Why Transportation Costs Are Out of Line

U.S. and Wisconsin use a Soviet model, which results in shortages of funding and long lines of traffic.

The US is facing a crisis in highway funding. The political will to increase the gas tax has collapsed both at the federal level and in Wisconsin. At the same time, there is a growing recognition that highway users don’t pay the full cost of highways.

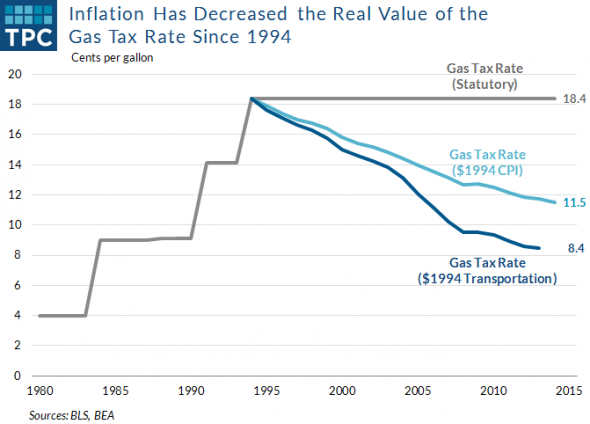

The chart to the right, from the Tax Policy Center, plots the history of the federal gasoline tax since 1980. Early in this period the tax was increased three times. However, since 1994 it has stayed flat at 18.4 cents per gallon. With inflation, it has declined to 11.5 cents in 1994 dollars. If the cost of building roads is considered, the decline is even greater. In effect the buying power of the federal gas tax has dropped by more than half. As a result, the federal highway fund is due to run short of its commitments in the near future, yet Congress has been reluctant to increase the tax.

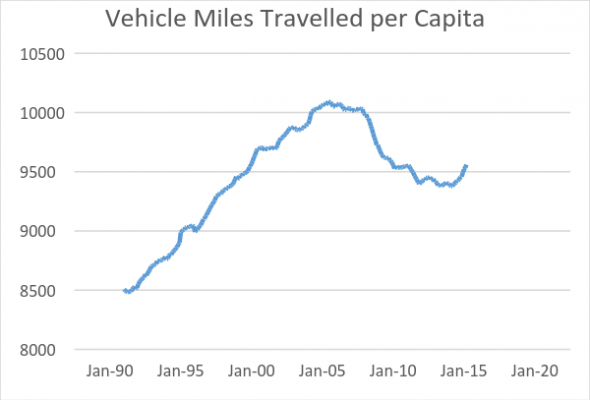

The decline in the purchasing power of the gasoline tax is compounded by two other factors. One is a substantial decline in per capita miles traveled in the last decade, as shown on the next graph, based on Federal Highway Administration figures.

Secondly, cars on the road have become more fuel-efficient. While a good thing from most perspectives, less fuel use means less money for highway construction and maintenance. And with electric vehicles the amount paid drops to zero.

The political reluctance to raise the federal gas tax is reflected in Wisconsin. Despite the highway-centric views of the governor and legislature, they are unable to agree on how to fund already scheduled highway projects. The recommendations from a commission established by Scott Walker’s Department of Transportation were largely rejected by Walker himself. Instead, the governor proposed funding roads through borrowing, which Republican legislators have reduced considerably, while delaying various highway projects to pay for this. No one seemed to favor a hike in the state gas tax, last increased eight years ago.

In Washington, two conservative US legislators introduced a bill, the Transportation Empowerment Act, to lower the federal gas tax from 18.4 cents per gallon to 3.7 cents. (Presumably the acronym “TEA” is not accidental.) This would shift costs of interstate highways to the states. Presumably states could add 14.7 cents to their taxes without increasing the price of gas, but this could run up against the Tea Party opposition to any tax increases.

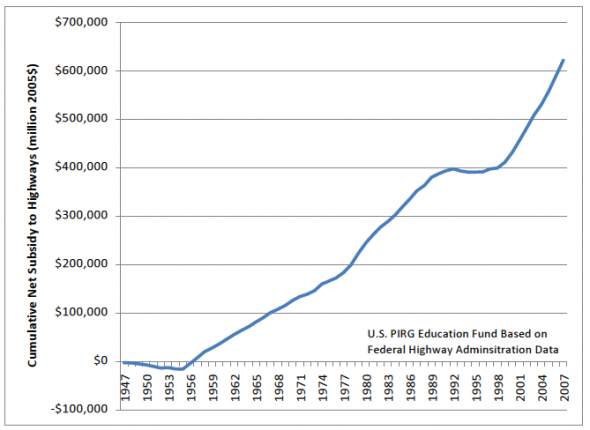

This reluctance to pay for roads comes at a time when the belief that highway users pay for the roads they use is increasingly shown to be a myth. A recent study of road costs by the PIRG Education Fund and the Frontier Group, using data from the Federal Highway Administration, found the subsidy to highways has been steadily mounting, rising 700-fold since the mid-1950s, where there was no subsidy, as the graph above charts.

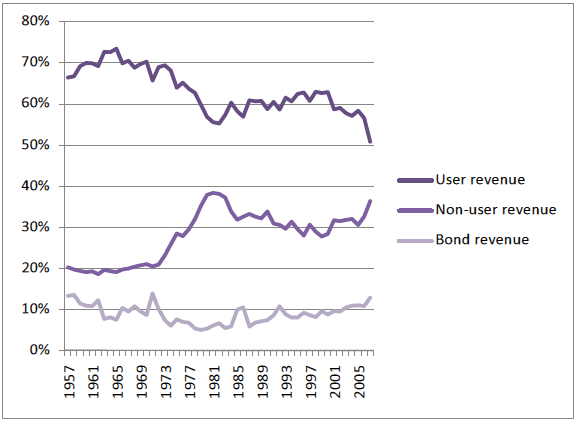

According to this study, the fraction paid by the gasoline tax has been steadily shrinking. As shown in the next graph, users currently pay about half the costs, with the remainder covered by non-users and borrowing.

One key reason is that the huge network of streets in Milwaukee and other cities are largely paid for through property taxes. Yet the gasoline used by cars and trucks on those streets is taxed largely for the construction of major highways.

A commentary at CityObservatory argues that the PIRG/Frontier Group analysis actually understates the subsidy. It lists “the hidden subsidies associated with the free public provision of on-street parking, or the costs imposed by nearly universal off-street parking requirements, that drive up the cost of commercial and residential development.” The analysis also does not include the social costs, such as air pollution or increased sprawl. Nor does accounting for roads include the implicit costs of depreciation, as they wear out.

Building freeways has become hugely expensive. The Wisconsin Department of Transportation estimates the cost of upgrading 3.5 miles of I-94 near Miller Park and widening it to four lanes in each direction at $850 million. The DOT arrived at this estimate after rejecting an even more expensive double-decker option.

Transportation policy is further complicated by applying different economic models to different modes. Roads are treated as “public goods.” Their major competitor, rail transportation, is treated as a “private good.”

The standard economic market model is built around private goods, which describes these as goods that are both “excludable” (meaning it must be purchased to be consumed) and “rivalrous” (meaning consumption by one individual prevents others from consuming it; two customers cannot both benefit from the same private good). This leads to the familiar cost-benefit diagram, where the market price of a good ends up at the point where the marginal cost of producing the good equals the marginal benefit to the purchaser.

Freight railroads outside the nation’s northeast corridor are largely treated as private goods and run by private companies. Unlike freeways, they pay property taxes on their rights of way. In the early part of the 20th century, public transportation systems were usually treated as private goods, but were closed or taken over by public authorities when they couldn’t compete with subsidized auto transportation. The change to public goods model may have come because the costs of setting up and staffing toll booths and the fact that traffic on most roads was once well below capacity so that another vehicle incurred little additional cost.

But today, our clogged roads act less and less like public goods. Technology makes charging based on usage much more feasible. Currently Oregon is among several states experimenting with systems in which cars are equipped with a GPS and charged based on mileage. This charge could be variable, so its higher when congestion is high–much like peak pricing for electricity.

Thus roads behave more and more like private goods, but ones that are heavily subsidized. When the price of a private good is capped, two things happen: demand goes up and supply goes down. As countries like the old Soviet Union or today’s Venezuela discovered, the result is shortages and long lines. In Wisconsin we have deteriorating roads and congestion caused by overuse and a reluctance to pay the resulting costs.

Another justification for subsidizing a private good is that it offers positive externalities—benefits to society as a whole. An example is education. It is easy to exclude students who don’t pay tuition and additional students require more teachers. Yet all modern societies heavily subsidize education in the belief an educated population benefits society as a whole and it is unfair to exclude children who have the bad luck to be born into poor families.

It is hard to identify similar positive externalities when it comes to roads. Most of the externalities are negative—pollution and sprawl by subsidizing car travel. Subsidizing freight travel shifts the supply chain to favor larger and more distant production over smaller and closer operations, countering any desire to buy local.

Government subsidies also make life harder for competitive modes of transportation, whether freight rail or public transit. Treating roads as private goods and making sure users pay the full costs would help level the playing field.

One interpretation of the current resistance to raising the gas tax is that Americans don’t value roads enough to pay their full cost. It appears that road users will make use of roads, especially new ones, only if their cost is subsidized by others.

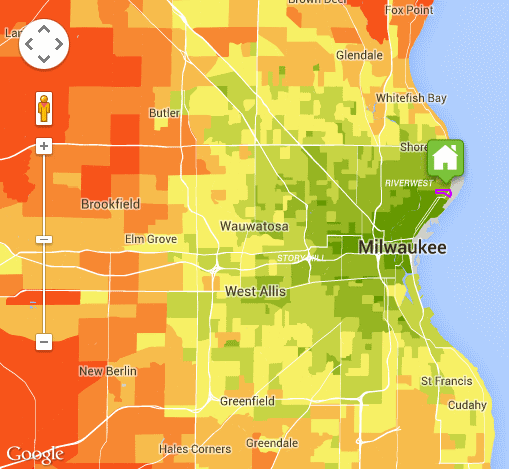

The more one uses roads, the more valuable is the subsidy. The map on the right shows estimated average driving costs in the Milwaukee area. People living in areas colored green spend less than the average while those in red spend more. Thus the heavy government subsidy of roads represents a cross-subsidy from people in green areas to those living in red areas. Perhaps this helps explain why Milwaukee’s suburbs are dominated by socialists when it comes to highways.

Generally new highways are bad for cities. One academic study estimated that one new highway passing through a central city reduces its population by about 18 percent. Conversely, the same study estimated that central city population would have grown by about 8 percent had the interstate highway system not been built.

The current resistance to paying even the heavily discounted cost of new roads presents an opportunity to reexamine the assumptions underlying the present transportation economic model, particularly the assumptions by some liberals that all infrastructure is a good thing. It depends on what kind of infrastructure. A place to start is to look at applying a market model to highway transportation. Markets can be a very powerful tool to make sure the costs of an activity are in line with its benefits.

Data Wonk

-

Why Absentee Ballot Drop Boxes Are Now Legal

Jul 17th, 2024 by Bruce Thompson

Jul 17th, 2024 by Bruce Thompson

-

The Imperial Legislature Is Shot Down

Jul 10th, 2024 by Bruce Thompson

Jul 10th, 2024 by Bruce Thompson

-

Counting the Lies By Trump

Jul 3rd, 2024 by Bruce Thompson

Jul 3rd, 2024 by Bruce Thompson

Great article. Although I fear that those that should read the article won’t. My friends out in Lake Country love to lecture me on the free market and that they pay for us in the city and that we’re all moochers. Meanwhile, they have three or four cars and have to fire up the Navigator to get a loaf of bread. They don’t want to pay for the roads they use and would rather increase registration fees than the gas tax, shifting the cost to those of us that don’t rely on a car for everything we do in life.

There is a cost to low density, car dependent development. I won’t mention the indirect and social costs involved, as the author mentioned, but there are many. However, in addition to roads, the utility infrastructure costs for serving the low density population must also be spread out across the population. For example, sewer systems, electric service, cable, etc, must be more per capita than in denser areas. One telephone pole serves six houses in the city, but maybe two in the outlying areas. I’m not against this type of development, but someone needs to pay.

I think a partial toll might be a good idea and get “pro-business” republicans on board. Require private single occupancy vehicles to pay a toll, reduced toll for car poolers and exempt semi’s and other “work” vehicles. This might reduce congestion and slow sprawl while at the same time free up the highways to better facilitate the movement of goods and services.

I’m sending this to my state senator and state assemblyman.

The Only reason I buy/own a car is to drive it on the road.

Please properly allocate the Sales Taxes from New and Used Auto and truck purchases to road building.

Then, further, re-allocate the sales tax from things like windshield washer fluid, oil changes, auto repairs, et al, to road building.

And, what about the monies collected in fuel taxes that are spent on things like bike paths, Subways and Bus route subsidies;re-allocate.

Please add this all up, and provide a spreadsheet with all the data/numbers; then, and only then, can we have a competent discussion.

Don’t make the claim that the users of the roads don’t cover the cost or construction and maintenance without a complete fact set.

JayS, the sales tax doesn’t work like that.

Why doesn’t the sales tax on books go find libraries? A: It’s an arbitrary way to fund something.

Besides, gasoline is already exempt from the 5.6% sales tax and the pittance that is collected largely funds highways and expressways.

People are tired of giving drivers a free lunch and frankly can’t afford it anymore.

Tim, did you read the article?

The author states that ‘cars’ and ‘their users’ don’t contribute enough funding to pay for the highways, so he wants assess more tax upon them. Please attach your spreadsheet, with math and supporting documents, clearly delineating that the the current gas taxes, and sales taxes assessed on cars and their maintenance/ownership, does not provide sufficient dollars for highway construction and maintenance.

Note that the author is promoting a ‘user fee’ for those actually ‘using’ the highway;directing all assessments upon ownership/usage of cars to roadway funding is, in-fact wholly, congruent with the ‘user fee’ position of the author. I, too, support user fees for roads. We must only spend the automobile ownership/user fees on roads. The first step is to spend each and every tax dollar assessed on automobiles on roadways;it’s called accountability.

General sales taxes are not automobile/driver user fees. An excise tax specifically levied on gasoline (or potentially on car tires or something of the sort) is a user fee.

A report by the Tax Foundation (“Gasoline Taxes and User Fees Pay for Only Half of State & Local Road Spending”) figured that user fees cover around half of road costs at the state/local level. It’s perfectly reasonable to me that a significant portion of the local streets should be funded through general revenues, rather than user fees, given that local streets are used for many purposes, not just driving automobiles. It should just be recognized that the costs of those streets are not borne entirely by drivers.

Of the federal gas tax, 2.86 cents/gallon, or 15.5%, is deposited in the Mass Transit Account. Similarly 11.7% of the diesel fuel tax is deposited in the Mass Transit Account. Less than 1% of each fuel tax is deposited in the Leaking Underground Storage Tank Trust Fund. Over 80% goes to the Highway Trust Fund.

That sales tax on the washer fluid at the auto parts store is paid by the store for the privilege of being able to do business with the surrounding infrastructure. So Jay- maybe there should be an additional tax on auto parts?

Couple of minor points.

1.BT, why would you use miles per capita? The only important figure is total miles driven, which is at an all time high. You know this, you’re better than that.

2. In one breadth you talk about non-users (as if someone who’s property is connected to a road is a non-user) supporting/subsidizing highways, but then point to a study that is talking about ALL roads, not just highways. You’re mixing these two ideas, and I think you do it on purpose. Very sneaky, and disappointing.

3. You don’t really believe that our highway system has more costs than it does benefits do you? Especially since the highways themselves are largely NOT supported by non-users (unlike local roads). You don’t think our economy was/is supported by our network of highways? That leaving rural areas or even smaller cities to pay for their own highways would somehow be beneficial? Or is it that you believe everyone except farmers should move from rural areas into large metros? Still wonder how food and other goods would make it to those metro’s and still be inexpensive enough for everyone to purchase.

4. Is your “Estimated average driving costs in the Milwaukee area” map just a function of average road costs to population density? And is this in terms of all roads or only highways? If all roads.. I don’t understand how I, as a Milwaukee resident, help pay for Bookfield roads when their own property taxes go towards this.

To AG:

Thanks for your comments. Let me start with your third point. Yes, several studies have found that highway users don’t pay the full costs of the roads they use. The Tax Foundation came up with similar results (as Eric mentions above): http://taxfoundation.org/article/gasoline-taxes-and-user-fees-pay-only-half-state-local-road-spending

It is worth mentioning that PIRG would generally be considered liberal while the Tax Foundation is conservative (it appears that PIRG includes more costs in their analysis than the Tax Foundation (such as exempting gas from sales taxes) but their overall conclusions are similar. Neither analysis tries to incorporate externalities. Their recommendations are the opposite: PIRG that we get rid of the myth that users pay; TC that we increase fees so that users pay. In this case, I tend to side with TC for reasons discussed in the article.

On your point 4, the map is not mine, although it does seem intuitively plausible–that people who live in more spread out areas spend more on transportation. It is taken from a site that estimates transportation costs by neighborhood (also housing costs). I included a link to the site in which they describe their methodology.. My point is the more one pays for something (see the paragraph above the more valuable it is and the more one will fight for it.

On point 1, you are right that starting last December, population growth cancelled the decline in miles driven so that total miles driven finally exceeded the previous peak in 2007.

BT, thanks for the response!

But I still bring up point #2, which is related to your response to #3… both of those, from my skimming of it, bundle local roads, county highways, statehighways, and interstate highways together. It skews the data… where as interstate is almost completely user fee funded (Bonding I still consider user funded b/c it gets paid off with user money in the end… at least for now) while state highways less so, then county and local roads even more. The more necessary for only local traffic, the more it’s paid for locally by more than just the user themselves.

And sorry for my snarky “you’re better than that” comment… sometimes responding to ridiculous posters on this website gets me goin’ and I don’t turn off the snark when I should. 🙂

AG. Taking your example of the interstate user, that highway is paid for by everyone who pays the federal tax, whether or not they use the interstate, including the car using the street in front of my house, which was paid for through property taxes and an assessment on me and my neighbors.

In the article, I did a rough calculation of what each car using the 3.5 mile proposed rebuilt of I94 passed Miller Park would have to pay for the capital cost if amortized over 20 years. It came to a bit over $1 per vehicle. At a rate of 18.4 cents per gallon and assuming 20 miles per gallon, I calculate that each car would contribute about 3 cents. This perhaps help explain why more toll roads haven’t been built; it is very hard to find places where they are self-sustaining.

Bruce, the gas tax in Wisconsin is 51.3¢/gallon. The 18.4¢ is federal tax; the rest is state tax.

Even so, there is no way the gas tax covers the cost of trips on freeways. Look at the Illinois tolls to see how much it costs to maintain freeways without subsidies.

@Tom D – actually, even the federal gas tax doesn’t cover federal transportation spending. The federal gas tax takes in about $34 billion each year, but federal transportation outlays are about $50 billion. Since around 2008, Congress has appropriated various general funds to make up the difference.

One could argue that the original Interstate Highway system was funded, not from user fees but mostly from money syphoned away from paying down the National Debt.

During World War II, the federal government imposed a series of transportation taxes designed to help the war effort (by reducing civilian fuel consumption) and to raise money. These taxes included a new gasoline tax (of 2 cents per gallon) and a new 10% excise tax (effectively a sales tax) on passenger railroad tickets.

When the war ended, the taxes were continued to help pay down the war debt (part of the National Debt). When President Eisenhower proposed building the Interstate Highway system, he just took the existing gas tax (money earmarked to paying down the National Debt) and applied it instead to the new Interstate Highways. (He also raised the tax by a penny to 3 cents per gallon—meaning that two thirds of the Interstate Highway funds came from money previously committed to paying down the debt.)

The railroad ticket tax remained earmarked for the debt (none of the railroad taxes were spent on improving or subsidizing railroads) into the mid-to-late 1960s. If the existing railroad tax were plowed into passenger trains (like the existing gas tax was plowed into highways), there might be enough money to fund Amtrak forever. (This tax was collected for decades during a time when—before jet planes and freeways—passenger trains were the primary method of intercity travel.)

But BT, you’re just cherry picking numbers. Just as you are using the most expensive section of highway, I could as easily take the cheapest, 5 million dollar per mile cost of a basic interstate section. Further, I could then use the entire gas tax (state and federal) while combining it with any user fees and suddenly I not only show how that road pays off in a couple short years with just the gas tax earned from driving on it but now provides funds for the next 40-50 years to put towards the expensive sections. It is a rather meaningless thing to do and really doesn’t back up anyone’s arguments.

AG, it sounds like you just explained how WISDOT justified their budget. If even the most well-used sections of interstate can’t pay for themselves… what does that say about your “basic interstate section” that has 20 cars an hour?

MirrorMirror, you’re talking about a complete rebuild of an interchange in the heart of a large dense metropolitan area. Not only are certain expensive connector areas like this required for the entire system to work, but the safety improvements themselves would make the rebuild worth it in my book even if only a fraction is covered by user fees. You can’t just pick out one part of the system and say it has to pay for itself…

AG, you use safety to justify increased highway spending. (” … the safety improvements themselves would make the rebuild worth it in my book even if only a fraction is covered by user fees.”)

But much bigger safety improvements could come by adding passenger rail to the transportation mix.

In 2013 (latest data available), Milwaukee County had 5.33 deaths per billion person miles traveled on its roads—freeways, local streets, everything. In that same year, America’s largest commuter railroad, Metro-North (near NYC) recorded 1.64 passenger deaths per billion person miles traveled.

So, in 2013, Milwaukee’s roads were over 3 times as dangerous as America’s largest commuter railroad, but 2013 was unusual—unusually good for Milwaukee (only 47 fatalities vs 59 and 66 in 2012 and 2014, respectively) and unusually bad for Metro-North (they had ZERO PASSENGER FATALITIES from 1983 through 2012).

When roads have an unusually good year but are still far more dangerous than a railroad’s unusually bad one, that tells you something.