Foxconn Package Returns $18 in Economic Impact for Every $1 in State Incentive

The analysis is based on the state’s tax credit agreement executed with Foxconn on November 10, 2017.

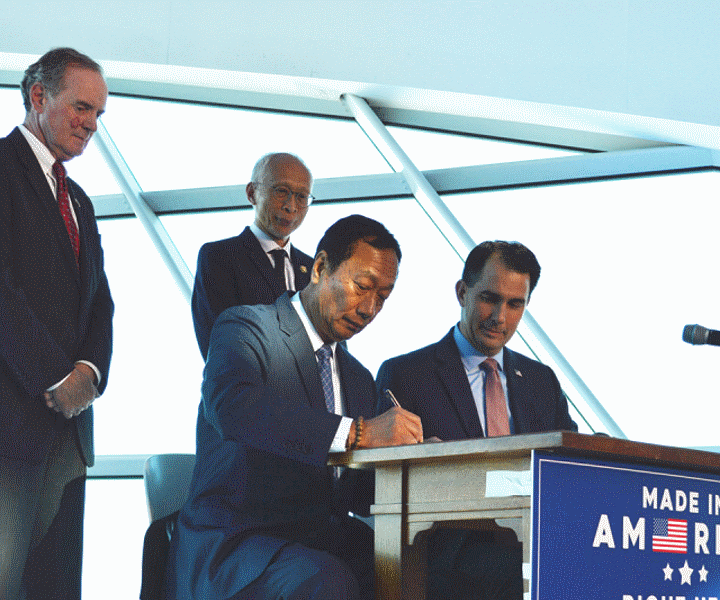

Foxconn chairman Terry Gou and Governor Scott Walker signing a memorandum of understanding. Photo from the State of Wisconsin.

MMAC today released its analysis of the projected impact to Wisconsin’s gross domestic product (GDP) from the incentive package tied to Foxconn’s capital investment and job creation. GDP is the best measure of the value added to the economy. The analysis is based on the state’s tax credit agreement executed with Foxconn on November 10, 2017.

The Foxconn development is projected to add almost $52 billion to Wisconsin’s GDP over the 15 years in which the state would pay out $2.8 billion, under a fully executed incentive package. The impact on GDP is derived from investments in capital, employment during construction, operating payroll from the plant, supply chain expenditures and their combined indirect economic impact. “The ripple effects of Foxconn’s $9 billion in capital investment, and the ongoing employment from up to 13,000 jobs, generate a return of $18 in additional state GDP for every $1 in state incentives,” said MMAC President Tim Sheehy.

The MMAC analysis recognizes that the incentive package is based on a “pay as you grow” model. Only when capital is expended and payroll is committed does Foxconn qualify for the incentives. The snapshot of economic impact applies only to the 15-year window of the state’s incentive package. “Much like priming a pump, the flow from Foxconn’s spending beyond the 15-year incentive window would significantly increase the state’s return. We believe this GDP analysis, while conservative, provides the fullest picture of the state’s return on investment,” stated Sheehy. This deal is one of largest corporate expansion projects in U.S. history.

Sheehy continued, “We should not lose sight that Foxconn’s investment in manufacturing high-resolution panels, combined with a faster telecommunications infrastructure, puts us in play in the digital economy. Bottom line, if you live or work in Wisconsin, the return on the Foxconn investment is real.”

MMAC is the region’s largest business organization, with more than 2,000-member companies supporting more than 300,000 jobs. MMAC is dedicated to a globally competitive region that drives high value jobs to support a vibrant quality of life for all.

State Gross Domestic Product Leveraged by Tax Credit Investment at Various Jobs/Capital Expenditure Performance Levels * Figures are cumulative for 15 years (2018-2032)

TABLE 1: GDP Created by Foxconn per $1 of WEDC Incentive

| Capital Expenditures | |||

| Jobs | $7B | $8B | $9B |

| 3,640 | $34.51 | $31.90 | $29.80 |

| 5,200 | $31.89 | $29.44 | $27.43 |

| 8,450 | $23.61 | $21.86 | $20.40 |

| 10,400 | $18.62 | $17.72 | $16.93 |

| 13,000 | $19.68 | $18.82 | $18.05 |

TABLE 2: Value of Tax Credits Disbursed by WEDC Calibrated to Actual Foxconn Performance *

| Capital Expenditures | |||

| Jobs | $7B | $8B | $9B |

| 3,640 | $ 545,251,000 | $ 609,536,714 | $ 673,822,429 ** |

| 5,200 | 771,451,800 | 857,166,086 | 942,880,371 ** |

| 8,450 | 1,513,157,988 | 1,633,157,988 | 1,813,157,988 |

| 10,400 | 2,257,306,425 | 2,407,306,425 | 2,557,306,425 |

| 13,000 | 2,550,000,000 | 2,700,000,000 | 2,850,000,000 |

TABLE 3: Economic Impact (Wisconsin GDP) Based on Actual Foxconn Performance *

| Capital Expenditures | |||

| Jobs | $7B | $8B | $9B |

| 3,640 | $18,814,015,655 | $19,446,268,432 | $20,078,521,209 |

| 5,200 | 24,598,980,630 | 25,231,233,407 | 25,863,486,183 |

| 8,450 | 35,723,913,273 | 36,356,166,049 | 36,988,418,826 |

| 10,400 | 42,028,041,770 | 42,660,294,547 | 43,292,547,324 |

| 13,000 | 50,186,325,708 | 50,818,578,485 | 51,450,831,262 |

Sources: Milwaukee 7 review of: 1. “Electronics and Information Technology Manufacturing Zone Tax Credit Agreement,” November 10, 2017; 2. July 2017, Economic Impact Report prepared by EY Quantitative Economics and Statistics; 3. August 2017, Baker Tilly Economic Impact Analysis

** Beginning in 2024, job counts of less than 6,500 could trigger cumulative claw-backs ranging from

$250-$500MM. Claw-backs will be calculated annually from 2024-2032 and will be assessed in any

year when employment falls below 6,500. Claw-backs are NOT reflected in these calculations.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

More about the Foxconn Facility

- Foxconn Paid Mount Pleasant $15 Million Make-Up Fee in 2025 - Steph Conquest-Ware - Jan 6th, 2026

- Murphy’s Law: Total Cost of Foxconn Is Rising - Bruce Murphy - Dec 8th, 2025

- WEDC, Foxconn announce additional $569 million investment in Racine County - Wisconsin Economic Development Corporation - Nov 25th, 2025

- Foxconn Acquires 20 More Acres in Mount Pleasant, But For What? - Joe Schulz - Jan 7th, 2025

- Murphy’s Law: What Are Foxconn’s Employees Doing? - Bruce Murphy - Dec 17th, 2024

- With 1,114 Employees, Foxconn Earns $9 Million in Tax Credits - Joe Schulz - Dec 13th, 2024

- Mount Pleasant, Racine in Legal Battle Over Water After Foxconn Failure - Evan Casey - Sep 18th, 2024

- Biden Hails ‘Transformative’ Microsoft Project in Mount Pleasant - Sophie Bolich - May 8th, 2024

- Microsoft’s Wisconsin Data Center Now A $3.3 Billion Project - Jeramey Jannene - May 8th, 2024

- We Energies Will Spend $335 Million on Microsoft Development - Evan Casey - Mar 6th, 2024

Read more about Foxconn Facility here

Recent Press Releases by Metropolitan Milwaukee Association of Commerce

GZ PrintPak expands U.S. footprint in Mount Pleasant

Dec 4th, 2025 by Metropolitan Milwaukee Association of CommerceCzech Republic-based company invests in Wisconsin to meet growing industrial demand

MMAC Backs Carmen Northwest’s Effort to Extend Operating Agreement with Milwaukee Public Schools

Nov 18th, 2025 by Metropolitan Milwaukee Association of CommerceEducational future of more than 500 students hangs in the balance