Congress Could Help State’s Working Poor

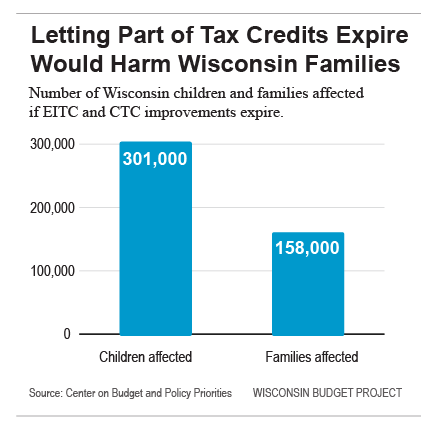

If lawmakers don't act, 158,00 Wisconsin families and 301,000 children could lose their tax credits.

Unless Congress acts to save key provisions of two working family tax credits, Wisconsin’s working families may pay more in taxes and have a harder time making ends meet. Congress has a window of opportunity this fall to make the improvements to these credits permanent, which will help Wisconsin working families climb the economic ladder and achieve stability.

More than 150,000 Wisconsin families and 301,000 Wisconsin children will be harmed if federal policymakers fail to save key provisions of the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) that are set to expire at the end of 2017. These families will lose an average of $1,100 per year they could use to make investments that help them keep working and improve the economic security of their family, such as paying for car repairs or saving for their children’s college educations.

Several temporary corporate tax provisions are expiring soon, and some federal lawmakers are pushing to make those business tax breaks permanent. Passing separate legislation to extend those tax breaks could make it very difficult to also pass legislation extending the credits for working families. Advocates for working families believe strongly that if the businesses tax breaks are made permanent, improvements to tax credits for struggling working families should also be made permanent in the same legislation.

Effective Tools for Fighting Poverty

Together, the federal EITC and the CTC lift more than 100,000 people in Wisconsin out of poverty in a typical year, including about 50,000 children. Both credits are only available to people who work, and mostly benefit parents who work at low-paying jobs. The EITC and CTC also have long-term benefits for children in families that receive the credits, which can help break the cycle of poverty.

The Earned Income Tax Credit (EITC) encourages and rewards the work of low and moderate income people as well as offsets federal payroll and income taxes. The amount of EITC depends on a recipient’s income, marital status, and number of children. During the 2013 tax year, the most recent year for which data is available, the average EITC was $3,074 for a family with children (boosting wages by about $256 a month), compared with just $281 for a family without children. Wisconsin, like 25 other states and the District of Columbia, also has a state EITC. Wisconsin’s EITC is calculated as a percentage of the federal EITC, although childless workers are not eligible for the Wisconsin EITC.

The federal Child Tax Credit (CTC) offers a tax credit of up to $1,000 per child. For low income workers, the CTC is phased in at 15 cents on the dollar of income earned above a $3,000 threshold.

The EITC and the CTC support families, help children do better in school, and strengthen the future workforce, according to a growing body of research.1 These working family tax credits:

- Encourage work, since only people who have earnings from work can benefit and the size of the EITC increases as a person’s wages increase (until the phase-out level is reached).

Improve the health of children and families. Studies have found that healthier babies are born to mothers who received increases in their credits, and mothers who received increases were less likely to drink or smoke during pregnancy and were more likely to receive prenatal care. - Boost school performance and college attendance rates. Children in families who receive the EITC have higher test scores, better high school graduation rates, and are more likely to attend college than families with similar incomes who did not receive the EITC.

- Increase work effort and income when children reach adulthood. For each $3,000 a year in added income that children in working poor families receive before age 6, they work an average of 135 more hours a year between ages 25 and 37, and their average annual earnings increase by 17%.

What’s at Stake for Wisconsin Families

If Congress does not act, key provisions of both the EITC and the CTC will expire at the end of 2017. Some Wisconsin parents who work at low-wage jobs will lose the entirety of these tax credits that are helping them lift their families out of poverty, and some other families will receive smaller credits than they would otherwise.

Here is what’s at stake if Congress does not save the EITC and CTC improvements:

- Married couples in Wisconsin that receive the EITC will be subject to higher marriage penalties, resulting in a smaller credit. Right now, the income level at which the EITC begins to phase out is $5,500 higher for married couples than for unmarried people, which helps reduce a tax disincentive to marriage. If Congress does not take action, the difference in the phase-out level for married couples will fall to just $3,000 at the end of 2017. That change will reduce EITC amounts for married couples.

- Working families with more than two children will have their EITC reduced. Larger families have higher costs associated with child-rearing. But if Congress doesn’t act, the maximum credit amount for families with three or more children will fall by more than $700 at the end of 2017, lowering it to the level of the maximum amount for families with just two children.

- Married couples and large families could also have their state EITC reduced. Wisconsin’s state EITC is calculated as a percentage of the federal credit. If the state doesn’t change the percentage for its calculation, married couples and families with two or more children would receive a smaller state EITC as well as a smaller federal EITC. The reduction in both the state and the federal EITC would make it even harder for those families to make ends meet.

- A single parent who works full time at the minimum wage would no longer earn enough to qualify for the refundable portion of the Child Tax Credit. The earnings needed to qualify for the CTC would jump from $3,000 to $14,600, barring many parents who work at minimum wage from receiving any benefit from the credit (a full‑time minimum-wage worker earns just $14,500 a year). The earnings needed to qualify for the full CTC would increase from $16,300 to nearly $28,000 for a married couple with two children.

If these provisions are allowed to expire, 158,000 families in Wisconsin will lose part or all of their tax credits, negatively affecting 301,000 children in Wisconsin. Those families would lose an average of about $1,100 each, according to Citizens for Tax Justice, and the Wisconsin economy would lose the $173.4 million annually that the improvements bring in to help Wisconsin families work towards economic stability. The families that will lose part or all of their tax credits if Congress does not take action include 64,000 rural families in Wisconsin and 17,000 veteran and military families with children.

The EITC and CTC help Wisconsin parents who work hard at low-paying jobs. By making key provisions of these tax credits permanent, Congress can help Wisconsin families improve the long-term economic security of their children. Failure to do so will make it harder for Wisconsin families to make ends meet and work their way out of poverty.