Moody’s State Debt Upgrade is Perplexing

Walker says it’s due to his reforms. But... the deficit is rising.

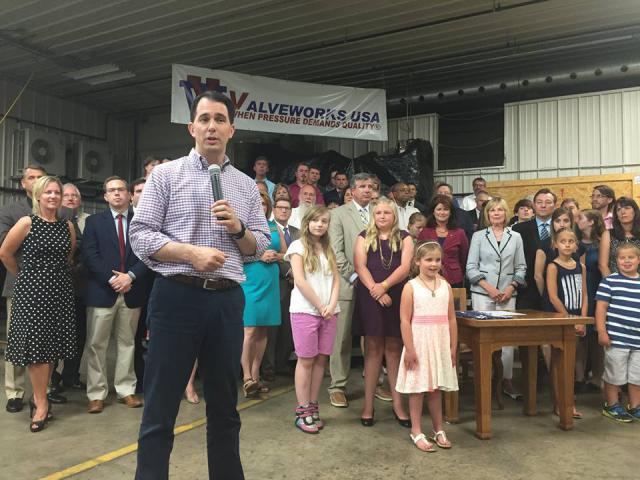

Governor Scott Walker signs the 2015-17 State Budget into law at Valveworks USA in Waukesha. Photo from the State of Wisconsin.

One of three national debt-rating firms has upgraded Wisconsin’s debt a notch.

Befitting a candidate preparing for a re-election campaign, Governor Walker called this “historic” news driven by “bold reforms and accountable stewardship of the taxpayer’s dollar…[It] shows that Wisconsin is working.”

Added Assembly Majority Leader Jim Steineke: “[C]onservative reforms and fiscal responsibility are translating into a stable and accountable future for Wisconsin’s finances…[O]ur reforms are working for Wisconsin.”

Of course the party in power will credit itself with any positive development. So, in the spirit of this topic, I rate the Walker and Steineke statements as typical political exaggeration.

On examination, the debt upgrade falls rather short of being explained by “bold reforms.” And, of greater interest, are factors that could lead to a reversal, i.e., a future downgrade. As I will explain, early warning signals merit watching.

The upgrade by Moody’s Investors Service groups Wisconsin with 18 states that are one notch below the top tier of 14 states. It remains to be seen whether the other two rating services (Standard and Poor’s and Fitch Ratings) will follow suit. Currently, S&P rates Wisconsin in a group that is below 29 other states.

The explanation offered by Moody’s is as follows:

The upgrade…reflects the proven fiscal benefits of the state’s approach to granting and funding pension obligations when many other states are experiencing stress from rising costs and heavy liabilities; an economy that delivers steady but moderate growth; conservatively managed budgets; and adequate liquidity.

Of the four factors cited, Republicans can claim direct credit for “conservatively managed budgets.” (As for those who tout “the state’s approach to granting and funding pension obligations,” that reflects longstanding practices that pre-date the 2010 Republican takeover of state government.)

Things get interesting — and, for me, perplexing — when one looks at (1) the actual trajectory of the Wisconsin budget since 2010 and (2) factors that Moody’s says could lead to a downgrade. Specifically, two budgetary measures that Moody’s cites are moving in the wrong direction.

For conservatives, the 2011-13 state budget was a major step forward. Governor Walker and the Legislature eliminated the “structural” budget deficit and moved away from one-time budget gimmicks that were a hallmark of the Doyle Administration.

Moody’s cautions that a debt downgrade could be prompted by a “return to structural budget imbalance…” As that clearly has happened, I asked Moodys to clarify. A spokesman said that “outyear budget gap projections are well under 5% of revenues which is typical of such forecasts…We weigh projected gaps against a state’s resources and its track record of [eventually] balancing budgets.” In other words, for Moodys the $1.1 billion projection is manageable. The caution about a “return to structural budget imbalance” likely harkens back to the sustained and larger deficits of the Doyle years.

A second caution factor that Moodys says could prompt a downgrade would involve “accelerated deterioration of the state’s financial position resulting in…larger GAAP-negative fund balances.” That refers to “generally accepted accounting principles,” a benchmark of a state’s fiscal position in light of projected obligations.

GAAP deficits soared under Doyle. Predictably, the return to fiscal sanity in the 2011-13 state budget reversed the Doyle trend. Just as predictably, the less prudent budgetary record since then has GAAP deficits back on the upswing. Governor Walker’s proposed 2017-19 budget would boost that shortfall by about 30 per cent. (Walker pledged to eliminate the GAAP deficit in his 2010 campaign, a pledge that obviously came with an early expiration date.)

Moodys told me “the GAAP deficit is one area where Wisconsin does not compare well” with other states. It further observed that a portion of the deficit effectively is artificial (my word, not Moodys) because of difference in the state’s fiscal year and that of local governments that receive state aid.

At the risk of getting even more wonky (Bruce Thompson alert), here are the state’s “GAAP-negative fund balances” for the last five years.

2012: -$2.63 billion

2013: -$2.34 billion

2014: -$2.02 billion

2015: -$2.44 billion

2016: -$2.39 billion

It remains to be seen what level of “acceleration” in those numbers would prompt Moody’s to revisit the Wisconsin debt rating.

My takeaways:

- GOP chest-thumping about the debt upgrade is business-as-usual political exaggeration.

- Actions since 2011-13 have eroded the major progress reflected in that biennial budget.

- The caution factors listed by Moody’s amount to a flashing yellow caution light.

- It remains to be seen whether the other rating agencies join Moodys in boosting Wisconsin’s rating.

The Contrarian

-

Parents May ‘Break Up’ MPS

Feb 8th, 2022 by George Mitchell

Feb 8th, 2022 by George Mitchell

-

School Choice Key Issue in Governor Race

Sep 1st, 2021 by George Mitchell

Sep 1st, 2021 by George Mitchell

-

Jill Underly Flunks School Choice 101

Feb 22nd, 2021 by George Mitchell

Feb 22nd, 2021 by George Mitchell

What would the deficit be if our roads and highways were maintained to the standard of the Doyle years? What effect will the 3 billion dollar corporate welfare giveaway to one foreign Chinese company have on our long term fiscal standing? What the numbers don’t reveal is the human cost of Walker’s 2010 deficit reduction, which was done by a wealth transfer from the middle class to the wealthy. Wisconsin now has the dubious distinction of the greatest decline in the middle class of any of the fifty states, according to Pew research statistics. The Republicans are very good at winning elections, generally because they exploit the gullible with negative messaging. Time and again they have shown they are not very good at governing.