July Home Sales Down Slightly, 0.8%

Highlights

- July Down, But Sales Ahead of 2024 YTD by 1.1%

- Large Gains in Listings in Milwaukee and Waukesha Counties

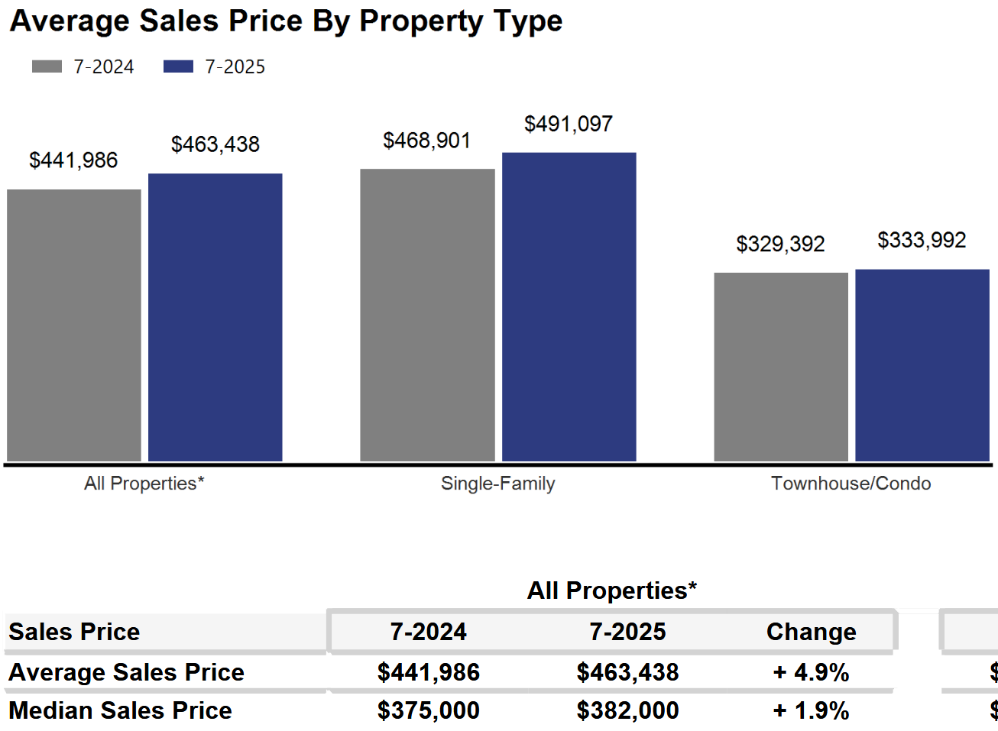

- Metro Prices Up 4.9%, Averaging $463,438

Market Summary

Home sales for July in the Metropolitan Milwaukee market were down 0.8% from the same period in 2024.

Sales have been very mixed this year. January was up, followed by four down months, up in June, and then down in July. For the year however, total sales are up 1.1% from 2024.

| July Sales | |||

| County | 2024 | 2025 | % Change |

| Milwaukee | 906 | 929 | 2.5% |

| Waukesha | 526 | 529 | 0.6% |

| Ozaukee | 134 | 107 | -20.1% |

| Washington | 157 | 145 | -7.6% |

| Metro Area | 1,723 | 1,710 | -0.8% |

| Sheboygan | 131 | 128 | -2.3% |

| Racine | 236 | 206 | -12.7% |

| Kenosha | 178 | 157 | -11.8% |

| Walworth | 117 | 146 | 24.8% |

| SE WI Area | 2,385 | 2,347 | -1.6% |

| July Listings | |||

| County | 2024 | 2025 | % Change |

| Milwaukee | 1,115 | 1,226 | 10.0% |

| Waukesha | 552 | 617 | 11.8% |

| Ozaukee | 142 | 121 | -14.8% |

| Washington | 210 | 223 | 6.2% |

| Metro Area | 2,019 | 2,187 | 8.3% |

| Sheboygan | 120 | 131 | 9.2% |

| Racine | 273 | 327 | 19.8% |

| Kenosha | 188 | 209 | 11.2% |

| Walworth | 186 | 201 | 8.1% |

| SE WI Area | 2,786 | 3,055 | 9.7% |

Milwaukee and Waukesha Counties are the engines that drive the regional real estate market, and there was good news from both in July. Each saw an increase in unit sales, but more importantly both saw substantial increases in new listings.

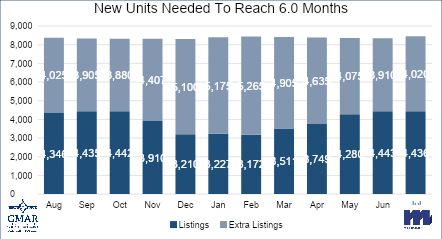

That’s a far cry from a “balanced” six-month market brokers would like to see. The Milwaukee market needs an additional 4,000 units to reach that threshold.

Increasing new construction would help meet demand and ease price pressure. In “normal times” new construction would add 3,000 – 4,000 units to the metropolitan market annually.

We are not in normal times, however. Through June of this year only 984 units were constructed (according to HUD statistics), which is 2.9% behind the first six months of 2024.

The lack of balance in the market is favorable to sellers with average prices going up 4.9% in July. The typical buyer had to shell out $463,438 in July compared to $441,986 in July 2024, and July 2024 was up over 10% from July of 2023.

The demand side of the equation is a circumstance of generational pressures as Millennial and Gen Z first-time buyers compete with Baby Boomer Empty Nesters in the market at the same time.

As we have been highlighting for several years – REALTORS® have had an exceedingly tough time helping home buyers find ownership opportunities in the form of condos and single-family houses.

There is a significant, long-term danger if we do not create additional supply in the form of single-family and condominium units. Thousands of would-be homeowners will be forced into rental units, unable to save for a down payment and foregoing the opportunity to build wealth through a home’s equity – as well as all of the other benefits of homeownership.

This will result in problems decades down the road when families do not have enough home equity to tap into for college expenses, to remodel their home, or for emergencies.

Where to go

Buyers should seek the counsel of a REALTOR® in determining their best housing options, and sellers need a REALTORS® expert advice in making correct marketing decisions for their home.

* Sales and Listing figures differ between the “Monthly Stats” and quarter or year-end numbers, because the collection of Monthly Stats ends on the 10th of each month, whereas quarters are a continuous tally to 12/31. For example, if a sale occurred on the 29th of the month, but an agent does not record the sale until the 5th of the next month, that sale would not be included in the sales figures of the reported month (or any subsequent month’s total) but would be added to the quarterly and annual total sales figures.

** All references to the “metropolitan” area denotes the four counties of Milwaukee, Waukesha, Ozaukee, and Washington Counties. The “region” or “Southeast Wisconsin” refers to the four metropolitan counties (Milwaukee, Waukesha, Ozaukee, and Washington), plus Racine, Kenosha, and Walworth Counties, to the south.

* * * * *

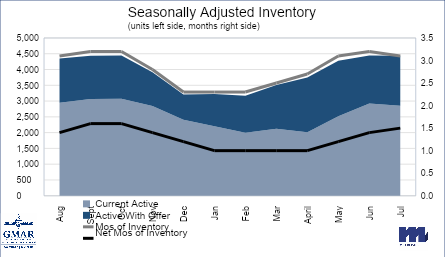

Seasonally adjusted inventory tells us how many months it would take to sell the existing homes on the market. The seasonally adjusted inventory level for July was 3.1 months. Subtracting listings that have an “active offer” from those available for sale (about 80% of listings with an offer sell) yields 3,733 listings, which equals 1.5 months of inventory.

With 4,436 current listings providing 3.1 months of inventory, the market would need an additional 4,020 units to push inventory to six months. Six months of inventory is considered a “balanced” market. If inventory falls below six months, the market favors sellers, and when inventory exceeds six months, it is a buyer’s market.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by Greater Milwaukee Association of REALTORS®

REALTORS® Home & Garden Show to bring a cascade of ideas for your home to Wisconsin State Fair Park, March 22 – March 30

Jan 29th, 2024 by Greater Milwaukee Association of REALTORS®98th annual show to offer tips and trends in landscaping, gardening, home improvements, interior design and more