State Infrastructure Spending Plummets

Has declined 31% since 2002, 7th worse drop in the nation.

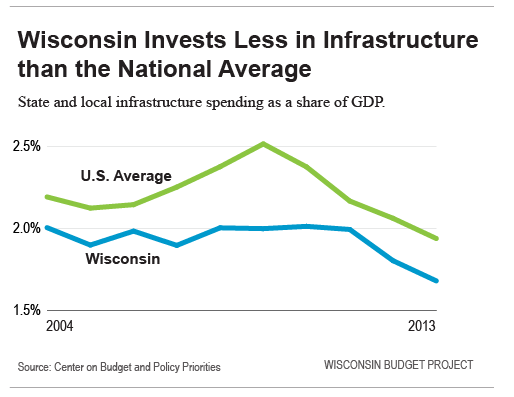

State and local governments have been neglecting to make investments in infrastructure according to a new analysis issued this week. The new study found that state and local spending on infrastructure, such as transportation, public buildings, and water systems, fell to a 30-year low in 2014, when measured relative to gross domestic product (see Figure 1). The drop-off since 2000 has been especially pronounced in Wisconsin.

Since the early 2000s, the decline has been very sharp. According to the new report from the Center on Budget and Policy Priorities:

- Infrastructure spending by state and local governments across the nation fell from 2.3% of gross domestic product (GDP) in 2002, to 1.9% in 2013.

- In 2002, Wisconsin was above the national average in the percentage of GDP spent for infrastructure at the state and local level, but as the first graph illustrates, Wisconsin has been will below the national average since 2004.

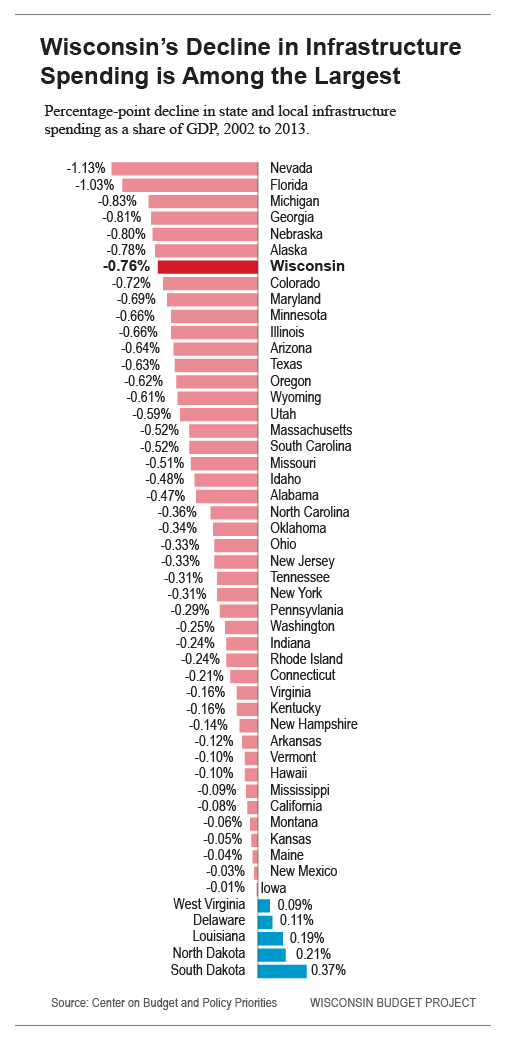

As the following bar graph from the report shows, Wisconsin had the 7th largest decline in infrastructure spending from 2002 to 2013 (measured as the percentage point change in the share of GDP).

Our own analysis of the CBPP data found that the drop in Wisconsin from 2002 to 2013 was 31%, compared to 17% nationally. Wisconsin’s rank in percentage of GDP spent at the state and local level for infrastructure dropped from 20th in 2000 to 41st in 2013.

The CBPP reports lays out a strong case for investing in infrastructure now:

“Reversing the decline in state investment in transportation, public buildings, water treatment systems, and other forms of vital infrastructure is key to creating good jobs and promoting full economic recovery — and this is an especially good time for states to do it.

“The condition of roads, bridges, schools, water treatment plants, and other physical assets greatly influences the economy’s ability to function and grow. Commerce requires well-maintained roads, railroads, airports, and ports so that manufacturers can obtain raw materials and parts, and deliver finished products to consumers. Growing communities rely on well-functioning water and sewer systems. State-of-the art schools free from crowding and safety hazards improve educational opportunities for future workers. Every state needs infrastructure improvements that have potential to pay off economically in private sector investment and job growth.”

I agree with those arguments and others made in the report, and I hope Walker administration officials and state legislators will seriously consider the report as they develop the next state budget bill. However, tax cuts made over the last several years and the long freeze of the gas tax complicate the task of balancing infrastructure needs and other pressing state and local needs, such as investing in K-12 and higher education. The report touches on that general problem and makes the case that some states should consider taking advantage of the very low interest rates now – in order to use bonding for increased capital investments. In addition, the report adds:

“In many states revenues still aren’t sufficient to adequately cover the costs of needed services such as education and health care, and still make the necessary infrastructure investments. These states will need to consider tax increases to preserve public capital that is crucial to long-term economic growth while meeting other needs.”

Wisconsin is probably one of those states that will need to increases taxes — at least to make some overdue investments in our transportation infrastructure. But it isn’t transportation alone where infrastructure investments are needed. Wisconsin school districts need to replace aging buildings, and anyone who has been following the news from Flint Michigan should be aware of how important it is to invest in and maintain quality public water systems.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

Why should WI increase taxes? Increase user fees, that’s the ultimate test. If extra road spending is necessary, people will pay to use it.

There’s a silver lining in all of this for Republicans: letting spending slide on infrastructure, particularly roads, is a good way to continue to maintain and promote segregation from one end of our state to the other.

Infrastructure is transportation, public buildings, and water systems.

I think it’s time to give wealthy campaign contributers and corporations more tax cuts. It’s the only solution.