Student Debt Hits $1.4 Trillion

Solutions needed. Trump, Walker policies will drive debt level higher.

April 25 marked the fifth anniversary of student loan debt reaching $1 trillion in the United States.

According to the latest estimates, over 43 million Americans now owe $1.4 trillion, making student loans the second largest consumer debt in the nation, more than what’s owed on credit cards or auto loans.

Research shows that this debt is a significant burden on families and a serious drag on our economy. For example, One Wisconsin Institute found borrowers are much more likely to rent versus own a home and drive a used versus new vehicle than their peers without student loan debt. Numerous other studies have confirmed this and further suggest that student loan debt also interferes with savings for things like retirement or a child’s education.

You’d think that with so many Americans, including nearly one million Wisconsinites with federal student loan debt alone, being so negatively impacted, national and state politicians would be rushing to help.

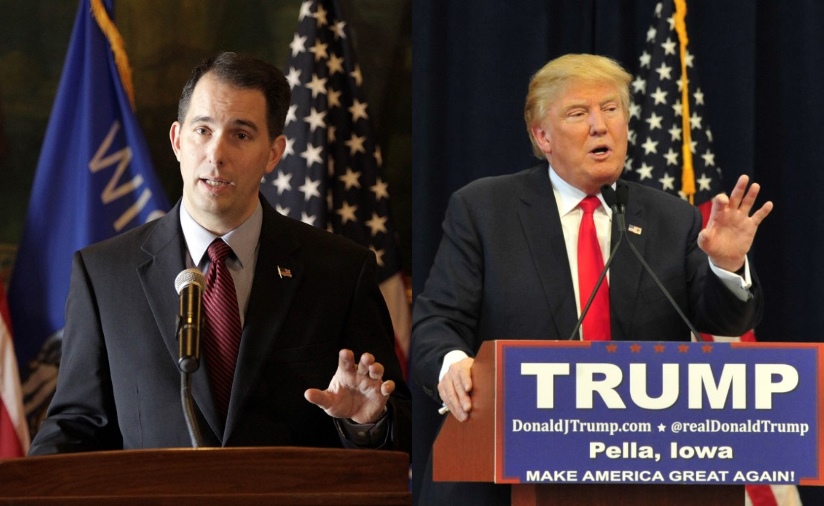

Led by Donald Trump, who settled for $25 million a class action lawsuit brought by students of his Trump “University”, the opposite is true.

Trump’s administration is repealing protections and allowing debt collectors to charge borrowers exorbitant fees on top of their loan payments. In addition, rules requiring companies servicing student loans prioritize helping borrowers and abide by basic consumer service and protection standards to win federal contracts are being repealed.

While these anti-borrower measures are being implemented by Trump’s Secretary of Education, Michigan billionaire Betsy DeVos, whose financial portfolio includes ties to the student loan debt collection industry, our GOP delegation has remained silent.

This same gang has also blocked consideration of Senate and House of Representatives bills that would have taken the common sense step of allowing borrowers to refinance federal student loans with the federal government. A measure that, based on data from the federal Department of Education, could have provided an immediate lowering of monthly student loan payments for over 500,000 Wisconsinites.

Meanwhile in Wisconsin, under the policies of Gov. Walker and the Republican controlled legislature, our state is in the top five in the nation for the percentage of college graduates with student loan debt. A debt, on average, of nearly $30,000 per borrower. Driving this burden higher are Walker and the GOP’s cuts to the University of Wisconsin and technical colleges of nearly $1 billion, double digit tuition hikes and woefully underfunded financial aid that leaves tens of thousands of eligible students without any help.

And like their Washington D.C. partisans, state Republicans have blocked multiple attempts to enact a state law would help Wisconsin borrowers refinance their student loans.

Student loan borrowers have worked hard to get their education, and they took on the personal responsibility to pay for it. They’ve earned a fair shot at the middle class, but instead are being punished by having consumer protections repealed and being prohibited from using common sense to manage their debt by refinancing loans to lower monthly payments.

The good news is, there are common sense solutions that can help reduce student loan debt – investing in public education as a public good to make it affordable, making sure financial aid is adequately funded so every eligible student get the award for which they are qualified and allowing those currently paying their student loan to refinance.

The bad news is if our leaders continue to fail to act, we’ll be facing $2 trillion day soon.

Analiese Eicher is the Program Director at One Wisconsin Now and a founding member of the national Higher Ed, Not Debt coalition.

Op-Ed

-

Wisconsin Candidates Decry Money in Politics, Plan to Raise Tons of It

Dec 15th, 2025 by Ruth Conniff

Dec 15th, 2025 by Ruth Conniff

-

Trump Left Contraceptives to Rot; Women Pay the Price

Dec 8th, 2025 by Dr. Shefaali Sharma

Dec 8th, 2025 by Dr. Shefaali Sharma

-

Why the Common Council’s Amended Budget is Good Policy for Milwaukee

Nov 20th, 2025 by Alds. Marina Dimitrijevic and Russell W. Stamper, II

Nov 20th, 2025 by Alds. Marina Dimitrijevic and Russell W. Stamper, II

“You’d think that with so many Americans… would be rushing to help.” ARE YOU SERIOUS….!??

1. First of all, these trillions of dollars went into the pockets of grossly overpaid professors and administrators who benefit from unfettered monies pouring in from government financing… paid for by American taxpayers.

2. The American taxpayers have already rushed “to help” students who choose to go to college on the taxpayers’ dime rather than work their way thru college. (See above)

3. Unless they’re in a technical or medical field, the current end product of their “higher education” is of such questionable value that many of them cannot find a job worthy of paying back the tens of thousands in debt the college has forced them to run up.

4. Finally, many Americans are realizing that many of these “institutions of higher learning” are nothing more than hotbeds of America-hating leftists producing uneducated socialists who want the country to be more like Venezuela… and as such, they are becoming a threat to our national security rather than an opportunity to learn the skills necessary to make a good living.

America-hating leftists! A threat to national security! How do you respond to someone who truly believes those things and is that out of touch with reality? When is the last time you were actually on a college campus Kevin?

Mr. Hanna… do you actually have a purpose in life… or do you just hang around this website… impressing yourself with vacuous rejoinders and pseudo-insults…??

As opposed to rhetoric lifted directly from alt-right message boards? I take it you haven’t been on a college campus in a while. Possibly ever. But you sure claim to know a lot about them.