Trump Tax Cut Massive Gift to Wealthy

Top 1% in Wisconsin would get more than half the tax cut.

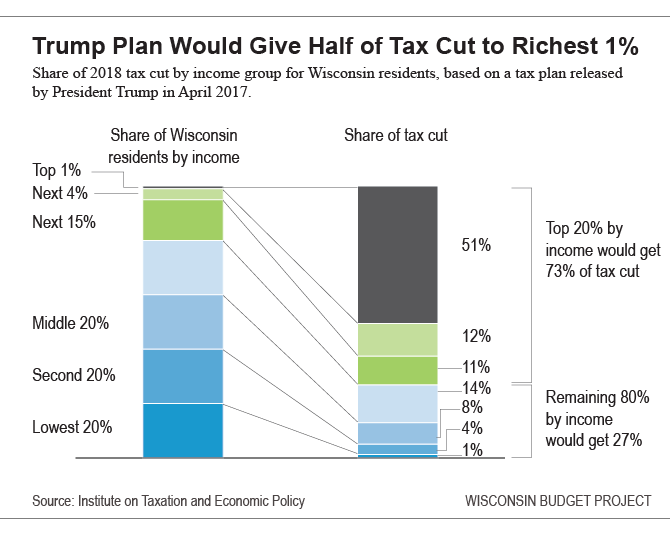

The federal tax reform plan outlined by President Trump in April would fail to deliver on its promise of largely helping middle-class taxpayers, according to a new analysis from the Institute on Taxation and Economic Policy (ITEP). Their July 20th report concludes that the President’s proposals would shower 61.4% of the total tax cut on the richest 1 percent of Americans.

ITEP’s analysis examines the overall effect of the Trump tax plan on federal revenue, as well as its impact on taxpayers in each of the 50 states. In sum, the plan would slash federal revenue by $4.8 trillion over the next decade.

The proposed tax cuts that primarily benefit the very wealthy would come with a heavy cost for vital program and services. Reducing investments in education, health care, food assistance, and other critical programs is too steep a price to pay for giving the very rich a tax cut that exceeds twice the income of the typical Wisconsin worker.

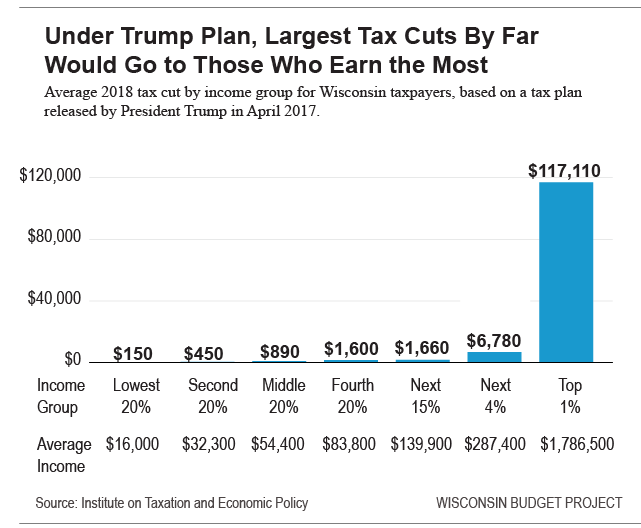

In Wisconsin, the top 1 percent of the state’s residents would receive an average tax cut of $117,100, compared with an average tax cut of $500 for the bottom 60 percent of taxpayers in the state.

The ITEP analysis for Wisconsin concludes that the richest 1 percent of taxpayers would receive slightly more than half of the proposed tax cut, compared to 12.9% for the bottom three-fifths of taxpayers.

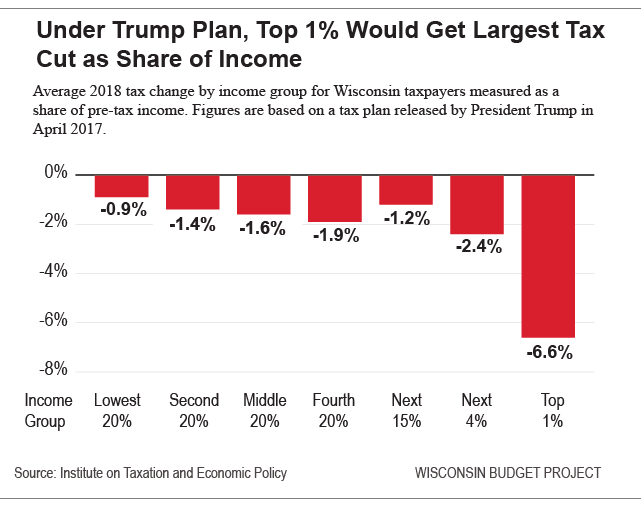

The large tax cuts for the richest Americans would also amount to a much larger portion of their income than the tax cuts for middle and low-income taxpayers. In Wisconsin, for example, the average tax cut for the wealthiest 1 percent would be 6.6% of their income, compared to just 1.6% for middle-income Wisconsinites and less than 1% for the poorest fifth of Wisconsin taxpayers.

Once Congress passes or sets aside the proposals to repeal the Affordable Care Act, tax cuts are expected to be a focal point of federal lawmakers’ efforts. The President’s tax plan would repeal the estate tax, the 3.8% tax on investment income for the very wealthy, and the Alternative Minimum Tax.

Trump’s proposals also include:

- reducing the corporate income tax rate from 35% to 15%;

- replacing current income tax brackets with three brackets of 10%, 25%, and 35%;

- repealing personal exemptions and doubling the standard deduction;

- creating a new deduction and tax credit for child care; and

- eliminating all other itemized deductions except those for charitable giving and home mortgage interest.

For a more detailed breakdown of how the tax plan would affect Wisconsin taxpayers, go to: https://itep.org/wp-content/uploads/trumptaxreport_WI.pdf

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Hey, it’s a new week! Time to re-publish the same ol’ article, “Those Who Pay The Most In Taxes Would Receive A Larger Cut If Tax Rates Were Cut.”

It was mathematically true when it was published the 19th time, and I’m sure it’ll be true when it’s published the 21st time as well.

Tamarine, your turn. You’re up next.

So these stories are as predictable as your posts?

Liberals just want to keep the peoples money. They want the Gwen Moore’s of the world to manage our health and well being, and it seems they want to take the right the vote away with the election of Donald Trump. Wisconsinite’s our compassionate people. Badgercare is such an amazing benefit that I have seen good worker’s turn down promotions and ask to stay part time so they can enjoy its benefits. A generation ago we would have looked down on people that choose welfare over work but times have changed.

What our conservative friends fail to understand is that while most of us would be able to take the family out for dinner once or twice more a year, each 1%er who pays in $100K less, well that’s revenue we no longer have to fund our already crumbling infrastructure or shoestring education budgets. But don’t let practicality get in the way of a good ideological argument.

A generation ago? You still look down on them. One day you blast Dems for not taxing the rich and the next day you say all they want to do is take people’s money. Troll hard.

Yes. That’s how it works. Those who pay get the benefits of the reduction. You guys are so predictable.

The problem is that it is not those who pay the most, get the biggest tax break. That’s what you are expected to believe. In fact, The top 1% are not making their income through wages but as capitol gains, which is taxed at a much lower rate. That is why, Warren Buffitt proclaimed that he pays less in taxes than his secretary. The current Republican trend is to move tax policy towards the regressive end, which means that individuals with lower incomes pay a larger portion of their income in taxes than those with higher income. This has been going on for 30 years. With the cost of the safety net, the pressure falls to the middle class, with wage suppression has shrunk over the same period. The answer is not to destroy the safety net, rather it is to return to a more progressive tax policy. We don’t have to go back to the 95% levels of the 1950s. However, a top rate of even 37 to 38 percent (that is 2 to 3 percent higher than what Trump is proposing) would take the pressure off the middle class and provide funding for healthcare, the safety net and necessary infrastructure investments. All of these will benefit everyone.

Vince, why do confuse your taxes? I am all for a wealth tax on billionaires. I am against the wealthy insisting that we raise the income tax and the payroll tax. The income tax and pay roll are not paid by the wealthy. These are taxes paid by the working man.

How about everyone pays 18% on all income . We’d be drowning in money .

Your party opposes those taxes you want raised Troll. Start writing Walker and Fitzgerald and Vos.

18% income tax is pointless since the wealthy pay no income tax. Bernie Sanders would be president today if he did two things. One, if he demanded half of all the wealth of Billionaires thru a Billionaires tax. So, Democrat fat cats like Warren Buffet would forfeit $35 billion and keep $35 billion . Second, use that money to pay reparations to African Americans for the atrocities of US slavery. Why Bernie did not do this in 2016 still burns me.

Yeah and as long as republicans are in charge the rich will only pay less in taxes. Helping rich white people and screwing everyone else is part of their platform.