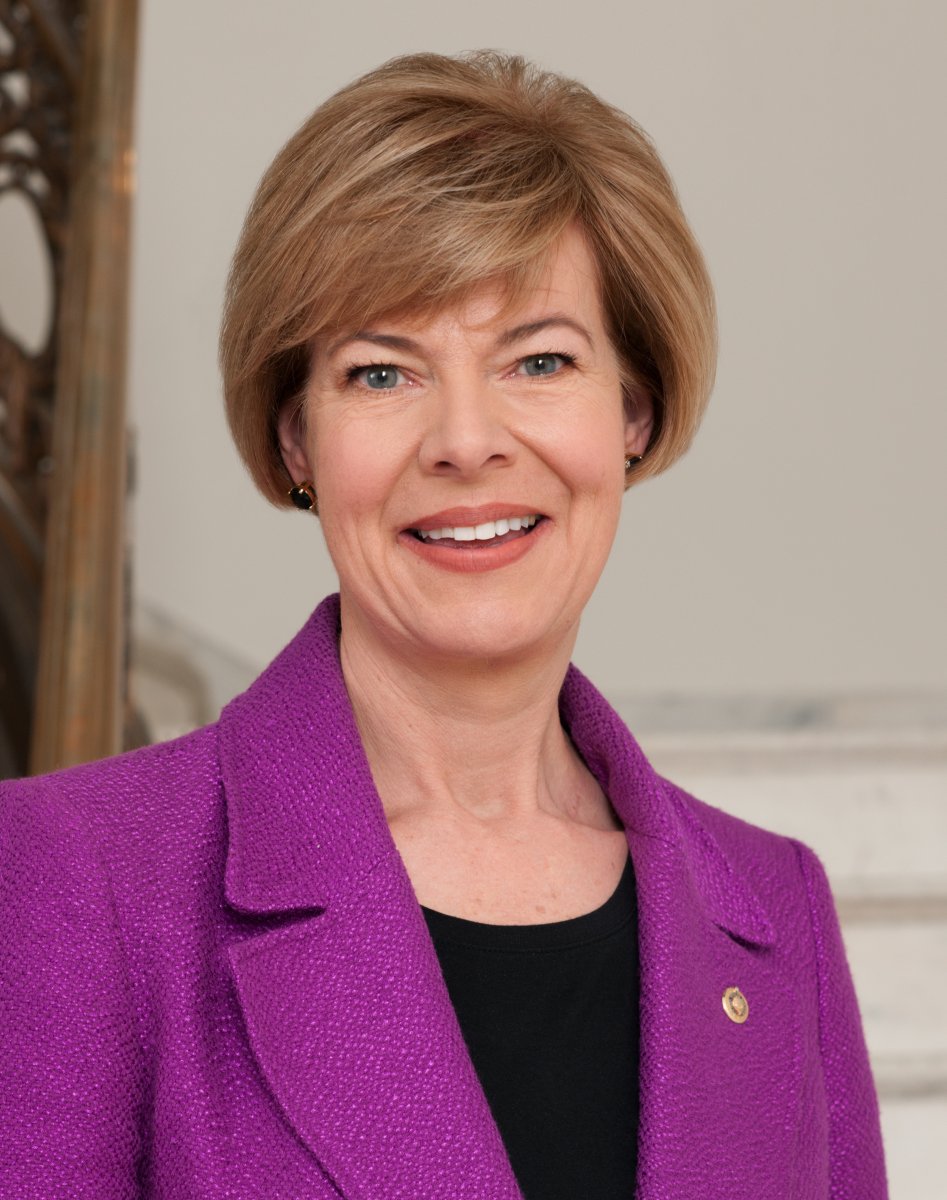

U.S. Senator Tammy Baldwin Introduces Tax Reform to Support Small Business Start-Up Growth

For three years in a row, Wisconsin has ranked last in business start-up activity

WASHINGTON, D.C. – For three years in a row, according to the Kauffmann Index, Wisconsin has ranked last in business start-up activity. Kaufmann’s 2017 report notes that in the last year, Wisconsin experienced a decrease in start-up activity and no growth in entrepreneurship.

Today at gener8tor in Milwaukee, U.S. Senator Tammy Baldwin announced that she is introducing new tax reform legislation that would support small business start-up growth in Wisconsin.

“Wisconsin has a proud history of entrepreneurship and innovation, but recent reports show that we need to do more to support our Made in Wisconsin start-ups,” said Senator Baldwin. “Wisconsin’s small businesses need a tax break and that’s what I’m working for. Small businesses are the engines of our economy and if we provide tax relief to start-ups, we can free up investments to create jobs and grow our economy.”

“The easier we can make it for entrepreneurs to create start-ups and succeed, the better,” said Joe Kirgues, Co-founder of gener8tor. “With many start-up founders living paycheck-to-paycheck, the Support Our Start-Ups Act could be the difference between a successful business or a start-up having to close their doors for good.”

“Senator Baldwin’s Support Our Start-Ups Act will help ease the personal financial burden placed on entrepreneurs who are the backbone of America’s economic growth engine,” said Matt Cordio, Co-founder & President of Startup Milwaukee.

“More and more we see that reducing barriers to start-up businesses provides great gains for all – new products, services, innovations and increased local and independent businesses in communities too,” said Wendy K. Baumann, President/CVO, Wisconsin Women’s Business Initiative Corporation (WWBIC). “This start-up bill specifically makes it easier from day one to start a new business. WWBIC celebrates 30 years of impact in 2017 and approximately 70% of the clients we serve are start-ups.”

The Support Our Start-Ups Act will:

- Increase the start-up deduction for new small businesses from $5,000 to $20,000, allowing small business owners to put money back into their business sooner, creating jobs and growing our economy.

- Increase the deduction’s phase-out threshold from $50,000 to $120,000; and,

- Extend the start-up tax deduction to organizational expenditures to ensure businesses can benefit regardless if they are organized as a partnership, LLC or corporation.

Text of the legislation is available here.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.