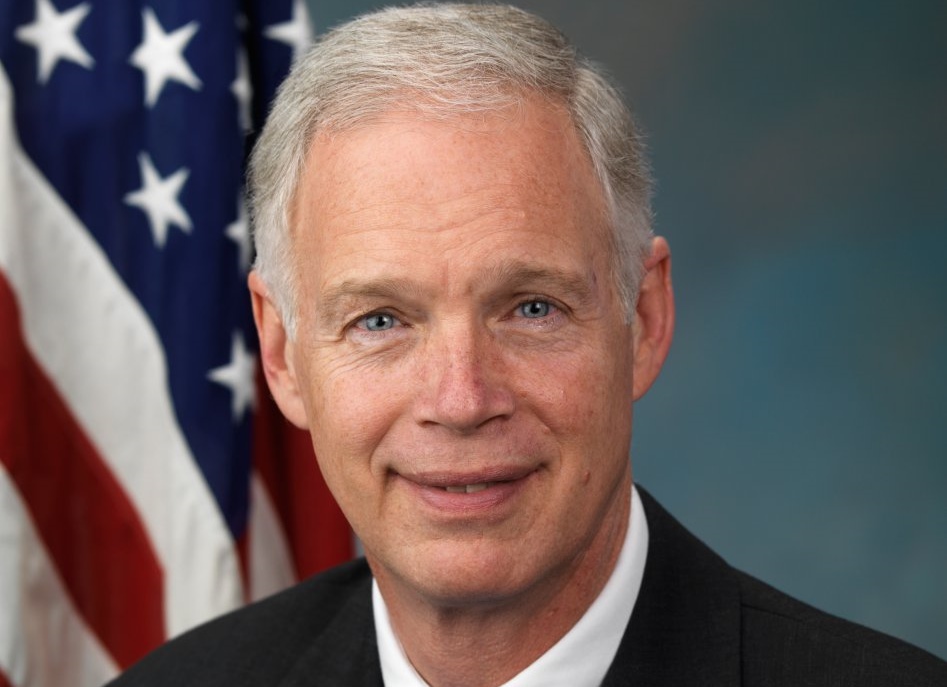

Does Tax Plan Enrich Ron Johnson?

And will changes senator championed help small businesses? A look at the numbers.

Wisconsin Senator Ron Johnson made waves last month when he became one of the few Republican voices opposing the Senate and House tax plans, saying both versions were unbalanced in favor of large corporations.

After a meeting between President Donald Trump and Republican members of congress, reports of a heated conversation between Johnson and the president about the status of pass-through businesses in the tax plan were leaked to the press. The plan cut the tax rate for conventional corporations from 35 percent to 20 percent, but created a much smaller tax cut, a 17.4 percent tax deduction, for individuals receiving pass-through income.

More than 90 percent of American businesses are pass-throughs, and range in size from sole proprietors and mom-and-pop shops to partnerships and limited-liability companies, both large and small, and include big investment partnerships, law firms, even some doctors. They’re called pass-throughs because all profits earned are passed through to the owners, shareholders and partners of the company, who pay tax on them through their personal returns

Johnson told the New York Times the tax bill gave an unfair advantage to larger corporations by giving less of a tax break to pass throughs. “I just have in my heart a real affinity for these owner-operated pass-throughs,” he said. “We need to make American businesses competitive — they’re not right now. But in making businesses competitive, we can’t leave behind the pass-throughs,” which he has said are drivers of American economic growth.

Johnson’s opposition won him sympathetic coverage from the Times, the Wall Street Journal and Wisconsin businessman and columnist John Torinus, who called the senator “a hero for small companies.”

Investors Business Daily noted the tax plan had huge benefits for pass-throughs: “Today, these pass-through businesses face a top income tax rate of 39.5%. Under the Senate bill, they’d get to deduct 17.5% of their income, with the rest taxed at the individual rate.”

Johnson’s opposition, however, had an impact: The final version of the Senate tax bill increased the allowable deduction on pass-through income to 23 percent, and Johnson’s office confirmed that this change secured his vote for the bill. He issued a press release saying, “I appreciate the Senate leadership’s willingness to work to close the gap between pass-through businesses and C corporations.”

But the conference committee to reconcile the differing house and senate versions of the tax bill has reduced the deduction on pass-through income to 20 percent, still higher than the original senate plan. Johnson hasn’t expressly signaled whether he will support the revised plan, but the media has been counting him as a supporter.

Johnson also has been silent on the issue of how he might personally benefit from the increased deduction on pass-through income. According to his financial disclosure documents, Johnson and his wife Jane own a 100 percent interest in a commercial real estate property in Oshkosh, Wisconsin valued at $5 to $25 million. They lease the property to a company called Pacur LLC, which produces polyester sheets and plastics used in food and medical storage. The Johnsons also hold a 5 percent stake in Pacur, valued at between $1-$5 million. “Mr. Johnson earned between $215,000 and just over $2 million in pass-through income in 2016, through several limited liability companies,” the Times story estimated.

Based on that estimate, the 17.4 percent tax deduction in the original plan would have given Johnson a tax deduction of anywhere from $37,410 to $348,000 in 2016; at the 25 percent level he preferred, his tax deduction would have ranged from $53,750 to $500,000 – a half million dollars.

In his statements, Johnson has never used the phrase “small businesses” to describe who would benefit from increasing the pass-through tax deduction, but has suggested larger corporations were getting favorable treatment in the tax plan. In fact, research from University of Chicago economist Owen Zidar shows that 70 percent of pass-through business income goes to the top 1 percent of earners, similar to what the Brookings Institution has found. And Johnson’s financial disclosures suggest he is included among the 1 percent.

Johnson’s office has so far not responded to requests for comment as to how much he would personally benefit from the change he has championed. Says Wisconsin Democratic Party Chair Martha Laning: “The people of Wisconsin deserve to receive full disclosure from Sen. Johnson on how his changes to the tax bill will benefit him personally. Senator Johnson should not join the president in obfuscating what could be his own personal gain on this tax bill that hurts real people to further enrich the 1%.”

Ron Johnson is a charlatan!

He got what he wanted from the republican’s disastrous tax scheme!

http://onewisconsinnow.org/press/ron-johnson-gets-his-badger-bribe-to-vote-for-disastrous-tax-cut-plan/

Dump Ron Johnson!!

Ron Johnson said will not face the voters again. Sadly, with the state Democratic party in disarray we will probably have Sen. Vukmir answering to the Koch brothers and Sen. Johnson answering to no one.

@GRAANDPAKWH, keep your chin up! Don’t let the Republican crooks and charlatans get you down. Yes they have stolen our voting rights. Yes they have destroyed Democracy in the state by gerrymandering. Yes the same big out of state money that funds them also funds many now sitting on the courts. Yes they have sold out our future via the 3 billion in corporate welfare FoxCON job. Yes our schools and roads are crumbling statewide. Yes people are fleeing the nightmare that is Scott Walker’s Wississippi in droves but we have one more chance, 2018, if we can’t get rid of these monsters and goons next Novemberbthen yes, all hope is lost. Get out and vote and bring as many people as you can with you!

Of course this enriches Senator Johnson. The deficit is no longer important as long as he gains personally.

@Terry, The Democratic party in Wisconsin will not give the voter’s an opportunity to vote the “monsters” out. Many races will go unopposed hiding behind the gerrymandering and voter suppression. The fact is the party is not doing its job. Why even go to the polls if there is not a local candidate you can support? No race should go uncontested.

If Ron Johnson’s business interests make a profit in 2018 then more than likely he would benefit. Most hard working Americans will benefit. It appears I will save $2000 thank you Ron Johnson.

@Troll, Money is a terrible God and avarice will get you nowhere.

I am sure all the atheist in this audience will enjoy your ode to Santa Claus. My money is my freedom in my pockets.

@troll, After you are done celebrating your avarice you and should meditate on why republicans choose to afflict the afflicted and comfort the comfortable, for this is the opposite of what Jesus taught.

Exposé Johnson for what he is a crook!

LOL you people are funny. Calm down, this isn’t a big deal.

Ron Johnson and other Republicans in the House and Senate have become the gatekeepers for the Trump family and administration and their wealthy supporters, which includes Ron Johnson and the Republicans in the House and Senate. Update, July, 2018.The floodgates are wide open, Ron and his wealthy brethren, and sisters, continue to reap the financial rewards that they deem themselves to be so deserving of. Meanwhile, tariffs are killing the small businessmen, small farmers, etc.

End this downhill rush to financial ruin. Trump’s long history of personal gain for himself and his family amidst bankruptcy after bankruptcy goes ignored, because there is profit to be made for those who use money to make money, but not for those who use blood, sweat, and tears to squeeze out a barely livable wage. Vote Democratic this November.

BUMPSIE – The same Ron Johnson blocked payments of $1,200 to Americans yesterday because he was concerned aboutn “mortgaging his kids’ future” by adding to the deficit.

He seemed to have no problem with adding to the estate he’ll give to his kids by signing off on the deficit-exploding Tax Scam in 2017, did he?