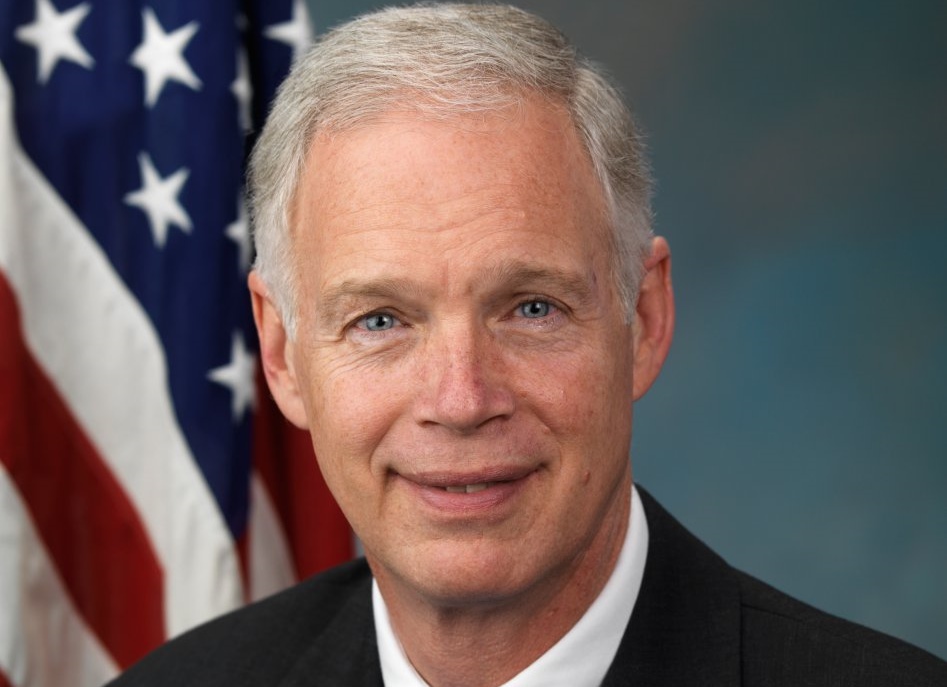

Sen. Johnson for The Wall Street Journal: The Ugly Truth About the ‘Big Beautiful Bill’

WASHINGTON – Today, The Wall Street Journal published an op-ed by U.S. Sen. Ron Johnson (R-Wis.) calling out unsustainable federal spending and urging the president and congressional leaders to reconsider a multistep budget reconciliation process.

The full op-ed can be found here and excerpts are below.

“The ‘One Big Beautiful Bill’ that Congress is working on is certainly big, but beauty is in the eye of the beholder. Too often the reality of these budget debates get obscured in details, politically charged issues and demagoguery. Let me attempt to clarify the current discussion by focusing on the most important facts and numbers.

“In fiscal 2019, federal outlays totaled $4.45 trillion, or 20.6% of gross domestic product. This year, according to the Congressional Budget Office’s January 2025 projection, total outlays will be $7.03 trillion, or 23.3% of GDP. That’s a 58% increase over six years. The CBO projects federal outlays will total $89.3 trillion across fiscal 2026-35. Much of the blame goes to pandemic spending, but lockdowns are long over. There’s nothing now to justify this abnormal level of government spending. Pathetically, Congress is having a hard time agreeing on a reduction of even $1.5 trillion from that 10-year amount. That’s a 1.68% cut—a little more than a rounding error. My guess is that much of that minuscule decrease will be backloaded to the end of the 10 years for which Congress is now budgeting, increasing the probability those savings will never be realized.

“Other than during World War II, the increase in spending we’ve experienced over the past six years is unprecedented. After the war, Congress and President Truman understood the importance of returning spending to normal levels. In 1941, total outlays were $13.7 billion, or 11.7% of GDP. They peaked in 1945 at $92.7 billion, or 41% of GDP. That was a 577% increase, 10 times as large as what we experienced with the pandemic. Yet by 1948, federal outlays were $29.8 billion and back to a little over 11% of GDP.

…

“It’s essential that Congress deviate from its current path. Under every scenario now being considered, federal debt continues to skyrocket from its current level of almost $37 trillion. The CBO’s current projection adds around $22 trillion over the next 10 years, resulting in total debt of approximately $59 trillion—134% of GDP—in 2035. That projection assumes an automatic tax increase will occur in 2026 when provisions of the 2017 tax cuts expire, increasing revenue from 17.1% of GDP in fiscal 2025 to an average of 18.1% over the next 10 years. With the CBO projecting 10-year GDP at $373 trillion, that 1% increase represents $3.7 trillion of additional revenue and lower debt.

…

“It’s also why I’m asking the president and congressional leaders to reconsider a multistep strategy on budget reconciliation. By immediately passing a bill based on the Senate’s original budget resolution, we can fund border security and defense priorities and bank $850 billion in real spending reductions. The next step would be to pass a bill that extends current tax law to prevent the automatic 2026 tax increase, and avoids default by including a smaller increase in the debt ceiling that maintains the pressure and leverage to achieve future spending reductions.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

No doubt the debt is starting to be a real problem. Interest expense on the national debt now exceeds $1T annually. But Johnson shows where his true priorities are as he continues to call for tax cuts and tax fraud.

“The next step would be to pass a bill that extends current tax law to prevent the automatic 2026 tax increase, and avoids default by including a smaller increase in the debt ceiling that maintains the pressure and leverage to achieve future spending reductions”.

And then there is the typical BS from this clown,

“It would also give us the time to simplify and rationalize the tax code, and go line by line through the entire federal budget to uncover, expose, and eliminate the hundreds of billions of dollars of waste, fraud, and abuse that the DOGE effort has shown exists. If we don’t, America is headed off a cliff”.

If DOGE and Johnson really wanted to address tax fraud why did we lay off so may IRS workers? More IRS agents are the answer to tax fraud, not less. They also pay for themselves many times over in increased tax revenue.

DOGE didn’t expose much fraud at all. A rich unelected oligarch simply had his clueless fanboy minions destroy government and steal data. And so far we have actually spent more in 2025 than compared to the same time last year ($166B more according to the CBO).

Up yours Johnson.