Wisconsin Exits Top 10 In Taxes

Now ranks average, 23rd in the nation. Credit Republican fiscal constraint.

Good riddance to 2021, a year when the bad news far exceeded the good. A saving positive, however, to end the year came unexpectedly in the form of a sharply lower tax picture for Wisconsin taxpayers.

For several decades before the turn of the century, state strategists decried the state’s perennial status as one of the higher taxed of the 50 states — often in the top ten. In 1995, for instance, the state was the third highest at 13.5% as a percentage of personal income. Wisconsin had topped 14% several times in the 1980s.

Few observers ever expected Wisconsin to drop out of the top 10 for taxation.

But led by Republicans fiscal restraint, this has been accomplished. State income tax cuts in the 2021-23 state budget promise an even further reduction going forward.

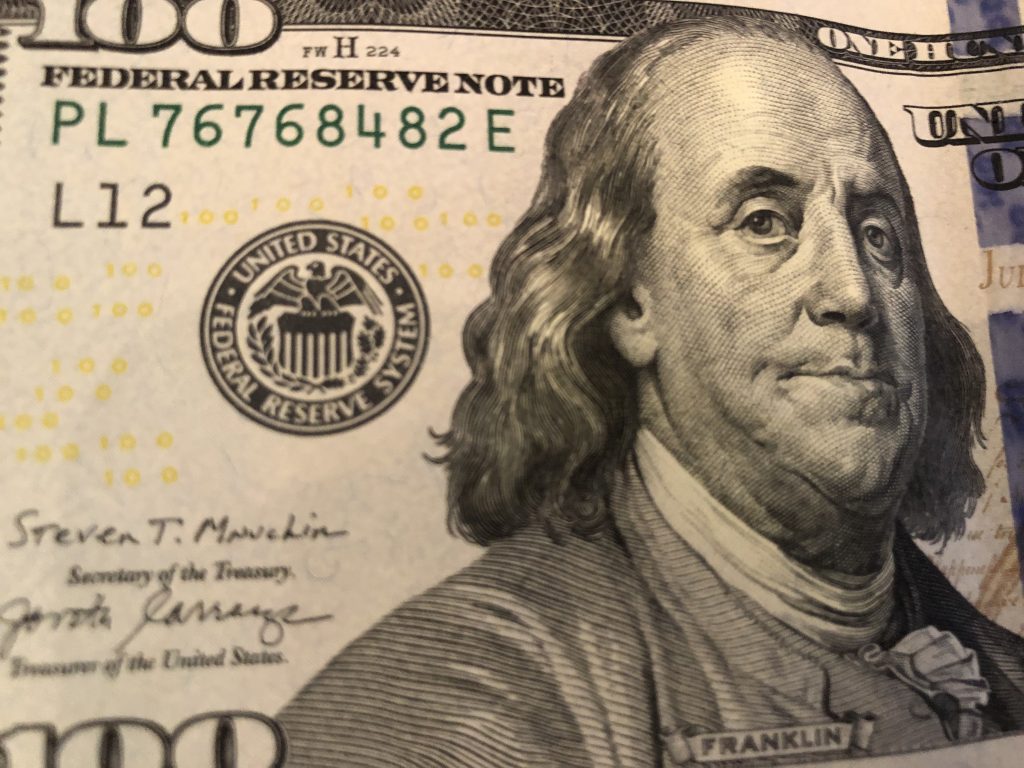

That will mean as much as $1,000 or more per household in the wallets of Wisconsinites.

The tax rankings, which used to be tracked by the Wisconsin Taxpayers Alliance before it merged into the Forum, has a great deal to do with the state’s competitiveness in terms of business climate and people moving to and from the state.

It is no accident that Wisconsin added 3,585 residents in the 12 months ending July 1 after years of brain drain.

In the Midwest, only Indiana and Iowa added more new residents with 20,341 and 4,410 residents, respectively. Michigan lost 17,000.

Wisconsin has three roughly equal pillars for tax revenues, and all three decreased as a percentage of personal income. The property tax led the way at 9.7 billion at 3.3% of personal income. Personal income tax and sales tax were close behind at 2.9% and 3.0%.

Taxes aren’t everything when a business or a person decides where to locate, but they are certainly a major factor.

Wisconsin’s attractiveness also benefits from its excellent quality of life. Its water resources in lakes and rivers are a big draw. Its forests and parks are a big plus. Its robust arts and cultural assets add to the mix. Its education resources are far above average among the states.

Despite the pandemic, Wisconsin’s unemployment rate dropped to an all-time low of 3%. Jobs at ever-higher pay are going begging.

If everyone would just get vaccinated, the damage to the economy would mostly disappear, but as long as the anti-vaxxers scare the populace with ungrounded misinformation, herd immunity will be unlikely. Every company and every household will share the economic pain caused by an unwillingness to take full advantage of the miraculous covid vaccines.

Ironically, the development of the vaccines was accelerated under Republican former President Donald Trump, but his party, led by the likes of Sen. Ron Johnson, has obfuscated and slowed the acceptance of the vaccines. The GOP that has long stood for lower taxes, smaller government and economic growth is undercutting its own success by opposing the broad adoption of the proven-to-be-effective vaccines.

Even Trump has changed his posture by getting his third shot.

We welcome the good news of lower taxes and a surplus of jobs in the new year, but we all have every right to be worried about the negative impact of the unvaccinated on the economy of 2022 and beyond.

(Note: John Torinus is a former chairman of the Wisconsin Taxpayers Alliance.)

John Torinus is the chairman of Serigraph Inc. and a former Milwaukee Sentinel business editor who blogs regularly at johntorinus.com.

Op-Ed

-

Unlocking Milwaukee’s Potential Through Smart Zoning Reform

Jul 5th, 2024 by Ariam Kesete

Jul 5th, 2024 by Ariam Kesete

-

We Energies’ Natural Gas Plans Are A Mistake

Jun 28th, 2024 by John Imes

Jun 28th, 2024 by John Imes

-

Milwaukee Needs New Kind of School Board

Jun 26th, 2024 by Jordan Morales

Jun 26th, 2024 by Jordan Morales

While I’m on board with your pleas for more people to vaccinate, I must point out that lower taxes in this state may serve some people well but not necessarily all of us. It shouldn’t be a question of higher or lower taxes. The question is, how is the money spent. If there is one thing that every community in our state can agree on, existing roads, state, county, and local r in terrible shape and have been for years. Shared revenue cuts have affected education, public services, and law enforcement. Recently Robert Riech posited a question about Government spending. We often discuss the cost of government [programs but do not consider the cost of not performing the government program in question.

Lower tax rates sound good, but may not be in the long run.

I want my taxes to go to wealthy republican donors.

Many of these things which were mentioned as attributes which draw people to Wisconsin were developed when we had a higher level of public support for parks and education. Over time I fear these things will deteriorate and we won’t have a competitive advantage. I think we’re already seeing this happen. No one enjoys paying taxes but we have to share in our responsibility to build the type of community we want to live in.

Under the single-party rule of the Republican-controlled state legislature has not given Wisconsin a robust economy.