Federal Tax Plan’s Impact on State

Half of tax cuts will go to the top 5 percent, many lose health care.

When we released an analysis a couple of months ago of the proposed tax bill, Speaker Paul Ryan claimed that the Wisconsin Budget Project and others who pointed out the extremely slanted nature of the tax package were engaging in “class warfare.” That’s an ironic charge from a lawmaker who has been leading the way for changes in taxes and spending that will substantially increase the wide gulf between the wealthiest Americans and the rest of us.

Numerous analyses of the distribution of the tax shifts have been completed, and they consistently show that the final tax bill will cause a huge shift in wealth to the richest Americans. This is exemplified by the fact that the new tax cuts for the wealthy and corporations are big and permanent, while the rest of us will either pay more in taxes, or if we do get a cut it will be relatively small and temporary.

In this story, we summarize the findings from the latest analysis of the final tax bill by the Institute on Taxation and Economic Policy (ITEP). Here are some of the key takeaways:

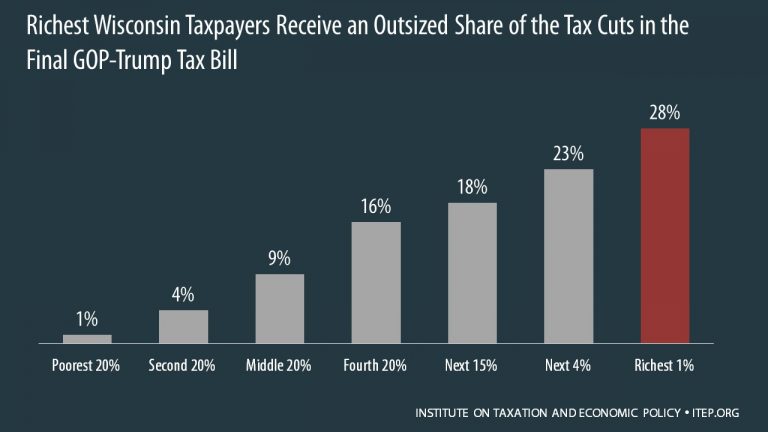

More than half of the benefit of the tax changes will go to the top 5 percent of Wisconsinites.

Numerous analyses have come to the same conclusion, that corporations and wealthy Americans will get a huge windfall from the tax changes. The ITEP report is the only one that models the effects in each state. Their analysis for Wisconsin concluded that in 2019 the top 5% of state residents would get 51% of the benefit of the tax changes, versus just 15% for the bottom three-fifths of taxpayers in our state.

Richest Wisconsin Taxpayers Receive an Outsized Share of the Tax Cuts in the Final GOP-Trump Tax Bill

The reason that so much of the tax cuts goes to the very wealthy is that nearly half of the total tax benefit in Wisconsin will go to corporations and businesses organized as pass-through entities. Of that amount, slightly over half goes to the top 1% of Wisconsinites, and a total of 72% goes to the top 5%. Over time the distribution of the benefits skews even more heavily toward the wealthy, for reasons we explain below.

Many people will owe more in taxes than they do now.

The ITEP analysis projects that in 2019 about 126,000 Wisconsin taxpayers will owe more federal taxes than they do now, including 57,000 who are in the bottom three-fifths of taxpayers (with incomes below $70,400).

As we explain below, the number who will owe more will grow sharply after 2025.

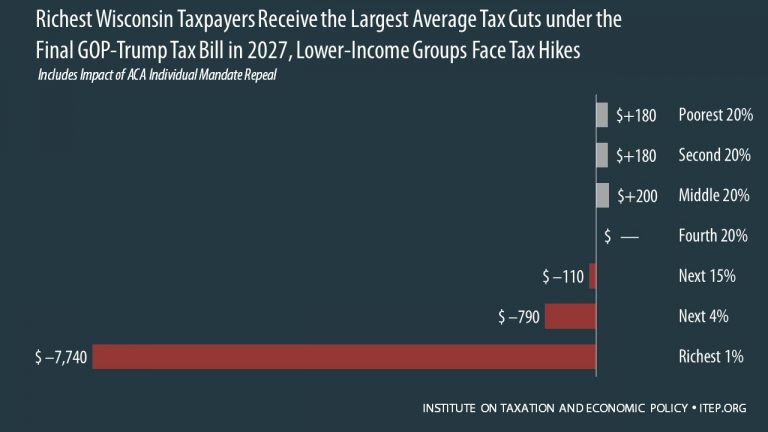

Many of the tax cuts end after 2025, and by 2027 Wisconsinites will collectively pay more than they would under current law

To keep the ten-year cost of the tax cuts below the $1.5 trillion cap set by the Senate, while providing massive tax credits to corporations, the bill ends after 2025 nearly all of the tax changes that relate to families and individuals. Yet most of the corporate tax cuts are permanent – which clearly illustrates the priorities of the bill’s architects. As a result of those priorities, the ITEP analysis shows that in 2027:

- About 804,000 Wisconsinites will owe more in 2027 than they would under current law.

- Although Wisconsin corporations will owe almost $1 billion less in 2027, the bill is expected to increase total federal taxes in Wisconsin that year by about $25 million.

- For the bottom three-fifths of Wisconsinites, the new law is expected to raise taxes in 2027 by $360 million.

Richest Wisconsin Taxpayers Receive the Largest Average Tax Cuts under the Final GOP-Trump Tax Bill in 2027, Lower-Income Groups Face Tax Hikes

Some proponents of the bill contend that Congress will act between now and 2026 to continue the new tax cuts and avoid tax increases. That’s a definite possibility, but it would result in even deeper cuts elsewhere, and/or a much larger increase in the deficit than the $1.5 trillion that the bill currently authorizes.

One change relating to federal individual income taxes that does not expire is to make smaller annuals adjustment in tax brackets for inflation. That change, coupled with deductions that will no longer be adjusted for inflation (like the cap on the deduction for state and local taxes), will continue to boost individual income taxes in future years. Similarly, the Earned Income Tax Credit will grow more slowly over time, which will gradually erode its value to low-income working families.

The eventual cuts in federal programs will hurt many more Americans

The calculations by ITEP of who will be worse off are based just on the changes within the tax code. Of course, sooner or later the bill will come due for the huge cost of the massive tax cuts for corporations and the very wealthy. It’s impossible to predict exactly where those cuts will be made, but it’s a safe bet that they will adversely affect a wide range of Americans – including those who get little or no benefit from the poorly targeted tax cuts.

13 million fewer people are expected to be insured

The final bill is a not-so-stealthy attack on the Affordable Care Act – particularly the most centrist part of that law, i.e., the subsidized private insurance Marketplace. The bill destabilizes the Marketplace and puts its future at risk by repealing the individual mandate. The Congressional Budget Office estimates that that change will cause 13 million fewer Americans to have health insurance, and it is expected to boost the cost of private Marketplace plans by 10%.

For all of these reasons and many others, this hastily-passed bill delivers a huge windfall to the rich and the powerful, but will be a huge setback for most Americans.

For more information on how the federal tax plans affect taxpayers, go to the Institute on Taxation and Economic Policy or the Wisconsin Budget Project page on this issue.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

If the bottom 40 percent pay no income tax, then there is no reason to give cuts to filers that pay no income tax.