Tax Plan Will Increase Black Student Debt

Blacks now have twice the college debt of whites; GOP tax plan would widen the gap.

Now that the Senate and the House of Representatives have each passed their own versions of a federal tax plan, they will try to reach agreement on a single plan for both houses of Congress to approve. The two tax plans are more alike than dissimilar – both hike taxes on a sizeable number of taxpayers with low and moderate incomes, give the richest extremely large tax cuts, and favor corporations over individuals and families.

One difference between the two plans is that the House version includes provisions that would push higher education out of reach for many students, by raising the cost of obtaining a college degree and blocking one of the main pathways students take to financing advanced degrees. Whether these measures will wind up in the final version of the tax bill is anyone’s guess, especially given that the extremely rushed process Congress has engaged in so far in the tax debate has limited the opportunity for taxpayers to weigh in on various aspects of the bills. But considering that the House approved a version of the bill including these harmful changes to higher education – with Wisconsin Republicans Paul Ryan, Jim Sensenbrenner, Glenn Grothman, Sean Duffy, and Mike Gallagher all voting in support — they could well end up in the final version of the bill and written into law.

There are two main ways the House GOP tax plan raises costs for college students and makes it harder for students with limited resources to earn degrees.

1. The bill eliminates the student loan interest deduction that allows people paying off student loans to subtract the first $2,500 of interest costs from their incomes before calculating the amount of tax they owe. Taxpayers with student loans can save up to $625 a year from this deduction. This change would increase taxes for student loan borrowers by about $24 billion over the next decade.

Ending the student loan deduction would hit close to home for Wisconsin students, making it harder to afford the cost of college. Nearly two-thirds of students in UW institutions take on some level of debt.

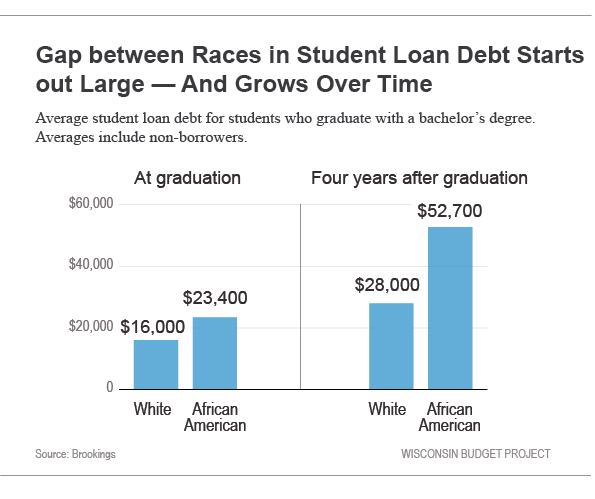

African American students would be particularly hard hit by the elimination of the student interest loan deduction, as they are typically burdened by larger debt loads than are white students. Black students often come from families with lower incomes than white students and have access to less in the way of family wealth, leaving borrowing as one of the few methods available to finance their education.

As described by a Brookings report:

“The moment they earn the bachelor’s degrees, black college graduates owe $7,400 more on average than their white peers ($23,400 versus $16,000, including non-borrowers in the averages). But over the next few years, the black-white debt gap more than triples to a whopping $25,000. Difference in interest accrual and graduate school borrowing lead to black graduates holding nearly $53,000 in student loan debt four years after graduation – almost twice as much as their white counterparts.”

The student interest loan deduction doesn’t do much to correct the fundamental economic imbalances that compel black students to borrow more than whites and make it harder for them to pay back the debt – but eliminating it would make the problem worse, and raise the costs for African American students to attend college.

2. The House GOP tax plan would dramatically increase taxes for students studying for advanced degrees. Students pursuing advanced degrees are often given a small stipend and free tuition (sometimes referred to as tuition remission) in exchange for teaching classes or doing research. The tax plan passed by the House would force students to pay taxes on the value of the free tuition as if it were income.

Some graduate students have calculated that this change would increase the amount of income tax they owe by 200% or more, making it much more expensive for students to pursue advanced degrees.

In a letter to students and faculty, the University of Wisconsin-Madison describes the harm that would result from repealing the exemption for tuition remission:

“A repeal [of the exemption for tuition remission] would lead to a completely unaffordable increase in taxable income and make the pursuit of a graduate degree much more challenging, if not impossible, for a large number of these students. In turn, this would greatly damage our nation’s scientific research enterprise. [Exempting tuition remission] is critical for developing the science and technology workforce pipeline that employers need to propel our nation’s economy forward.”

Like the elimination of the student loan interest deduction, the proposal to make it more expensive to attain an advanced degree would do particular harm to students of color. An editorial by Steven W. Thrasher in the New York Times warns:

“If included in the final tax plan [taxing tuition waivers] would disproportionately harm nonwhite graduate students and be disastrous for the already dismal diversity of academia, putting an additional roadblock between people of color and the ivory tower and depriving all of us of their desperately needed intellectual contributions…

One thing that has been at least somewhat helpful at redressing enormous structural racial barriers is the way some modern Ph.D.s are funded. As the National Science Foundation noted in June in its Survey of Earned Doctorates, ‘a growing proportion of students over the past 10 years has relied on research assistantships and teaching assistantships for their financial support during graduate school.’

While the vast majority of doctorates still go to white people, this effort seems to have contributed to an increase in racial diversity. According to the survey, there has been a 31 percent increase in black doctoral recipients over the past 10 years and a 71 percent increase in the number of Hispanic or Latino doctorate recipients.

This model, which House Republicans have proposed effectively taxing into elimination, was the only way a doctoral education was possible for me.” (A Republican Tax Proposal Would Make Academia Even Whiter, Nov. 29, 2017).

Congress should be working to make higher education more affordable for everyone. Instead, Congress is considering changes that would push college and advanced degrees out of reach for many low-income students and especially African American students. Unfortunately, these provisions are in the same spirit as many of the other components of the proposed tax bill, which would raise taxes on a significant number of low- and middle-income taxpayers, give outsize tax cuts to corporations and the very wealthy, and make it harder for Wisconsin taxpayers to achieve economic security. The Wisconsin Budget Project website has more about how the federal tax plans would affect Wisconsin taxpayers.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Tamarine,

Doesn’t the tax plan increase also the standard deduction? My guess is that most, if not all college students do not itemize their deductions because the standard deduction is already more than what they would itemize. I could be wrong, hopefully the author can address this. Maybe with an example of someone who makes $30,000 and pays tuition debt and uses standard deduction when calculating their taxes. Can you show what the actual impact would be?

LT, under current law, the student loan interest deduction can be taken even if you don’t itemize because it is claimed on Form 1040 Line 33 (not Schedule A).

A single taxpayer earning $20,000 with at least $2,500 in student loan interest would have a tax increase of 37% (House bill) or 17% (Senate bill).

A single graduate student (at a school with a $40,000 annual tuition) earning $20,000 with at least $2,500 in student loan interest would have a tax increase of about 800% (790% under the House bill, 849% under the Senate plan) compared to current law.

(All numbers shown are for 2018.)

Current law (not a grad student)

6,500 Std Deduction

4,150 Personal Exemption

2,500 Student Loan Interest deduction (itemization not required)

13,150 Total Exclusion

20,000 Wages

13,150 Exclusion (see above)

6,850 taxable income

10% tax bracket

685.00 Total income tax owed

House Bill (not a grad student)

12,200 Std Deduction

0 Personal Exemption (repealed)

0 Student Loan Interest deduction (repealed)

$12,200 Total Exclusion

20,000 Wages

12,200 Exclusion (see above)

7,800 taxable income

12% tax bracket (a higher tax rate!)

936 Total income tax owed

Tax increase vs current law: 37%

Senate Bill (not a grad student)

12,000 Std Deduction

0 Personal Exemption (repealed)

0 Student Loan Interest deduction (repealed)

$12,000 Total Exclusion

20,000 Wages

12,000 Exclusion (see above)

8000 taxable income

10% tax bracket (a higher tax rate!)

800 Total income tax owed

Tax increase vs current law: 17%

Current law (grad student with $40,000/yr tuition)

(everything is the same as above, with income tax of $685)

House Bill (grad student with $40,000/yr tuition)

12,200 Std Deduction

0 Personal Exemption (repealed)

0 Student Loan Interest deduction (repealed)

$12,200 Total Exclusion

20,000 Wages

40,000 Tuition

60,000 Taxable income

12,200 Exclusion (see above)

47,800 taxable income

25% tax bracket (a higher tax rate!)

6,100 Total income tax owed (over 3 tax brackets)

Tax increase vs current law: 790%

Senate Bill (grad student with $40,000/yr tuition)

12,000 Std Deduction

0 Personal Exemption (repealed)

0 Student Loan Interest deduction (repealed)

$12,000 Total Exclusion

20,000 Wages

12,000 Exclusion (see above)

40,000 Tuition

60,000 Taxable income

48000 taxable income

22% tax bracket

6,500 Total income tax owed (over 3 tax brackets)

Tax increase vs current law: 849%

Details of the House and Senate tax bills can be found here:

https://www.jct.gov/publications.html?func=download&id=5048&chk=5048&no_html=1

2018 tax rates, etc (under current law) can be found here:

irs.gov/pub/irs-drop/rp-17-58.pdf

Sometimes the devil is not in the details, but in the big picture. And the big picture in this case is pretty clear. Large majorities of Americans oppose this tax bill, but it will pass anyway, and the president who lost the popular vote by 3 million votes, will gleefully sign it, adding the flourishes of his usual lies about how great it is going to be for “ordinary Americans” and denying the fact that he is giving himself a huge tax cut.

If there is a smoking gun that makes clear beyond doubt that we now live in a kleptocratic plutocracy, this transfer of wealth from the struggling masses, including the former middle class and poor people, to the rich and corporations, will be it. It will increase our world class inequality, our world class lack of upward mobility, and, at the same time, entrench the corporate, ultra-rich and the undeserving hereditary elites like Ivanka/Jared and the boys who now call the shots in our country.

Since there will be no growth to make up for he lost revenues, it will be essentially a zero-sum game, a perfect example of class warfare, with “the little people” getting the short end of the stick.

And, as the fraud of sparking growth becomes inescapable, the deficits increase, and Paul Ryan and the reactionary right’s demands for huge spending cuts via “entitlement reform” begin to bite the far-right’s white base, the need to ramp up the attack on scapegoats will be the last refuge of the Republican Party.

In the minds of Ryan, McConnell and the rest, they can cleverly structure this bill to mask the disaster that lies down the road. In their minds, it’s “IBY/YBG,” or “I’ll be gone/you’ll be gone,” the Wall Street mantra that produced the Great Recession. Or they believe that they will have achieved permanent control over all branches of the government, discredited the press, hidden the rampant criminality and self-dealing, and replaced the mentally ill president who, having served his purpose, would now be an embarrassment and can be moved out.

Maybe the devil is in the details, but the evil is in the big picture.

Earlier this month the U.S. Department of Education’s National Center for Education Statistics published a report on patterns of student loan repayment for two groups of borrowers who first enrolled in college in 1995-1996 and in 2003-2004.

Historically the department has not collected much data on student debt that can be broken out by the race or ethnic background of borrowers. The new report, however, included tools that researchers can use to compare how various groups are faring.

Two resulting analyses found a troubling picture for black students who take out loans.

Nearly half (49 percent) of all black borrowers in the 2004 group defaulted on at least one loan within 12 years, wrote Robert Kelchen, an assistant professor of higher education at Seton Hall University. That default rate was more than twice that of white students (20 percent) and more than four times the rate of Asian students (11 percent).

“The differentials are still present across sector, with more than one-third of black students defaulting across all sectors while a relatively small percentage of Asian students defaulted across all nonprofit sectors,” Kelchen said. “Default rates at for-profit colleges are high for all racial/ethnic groups, with almost half of white students defaulting alongside nearly two-thirds of black students.”