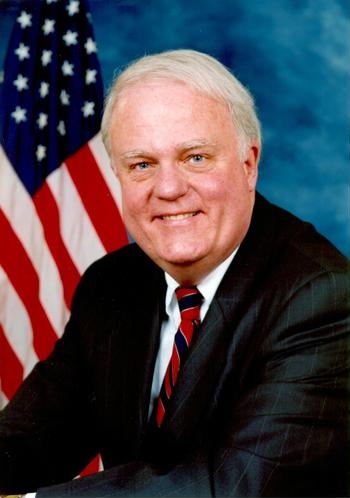

Congressman Sensenbrenner Introduces the No Regulation Without Representation Act

States are growing increasingly aggressive in imposing regulatory burdens on out-of-state businesses.

WASHINGTON, D.C. – Today, Congressman Jim Sensenbrenner (R-Wis.) introduced the No Regulation Without Representation Act of 2017 in the House of Representatives.

In their never-ending quest for new revenues, states are growing increasingly aggressive in imposing regulatory burdens on out-of-state businesses. The No Regulation Without Representation Act of 2017 will stop such overreaches by states and help out-of-state businesses defend themselves against overly burdensome tax obligations.

This legislation prohibits states from regulating beyond their borders by imposing sales tax collection requirements on businesses with no physical presence in the taxing state, and no vote in the representation that would implement such a tax.

Prohibited activities include:

- Telling an out-of-state business how to make or dispose of its products

- Imposing income tax or sales tax collection burdens on out-of-state businesses

The No Regulation Without Representation Act of 2017 does not prohibit states from regulating businesses within their borders. States remain free to insist that products entering their borders comply with national standards.

Congressman Sensenbrenner: “Over-taxation and regulatory burdens weigh heavy on American businesses. These practices prohibit economic growth, stunt hiring, and make it harder for businesses to expand. The No Regulation Without Representation Act of 2017 helps alleviate these burdens, promotes entrepreneurial endeavors, and is an ally of small business. It reduces overregulation, keeps government overreaches in check, and ensures that only businesses within a state are subjected to state tax obligations.”

The No Regulation Without Representation Act of 2017 is supported by various organizations, including: Council for Citizens Against Government Waste; Net-Choice; National Taxpayers Union; Software Finance and Tax Executives Council; Overstock; Electronic Retailing Association; Americans for Tax Reform; American Catalog Mailers Association.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.