Fetuses Would Count For Tax Exceptions Under Republican Proposal

State Senate endorses plan, which also includes per dependent exception increase of $300.

Wisconsin’s Republican-led Senate has approved legislation that would expand child tax breaks to include fetuses.

The bill, which now heads to Wisconsin’s Republican controlled-Assembly, would increase the state’s individual income tax exemption for a dependent from $700 to $1,000. And it would allow someone to claim a fetus as a dependent once a fetal heartbeat is detected. That exemption would not apply to pregnancies that end in abortion.

Republican backers say their goal is helping families offset the costs of having children, starting during pregnancy.

“Recognizing a child in the womb as a viable person demonstrates our support of all children, born and unborn,” state Rep. Karen Hurd, R-Fall Creek, said during a public hearing this fall.

But Democrats said the proposal would do little to help Wisconsin families. Instead, they accused Republicans of furthering an “anti-choice agenda” despite widespread support for abortion rights among Wisconsinites.

“It is part of a national strategy to chip away at abortion rights and ultimately establish legal personhood for embryos and fetuses so that embryos and fetuses have rights under the law and, of course, the pregnant woman has fewer,” Sen. Kelda Roys, D-Madison, said on the Senate floor on Tuesday.

Under a state law that recently went into effect in Georgia, a parent can now claim a fetus with a detectable heartbeat as a dependent for tax purposes. In at least half a dozen other states, lawmakers have introduced state tax bills that would allow fetuses to be claimed as dependents, according to a review by Tax Policy Center.

In Wisconsin, Sen. Mary Felzkowski of Tomahawk was the lone Republican senator to vote against passage of the bill. A representative of her office said Felzkowski was not available for comment Tuesday afternoon about the reason behind her vote.

A spokesperson for Democratic Gov. Tony Evers did not respond Tuesday to a question about whether the governor would veto the bill, should it get to his desk. It would take a supermajority in both chambers of the Legislature to override his veto, and Republicans are short of that threshold.

The increase in the amount of Wisconsin’s tax exemption for dependents, combined with the expanded eligibility for fetuses, would lead to a $20 million reduction in state tax revenue beginning in fiscal year 2024, according to an estimate from Wisconsin’s Department of Revenue. It would also cost the department about $94,000 in annual administrative costs to review claims associated with the bill, according to the estimate.

To claim Wisconsin’s exemption, the bill would require a taxpayer to submit an attestation from a qualified professional who performed an ultrasound, confirming that a “fetal heartbeat” was detected, the legislation says. Typically, providers can detect cardiac activity from an embryo starting at about six weeks of pregnancy.

The expanded tax credits will help families struggling with inflation and other financial pressures, said Rep. Patrick Snyder, R-Schofield, who introduced an identical version of the legislation in Wisconsin’s Assembly.

“Preparing for a birth of a child is very exciting and stressful time,” Snyder told the Senate’s Committee on Licensing, Constitution and Federalism in September. “You might find out that you have to start saving. You have to think of diapers and highchairs.”

Providers across Wisconsin stopped providing elective abortions in June 2022, after the U.S. Supreme Court overturned nationwide constitutional protections under Roe v. Wade.

But Planned Parenthood of Wisconsin resumed those services in September at one clinic in Milwaukee and another in Madison, citing a July ruling in an ongoing lawsuit over the legality of abortions under a 19th-century state law.

Listen to the WPR report here.

Senate Republicans advance tax proposal allowing Wisconsinites to claim fetuses as dependents was originally published by Wisconsin Public Radio.

Fetus tax exemptions? Then why not fetus child support?

How many idiots do we have in the legislature? Plenty.

This is a good illustration of the Republicans caring about unborn children but do nothing for children once they are born. They want State funding for this but refuse to financially support quality child care centers for working parents.

These politicians playing games with our money is simply annoying.

Everything from this bonehead proposal costing $20 million, to King Evers deciding last week to spend $15 million of our “Covid Emergency” funds on a soccer stadium & an art center is just pathetic.

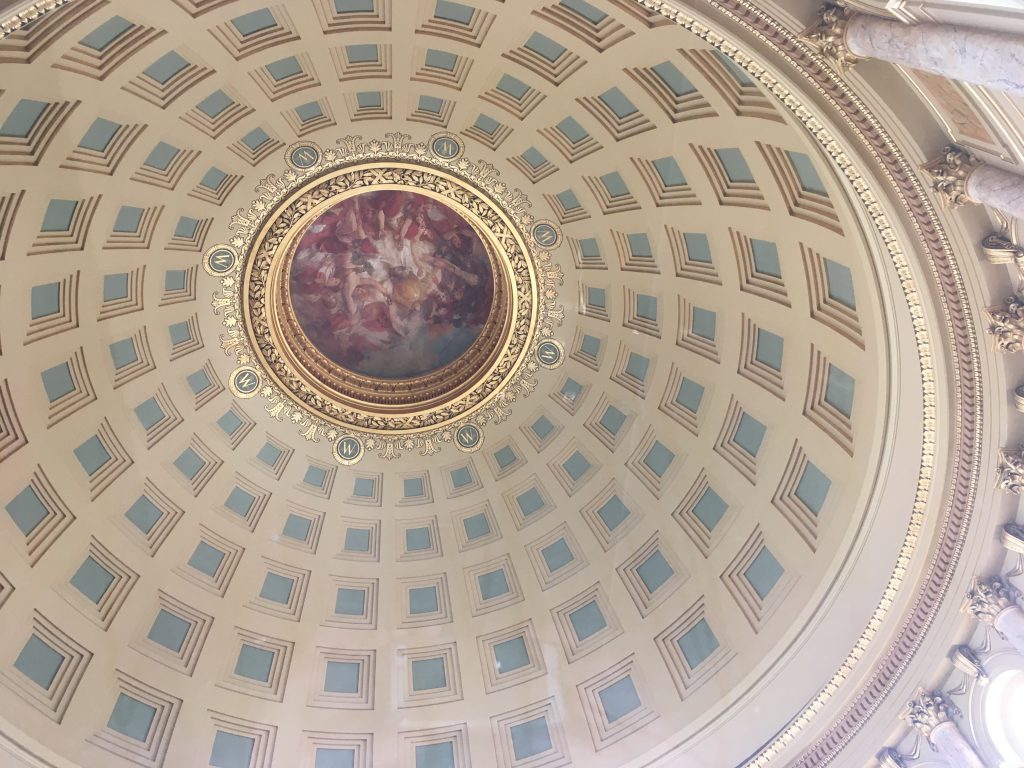

This is OUR money. They have been elected to be stewards of it. Feels like their ongoing games violate Article VIII of our Constitution. …. unfortunately we have no requirements for financial prudence in our Constitution. They could stand on the Capital steps and light our money on fire without violating their Oath to Office.

After reading the Senate Bill, this seems even more insane.

The WI tax rule for dependent exemptions has always just pointed to how the IRS determines eligibility.

So… how will the WI Dept of Revenue now determine who gets the exemption in scenario where parents aren’t married? (the IRS gives it to parent the dependent resided with for the longest amount of time in the year when both parents want to claim the same dependent)

Additionally, the IRS rule for dependent exemptions state that when neither parent claims it on their return… then the exemption can be claimed by ANY taxpayer with a higher income than either of the parents.

Seeing as the Senate Bill makes no provisions for these types of scenarios, there is high probability that there will be filers cashing in on this.

It would be great if reporters/journalists asked logical questions to the politicians that propose these laws.

What incredible HYPOCRISY. Since when does the Republican Party care about families? Health care, child care, education, food, higher wages, public transportation etc etc. This has nothing to do with caring for families. It’s all about controlling a woman’s right to make her own reproductive and health care decisions.., and they know it!

What happens when a miscarriage occurs after the tax return closing the exemption is filed? That will happen for sure. And the “attestation by a professional qualified to perform ultrasounds” (as at “crisis pregnancy centers,” for instance?) surely gives rise to opportunities for tax fraud, one fetal heartbeat at a time. Because who is going to go after the parent grieving a miscarriage for a measly $1000 tax credit?

The PiOuS wisco rCons live to virtue signal.

“Under a state law that recently went into effect in Georgia, a parent can now claim a fetus with a detectable heartbeat as a dependent for tax purposes. In at least half a dozen other states, lawmakers have introduced state tax bills that would allow fetuses to be claimed as dependents, according to a review by Tax Policy Center”.

Since it is happening simultaneously in other states doesn’t this make you wonder who is really behind all this nonsense? Am I stupid to believe it is happening organically? I know ALEC is often writing legislation to be introduced into law, I wonder if something similar is behind this.

Does this proposal back fire and cause more “miscarriages” (after doctor confirms heart beat)?

Is this a clever way to stop funding abortions – if our tax dollars are going to fetuses, citizens won’t want to pay again to abort fetus.

If I’m having twins, do i get two deductions?