Housing Fair Offers Home Buyers Advice

More than 40 experts from city and non-profits were at 5th annual fair.

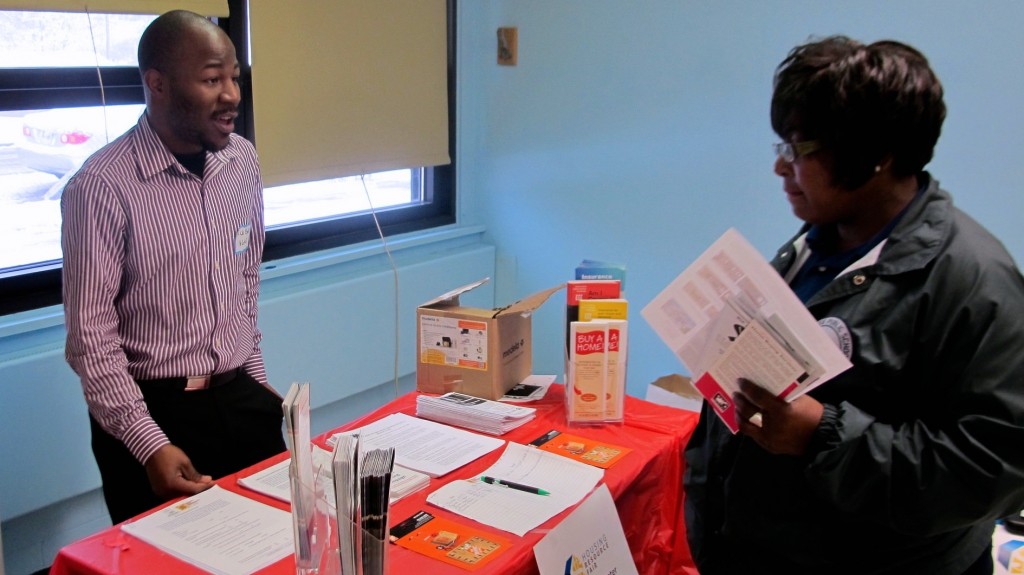

Rick Banks (left) of Harambee Great Neighborhood Initiative was one of many community leaders available at the housing fair to help residents improve their neighborhoods through home ownership. Photo by Wyatt Massey.

Charles Muhammad had enough of seeing people abuse the vacant lot next to his home. “For so many years the lot has been dumped on and trashed, so I wanted to do something about it,” he said.

When he heard District 6 Alderwoman Milele Coggs on the radio promoting the 5th Annual Housing Fair, an event for residents to learn about buying and renovating properties, he braved the snow to find out more.

Coggs and District 15 Alderman Russell Stamper sponsored the fair at UACB Lee Campus, 921 W. Meinecke Ave. Muhammad and other attendees were able to connect with representatives from 39 organizations and receive information about buying, repairing, financing or renting a home in the city.

Arthur Mays, broker and owner of Realty Among Friends, said his business constantly gets calls from people who are misinformed about the home-buying process.

Charles Muhammad attended the housing fair to learn about city programs that can help him improve the empty lot adjacent to his home. Photo by Wyatt Massey.

People shopping for a home have fallen for the Internet scam of paying for a list of available houses. These listings can be six months to a year old, Mays said. He said people who are unsure about the buying or financing process should seek help from nonprofit housing counselors.

“Our biggest challenge is just making sure that we get people to call and go through the right resources first,” he said.

Bethany Sanchez, senior administrator at Metropolitan Milwaukee Fair Housing Council, shared information about scams in which an individual pretending to work for a mortgage modification service asks for money up front from a homeowner to re-negotiate mortgage payments. Scammers create authentic-looking letters and websites to gain trust and steal money from residents unable to keep up on their mortgages.

“There’s a lot of people struggling and they don’t know where to turn,” Sanchez said. “99.9 percent of people don’t know that it’s illegal to charge up front.”

The fair housing council also helps people who are discriminated against in the housing market. Race, disability and family status are the most common forms of housing discrimination in Milwaukee, Sanchez said.

Workshops at the resource fair included how to improve public safety by building healthy relationships with neighbors, resources to help elderly residents stay in their homes and information about buying or rehabilitating a city-owned home.

Information was available about several city programs, including the Homebuyer Assistance Program and theStrong Neighborhoods Plan. The Homebuyer Assistance Program, run by the city’s Neighborhood Improvement Development Corp., offers up to $20,000 in second mortgage loans to purchase and improve city-owned foreclosures. The Strong Neighborhoods Plan works to prevent tax foreclosures, mitigate blight and sell city-owned foreclosed properties to generate funds for renovation.

Several programs focus on home repairs. For example, the city’s Targeted Investment Neighborhood (TIN) program works to decrease crime by supporting homeowners and landlords with funds for common repairs, such as lead paint removal, heating, plumbing, weatherization or window replacement. The funds are available for properties in nine neighborhoods.

Select Milwaukee also is creating a new Home Loan Fund, which will finance home improvement projects for up to 100 homeowners and cover the cost of purchase and repair for up to 250 homes in its first three years of operation, according to the group’s website.

Repair assistance does more for a neighborhood than improve one home’s appearance, said Rick Banks, Harambee Great Neighborhood Initiative community organizer. Residents who improve their homes empower other residents to do the same and promote neighborhood values. This is only possible if people take advantage of the programs designed to keep neighborhoods healthy, he said.

“So many people need repairs to windows and roofs,” Banks added. “By giving help, crime goes down, homeownership goes up.

This story was originally published by Milwaukee Neighborhood News Service, where you can find other stories reporting on fifteen city neighborhoods in Milwaukee.