Who Benefits From Federal Housing Subsidies?

Higher income get more than low income, Waukesha more than Milwaukee.

McMansion. Photo by Paul Sableman.

Matthew Desmond’s recent book Evicted, based on Milwaukee, has drawn attention to the plight of poor people whose rent consumes most of their income. This often leads to evictions and the inability to afford other necessities, including food and utilities. Desmond’s book follows two Milwaukee landlords and struggles of their tenants to pay the rent,

Desmond’s penultimate chapter, “Epilogue: Home and Hope,” argues that the problems he describes could be substantially ameliorated by expanding an existing federal housing program. Called “Section 8,” it operates on the principle that no one should be forced to spend more than 30 percent of their income on housing. If rent and utilities take up more than 30 percent of a participant’s income, a Section 8 voucher pays the difference.

The problem is that Section 8 funding is far short of what is needed to offer vouchers to everyone who qualifies. In most places, there is a substantial waiting list for vouchers, and many waiting lists are closed.

A recent study from Apartment List, a website which aggregates apartment listings from around the web, compares spending on two federal programs that subsidize housing costs. One is the mortgage interest deduction that allows taxpayers to deduct from their taxable income the interest they pay on home mortgages. The second is Section 8 housing vouchers.

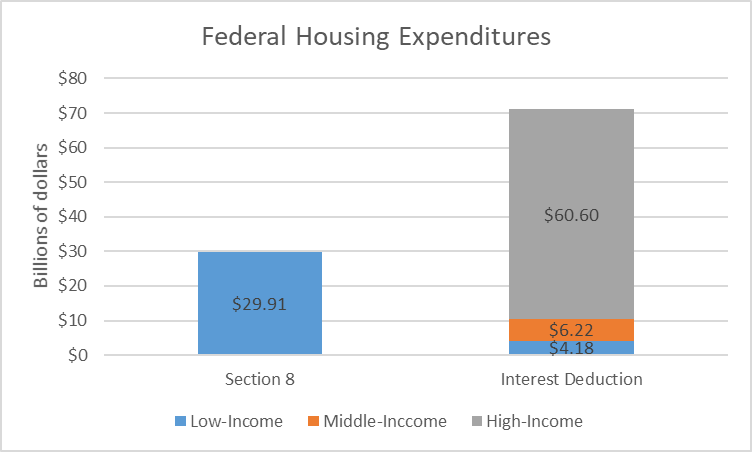

As the next graph shows, the cost to federal taxpayers of the mortgage interest deduction is around $70 billion, compared to $30 billion for the Section 8 vouchers. $60 billion of the $70 billion mortgage interest deduction benefits high-income people. Several factors help explain why wealthy people are the prime beneficiaries of the mortgage interest deduction. They are more likely to own their house. A more expensive house leads to a larger mortgage and higher interest payments. The higher the marginal tax rates the more valuable the tax deduction. Wealthy people are more likely to itemize rather than take the standard deduction.

Using data published by the US Department of Urban Development, Apartment List calculated the voucher amount for each county in the US. It used the IRS’ Statistics of Income database to calculate the mortgage income deduction by income. It defined middle-income people as those making 80 percent to 120 percent of the median area income.

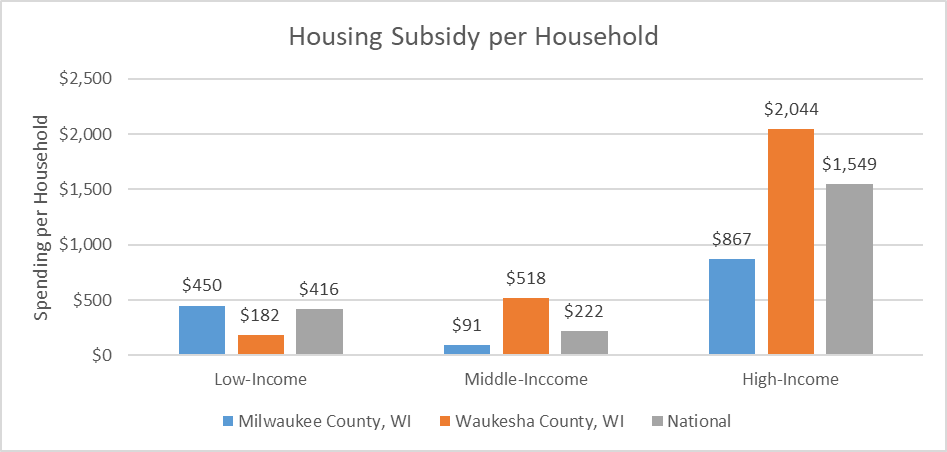

The next chart shows the average total housing subsidy per household in Milwaukee County (in blue), Waukesha County (in rust), and the whole US (in gray). Apartment List calculated these by taking the total spent by the two programs on low, middle, and high-income households and dividing that by the number of households in each of the income groups.

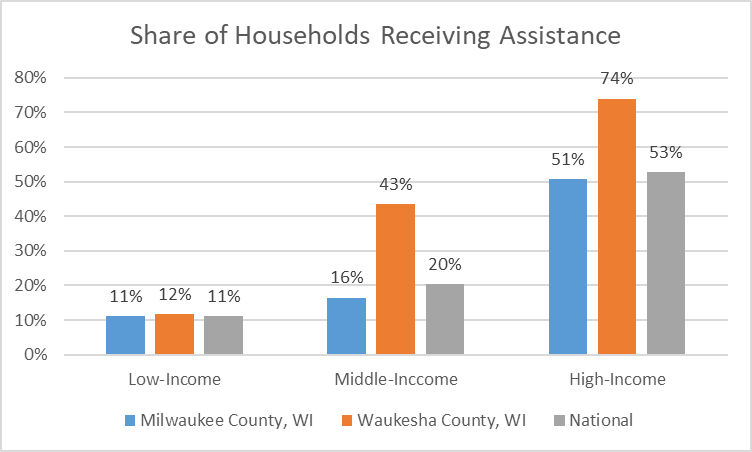

The next chart shows the share of low, middle, and high-income households receiving any federal housing benefit. Contrary to the wide-spread view that government benefits flow mostly to poor people, wealthy Waukesha County households are those most likely to receive a federal housing subsidy.

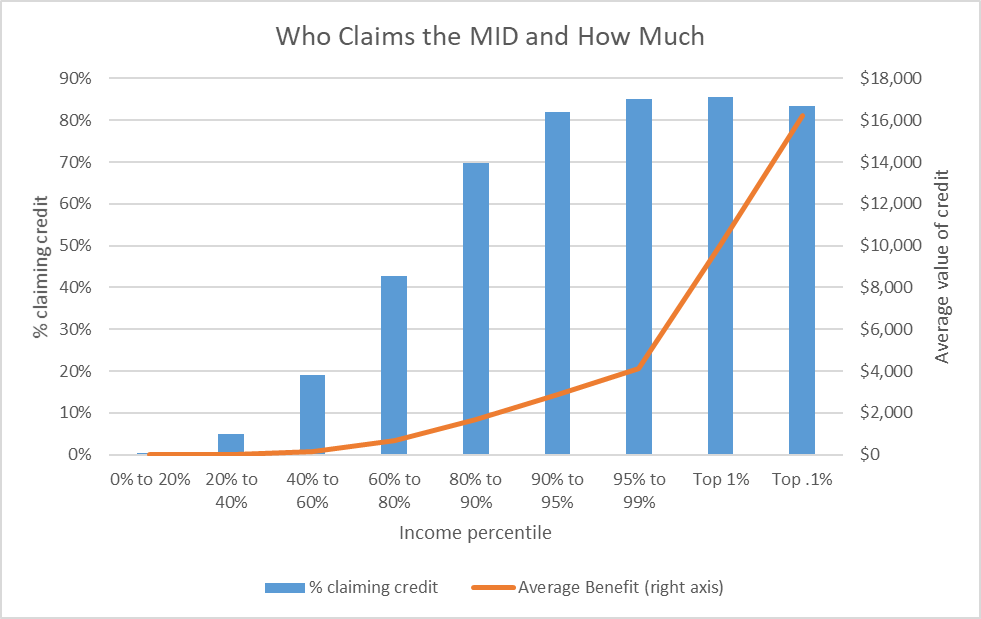

Apartment List’s analysis of who benefits from the mortgage interest deduction are consistent with others. The next chart summarizes the Tax Policy Center’s analysis of the mortgage interest deduction. The vertical bars (using the left axis) show the percentage of taxpayers claiming the deduction. Among the wealthiest 10 percent, practically everyone takes it. Likewise, the value of the deduction (red line and right axis) rises steadily with income.

The tax reforms of the 1980s eliminated deductions for most kinds of interest. It was feared that being able to deduct interest encouraged people to go into debt, rather than build up savings. The mortgage interest deduction was the sole survivor. It was argued that encouraging home ownership had social benefits, helping build strong communities.

Recently, however, there is growing concern that home ownership may have adverse effects. Owning a home may make one more reluctant to move from an area with high unemployment to one with more jobs if that means taking a loss on your house.

This would suggest the goal of government policy should be less that of incentivizing house purchases than helping those struggling to afford housing of any sort. As currently designed, the mortgage interest deduction serves mostly people who do not need help with housing costs.

Two changes to the interest deduction would help address this imbalance. One is reducing the current $1 million cap on mortgages. Another is eliminating the deductibility for second homes. Both would help make the deduction less regressive and free up funds to help more low and middle-income people. Converting the deduction into a tax credit would provide tax relief to middle and low-income homeowners with mortgages regardless of income.

What are the chances for a reform in federal housing subsidies? There are reasons to be pessimistic. The Trump administration and Republican leadership recently issued a nine-page Unified Framework for Fixing Our Broken Tax Code.

Although vague on many details, the framework lists business incentives for low-income housing and for home mortgage interest among things it plans to preserve. It pledges that the result will be at least as progressive as the existing tax code—that it will not shift the tax burden from high-income to lower- and middle-income taxpayers.

The specific details included in the framework, however, raise doubts about that. Among proposals having the effect of reducing taxes on wealthy people are lowering the top marginal rate, eliminating the alternative minimum tax and the estate tax, and introducing lower rates on certain forms of income such as that from pass-through corporations.

A Tax Policy Center analysis of the Framework, using earlier Paul Ryan proposals to fill in the gaps, concluded the benefits would be largest for taxpayers in the top 1 percent. According to the TPC, the federal deficit would increase by $24 trillion over the first decade and by $32 trillion over the following decade.

For many—and not just liberals—this conclusion confirmed the belief that reducing taxes on wealthy people is the overriding goal. As conservative New York Times columnist Russ Douthot wrote:

… the G.O.P. lurched away from the middle class in a more stark way than it ever did under Reagan or Bush or the Newt Gingrich speakership, embracing theories about how the working class was actually undertaxed, rallying around tax plans that seemed to threaten middle-class tax increases and promoting an Ayn Randian vision in which heroic entrepreneurs were the only economic actor worth defending.

The reaction to the TPC report was swift and vicious. Business Insider reported that Kevin Hassett, chair of Trump’s Council of Economic Advisors, attacked the TPC at an event hosted by the center, saying:

I’m sure many people in these halls have been struck and perhaps even dismayed by the tone and pushback from around Washington regarding the Tax Policy Center report. I think that’s what happens when you behave irresponsibly.

Hassett also said the report contained “imagined numbers” and he did not “understand the purpose of the document.”

Business Insider also quoted Paul Ryan on Fox News: “It’s very predictable coming from this group. I think the Wall Street Journal got this right when they said this is an anti-reform, propaganda group.”

Mitch McConnell’s Senate website repeats the attacks on the TPC study with a page headlined “Tax Policy Center: ‘Premature Guesses Based On Partisan Assumptions.’”

Recently, Treasury Secretary Steven Mnuchin took a different tack. According to Politico, Mnuchin argued that cutting taxes on the wealthy was unavoidable:

The top 20 percent of the people pay 95 percent of the taxes. The top 10 percent of the people pay 81 percent of the taxes. So when you’re cutting taxes across the board, it’s very hard not to give tax cuts to the wealthy with tax cuts to the middle class.

For those concerned about making housing affordable for low and middle-income people, the pessimistic interpretation is that any such proposal would have rough sailing given the evident desire of the Trump administration and the Republican legislative leadership to give wealthy people a tax break.

However, the attacks on the Tax Policy Center suggest they are sensitive to the charge that “tax reform” means a tax cut for the rich, but don’t know how to avoid doing so, as suggested by Mnuchin. If so, embracing proposals that make housing affordable would serve their interests.

Data Wonk

-

Why Absentee Ballot Drop Boxes Are Now Legal

Jul 17th, 2024 by Bruce Thompson

Jul 17th, 2024 by Bruce Thompson

-

The Imperial Legislature Is Shot Down

Jul 10th, 2024 by Bruce Thompson

Jul 10th, 2024 by Bruce Thompson

-

Counting the Lies By Trump

Jul 3rd, 2024 by Bruce Thompson

Jul 3rd, 2024 by Bruce Thompson