State’s Tax Loopholes a Boon to Wealthy

Helps many dodge taxes, contributes to wealth gap.

Jericho / (CC BY)

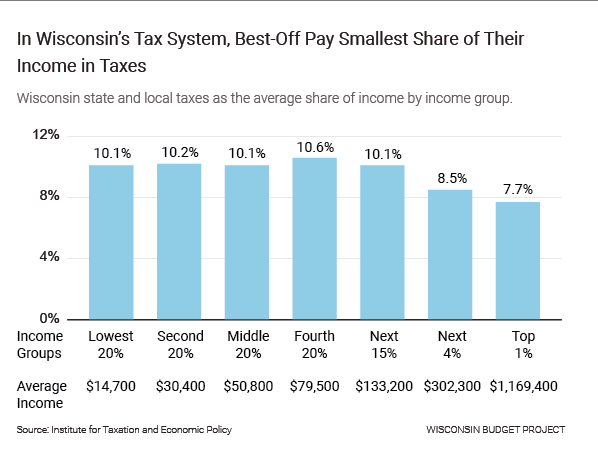

The disclosure that President Trump pays next to nothing in income taxes has highlighted the fact that the federal tax system is stuffed full of loopholes only available to the ultra-wealthy. But you don’t have to look to the federal system to find a tax code tilted in favor of the rich and powerful. Wisconsin’s system is also loaded up with a collection of special-interest tax breaks that siphons revenue away from where it is needed most, and instead directs it towards a small number of wealthy, well-connected individuals and big corporations.

Wisconsin tax breaks that allow some wealthy and powerful people to pay less than their fair share of taxes include:

- A tax credit for manufacturers that allows businesses or business owners to pay next to nothing in state income taxes. This credit is so slanted that most of the tax break that is claimed through the individual income tax goes to multi-millionaires. For people who claimed the credit and had incomes of more than $30 million, this credit provided an average tax break of $1.8 million each. Owners and businesses do not need to create new jobs to be eligible to claim the credit. Even businesses that lay off workers, send jobs overseas, and close factories may receive this tax break.

- A provision that favors income earned from wealth over income earned from work. Wisconsin is one of only a few states that gives preferential tax treatment to income earned from investments, taxing that income at a lower rate than income that comes from earning a paycheck at a job. This practice means that people who already have a lot of money and live off their investments can pay a lower income tax rate than people who work for a living.

- A new tax break for people who roll their profits from investments into funds that invest in certain designated neighborhoods or “Opportunity Zones.” These funds generally have a minimum income requirement of at least $200,000 for individuals and $300,000 for couples. The top 1% of people by income will reap an estimated three-quarters of the Opportunity Zone tax breaks in Wisconsin.

In Wisconsin, as at the federal level, lawmakers have written the tax code so as to allow the wealthy and powerful to sidestep paying the taxes that fund government services, including schools, and modern transportation networks. These loopholes drive up taxes for people who live paycheck to paycheck, and also help starve communities of the revenue they need to provide critical public services.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock