in 2022, according to data from the state Department of Financial Institutions.

“I really am not finding individuals who have gone to payday lenders and that has been something that helped them out of a horrible situation,” said state Sen. Andre Jacque, R-DePere. “It’s really something that has only put them into a deeper hole.”

One bill would cap payday loan interest rates at 36 percent

Jacque is circulating a bill that would cap interest rates for payday loans at 36 percent. Twenty states and the District of Columbia have already done so, according to the Center for Responsible Lending.

Barbara Sella is the executive director of the Wisconsin Catholic Conference. She said she supports the reform.

“We always have to be aware of what the impact would be on the most vulnerable, and of those living in poverty,” she said. “And we know everybody agrees that payday loans trap people in poverty.”

Rabbi Bonnie Margulis, executive director of Wisconsin Faith Voices for Justice, said she supports any change that would make lending less predatory.

“There’s no requirement that payday lenders do any due diligence to see that the people that they’re making these loans to have any ability to pay them back,” she said. “And what often happens is people end up taking out second loans in order to pay back the balances on the first loan, and then it just snowballs from there and they end up in an endless cycle of debt.”

Another bill would broaden the definition of payday loans

There are other high-interest loan products on the market that are not classified as payday loans and would not fall under the rate cap in Jacque’s bill.

A 2021 study from the WISPIRG Foundation found that nine of the top 10 high-cost lending companies in Wisconsin offer installment loans with a term longer than 90 days.

“There are companies out there lending to Wisconsin consumers at really just exorbitant interest rates. I mean, I’ve seen 400 percent, 300 percent APRs,” said Sarah Orr, director of the University of Wisconsin-Madison Law School’s Consumer Law Clinic.

These longer installment loans also result in borrowers needing to take out a second loan to pay off the first, Orr said.

“You can’t really catch up. You can’t bring that loan down through the payments that you’re making. You’re just constantly paying the fees, and the cost of having the loan,” she said.

Orr said she supports another bill that extends the definition of a payday loan to any that has to be paid off in less than six months and that is not secured by real property or other collateral. The bill would also require a portion of each installment payment to go toward paying down the principal debt.

The bill has bipartisan co-sponsors including Republicans Rep. Scott Allen of Waukesha and Sen. Rachael Cabral-Guevara of Appleton, and Democratic Rep. Dora Drake of Milwaukee.

“This bill would remove the worst of the predatory aspect of payday loans while still leaving a viable business that can serve those who cannot take out traditional bank loans,” the co-sponsors wrote in a memo.

Listen to the WPR report here.

Bipartisan bills aim to reform payday loans in Wisconsin was originally published by Wisconsin Public Radio.

There were once laws against usury. I can’t help wondering how this once illegal, not to mention immoral, arrangement found its way back into being a permitted business practice.

It’s amazing that the country has moved so far to the right that paying 36 percent interest on a loan is seen as a bipartisan solution.