What Does The Data Say About The Wisconsin Economy?

Poll reviews sour mood, but data paints a different picture.

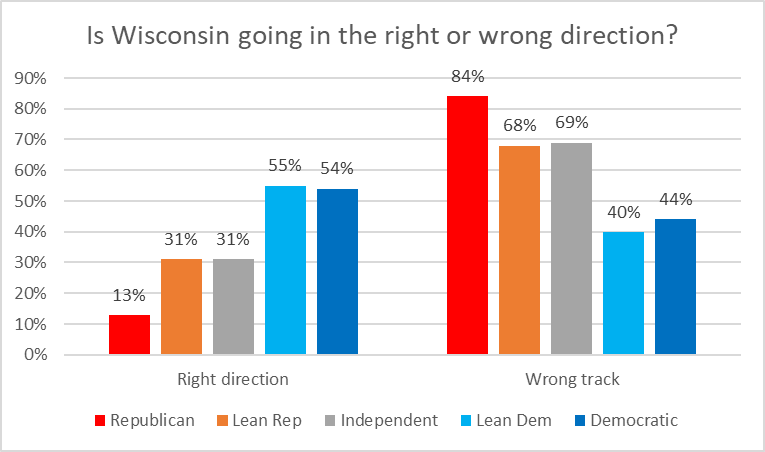

The most recent Marquette Law School Poll asked a sample of Wisconsin voters whether they thought that things in the state are generally going in the “right direction,” or do you feel things are headed down the “wrong track?” As the graph below shows, Wisconsin voters are in a sour mood.

By contrast, a majority of Democrats and independents who leaned Democratic (shown in shades of blue) were positive—but much less positive than the Republicans were negative. Finally, two thirds of true independents and those trending Republican chose “wrong track.” (Note: for simplicity, I left out respondents who did not answer, which is why the totals are less than 100%.)

This right direction, wrong track question is very popular among pollsters as a quick measure of the mood of the electorate. Unfortunately, it does not tell us much about what is causing the mood.

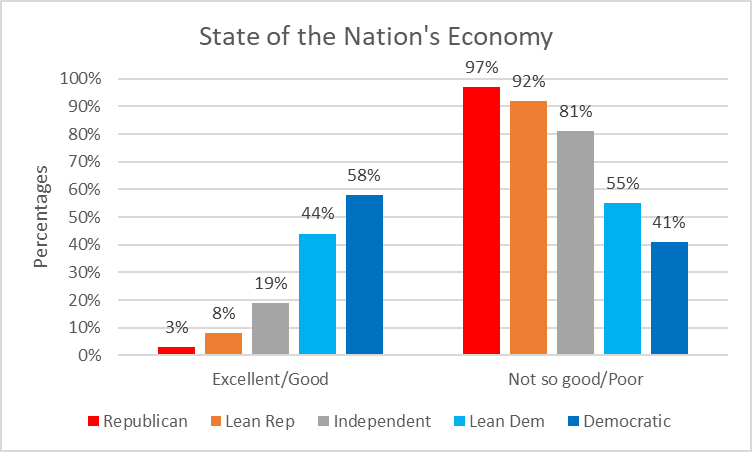

One possible explanation is beliefs about the state of the economy. The next graph shows responses to a question asking respondents to choose among four different ratings, ranging from “excellent’ and “good” to “bad” and “not so good.” For simplicity, I combined the first two responses and the last two.

Only 3% of the Republicans were willing to say the economy is excellent or good. Democrats were more willing to be positive, but much less than Republicans’ negative view. But the negativity extends far beyond partisanship. Only 3% of the total sample said the economy is excellent, while 73% said it is bad or not so good.

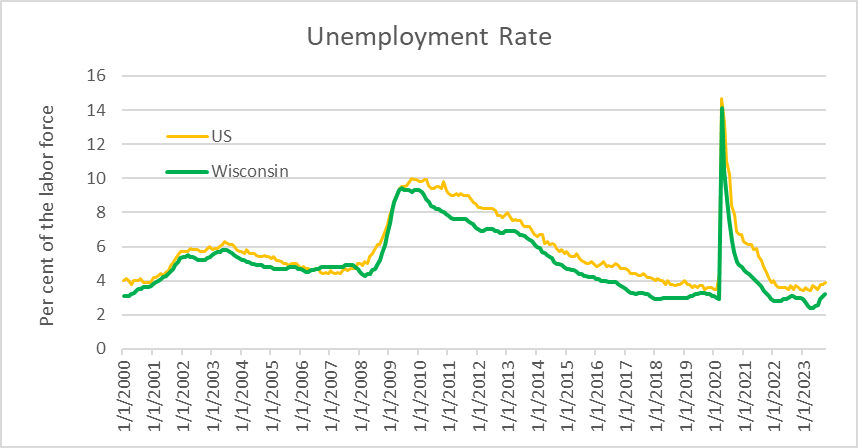

The remainder of this column considers some of the measures that could be used to rate the economy. The first of these metrics is the unemployment. The next graph shows the rate of unemployment since the year 2000. The rate for the nation is shown yellow, Wisconsin’s in green.

The second, very sharp, peak is due to the COVID-19 pandemic, when many businesses were forced to shut down. In contrast to the earlier recession, Congress passed a number of bills aimed at stimulating the economy, starting with the last year of the Trump administration. Currently, the unemployment rate for both the U.S. and Wisconsin economies is at or below the rate just before the pandemic.

The obverse of unemployment is job growth. The following graph shows the annual job growth both in Wisconsin and the US as a whole. Above the dotted line, jobs were growing; below, jobs were shrinking. Wisconsin’s job growth closely tracks the nation’s, but, like other Midwestern states, is lower.

Current growth exceeds the pre-pandemic growth rate. This high level is unlikely to continue, both because it is making up for the high job loss due to the pandemic and it appears that employers are running out of job seekers.

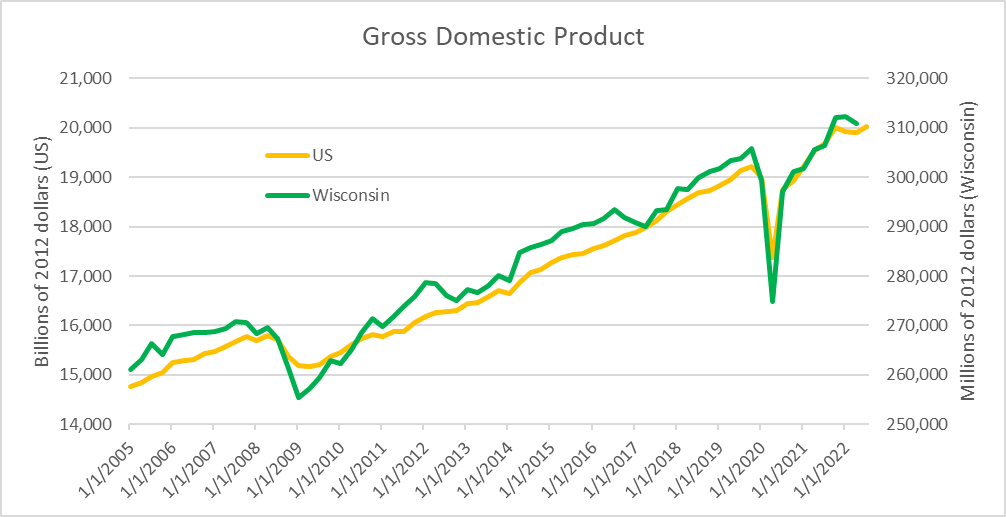

The gross domestic product (GDP) aims at measuring the total goods and services in the economy. The next graph traces the behavior of the real GDP in Wisconsin and the U.S. The use of “real” means that the numbers are corrected for inflation. Note that the left-hand scale is for U.S. GDP; the right-hand scale is for Wisconsin.

Despite the two recessions on this graph, the U.S. and Wisconsin GDPs have steadily grown.

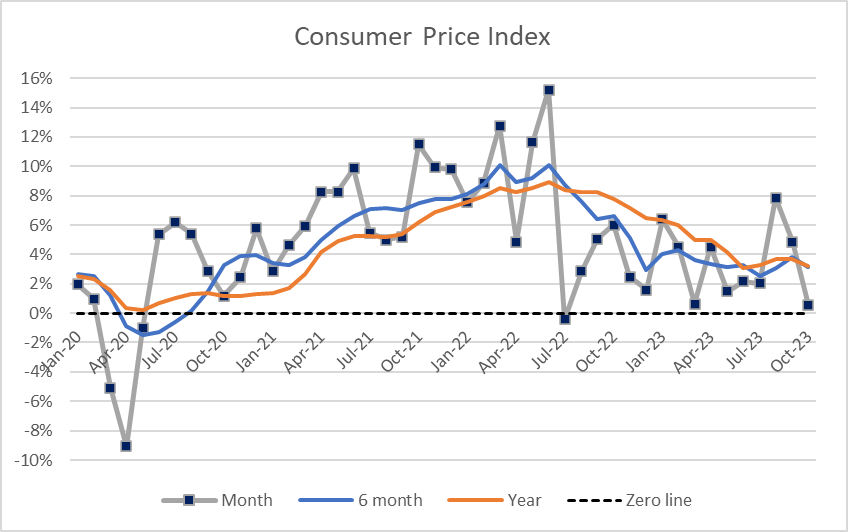

Inflation is probably the major factor contributing to the belief that the current economy is bad. The next graph shows the change in the consumer price index starting in January 2020, just before the pandemic hit.

The graph shows the inflation rate over three periods: a year, six months, and one month. The six-month and single-month figures have been annualized—what would the growth be if it were to continue over the following year? Using a year gives the smoothest plot, but it lags behind changes in the rate of inflation, either an increase such as happened before June 2022 or a decrease such as after that date.

While current inflation has come well down from its peak of 8.9% in June 2022 (15.2% if measured monthly). Yet the current rate, a bit over 3%, is still above the Federal Reserve’s goal of 2%.

Based on this and other data, I would rate the economy as excellent or at least good. That said, predictions of the future economy are often wrong. A recent article in the Journal Sentinel, based on a survey of business economists, was headlined, “Economists think nation can avoid a recession.” However 24% of the economists surveyed said they saw a recession in 2024 as more likely than not.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

Data Wonk

-

Why Absentee Ballot Drop Boxes Are Now Legal

Jul 17th, 2024 by Bruce Thompson

Jul 17th, 2024 by Bruce Thompson

-

The Imperial Legislature Is Shot Down

Jul 10th, 2024 by Bruce Thompson

Jul 10th, 2024 by Bruce Thompson

-

Counting the Lies By Trump

Jul 3rd, 2024 by Bruce Thompson

Jul 3rd, 2024 by Bruce Thompson

People believe what the politicians and corporate media want them to believe. RRRs want people to believe inflation is out of control, even though it is significantly better than post COVID. They also don’t want people to believe the high inflation rates were impacted by their refusal to take COVID seriously. They also don’t want people to believe that hyperinflation is a by product of pandemics like COVID, The Spanish Influenza, or even the Black Death. The tremendous loss of life requires countries to reset their economies with fewer workers. Fewer workers also leads to higher wages for those who survived. RRRs don’t want people to believe the stimulus packages from the Biden administration had any impact on the our ability to recover, though government stimulus are precisely what is needed.

What doesn’t work is forcing people back to work (especially when necessary safety measures are not in place,) cutting taxes for the very rich, removing corporate regulations meant to protect average Americans, and pricing healthcare out of the reach of working Americans. What else doesn’t work is attacking marginalized people, preventing immigration, and banning books. In fact, public education has historically been a stimulus for economic growth something RRRs do not want people to know

As for corporate media, it doesn’t help misusing statistics, focusing on non-issues, reporting conspiracies as facts, and providing misleading headlines meant to stoke fear and anxiety.

mkwagner is exactly right. Look at any “news feed.” Every day there is some

outrageous statement by musk or trump. One company owns most of the newspapers

in Wisconsin and Democrats are the target.

What did any Republican do for you? Foxconn? Tax cuts for the rich. Act. 10. Wacko judges.

If things are so bad, how did Wisconsin end up with a $7 billion surplus?