Cinnaire Closes Funds Totaling $193 Million, Committing Capital for Affordable Housing in Ten States

Fund Closings Brings Total Equity Investments Raised in 2023 to $417 Million

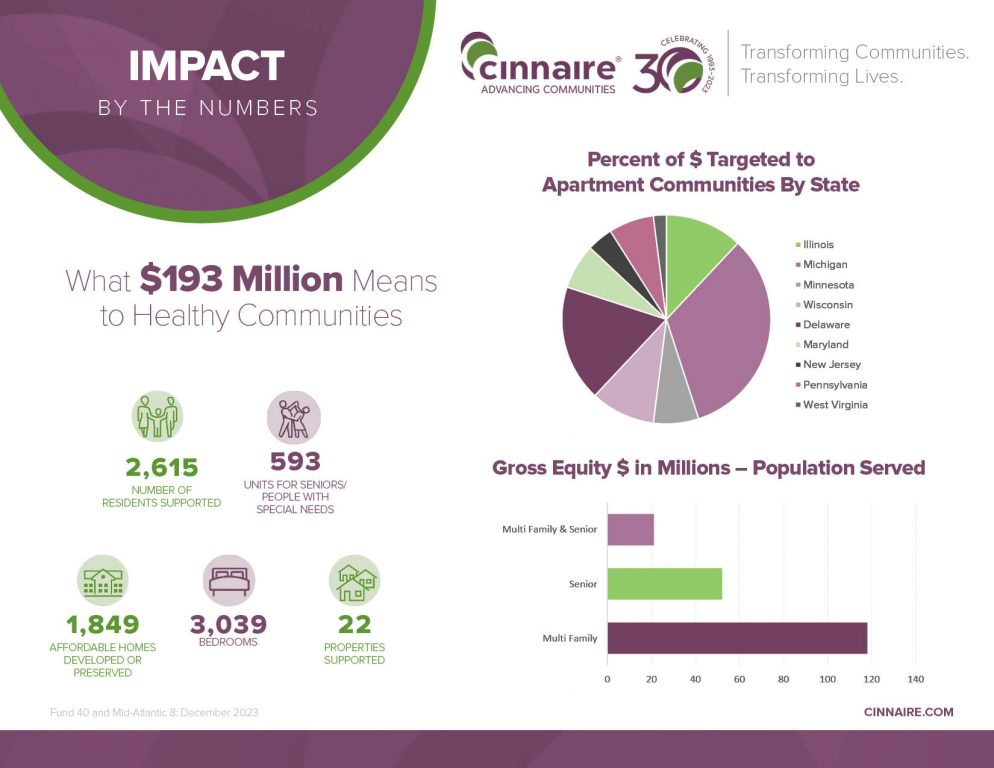

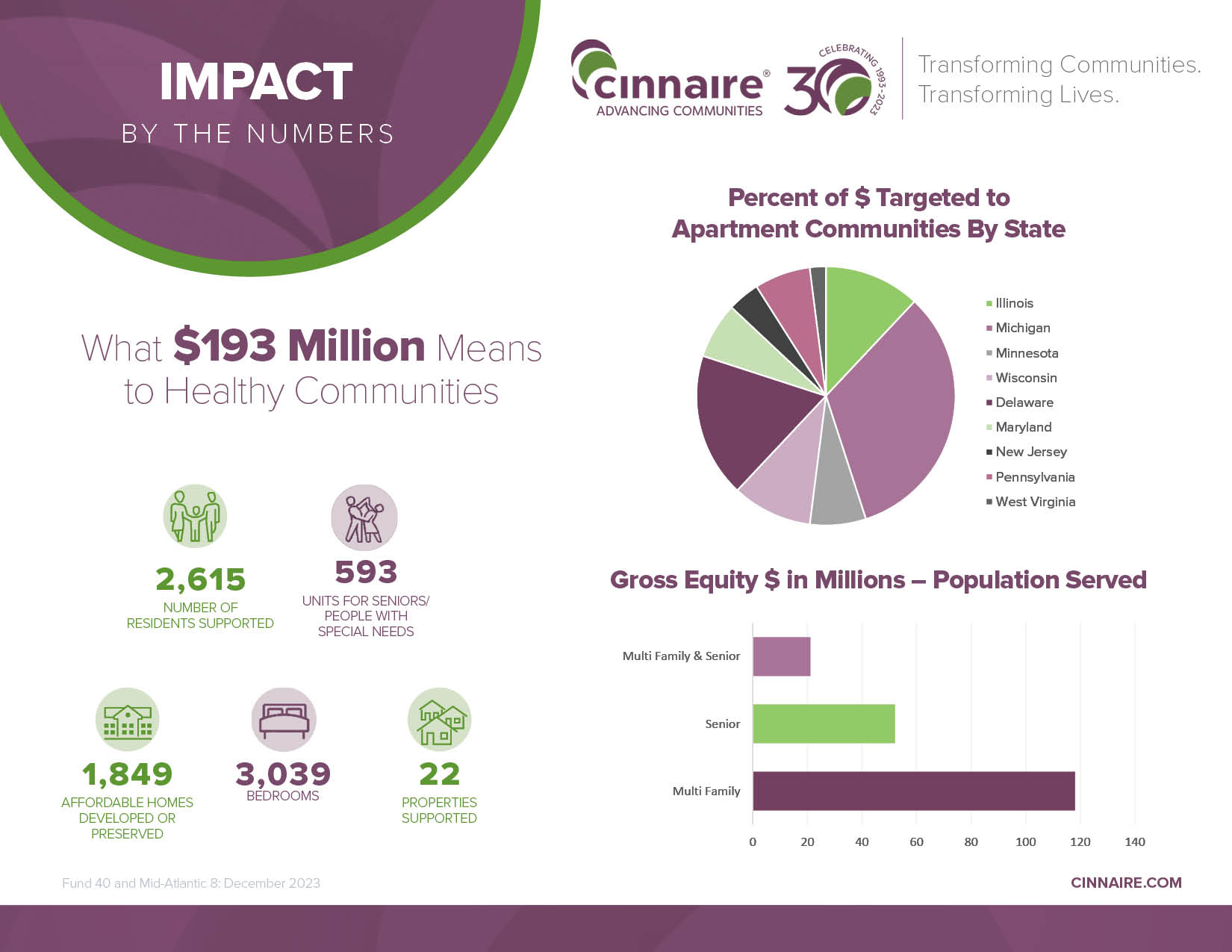

Cinnaire has announced the closing of two Low-Income Housing Tax Credit funds totaling $193 million. These multi-investor funds – Cinnaire Fund for Housing (Fund 40) and Cinnaire Fund for Housing Mid-Atlantic 8 (MA8) – will support the creation of preservation of 1,849 affordable homes across 22 projects in nine states.

“2023 has been a remarkable year with our capital raising team and partners coming together to raise $417 million in equity investments to support 3,313 affordable homes,” said Josh Ghena, Cinnaire Senior Vice President, Equity Business Funding. “Our focus on creating and preserving affordable housing goes beyond structures – offering residents a secure home and empowering communities. This unique investment opportunity aligns financial returns with a social mission, creating value for investors and positively impacting the lives of individuals and families.”

The $417 million in equity investments Cinnaire raised in 2023 will leverage $657 million in total development costs creating 2900 quality, affordable homes and providing housing for approximately 6,400 low-income individuals in 10 states.

“Through the power of collaboration and a shared commitment to mission-driven investing, we are proud to join our 21 investor partners, including four new investors, to direct these equity funds to amplify impact, transforming communities and transforming lives,” said Matt Hodges, Cinnaire Senior Vice President, Business Funding Lead. “We are grateful to our partners for their commitment to creating opportunities for equitable growth and shaping a brighter future for the people we serve.”

Cinnaire Fund for Housing Fund 40 to Benefit Residents in the Midwest

Cinnaire’s Midwest Fund 40 raised $120 million in committed capital for a multi-investors LIHTC fund that will support the creation of 1,165 affordable homes across 15 new construction and rehabilitation projects in four Midwest states.

Cinnaire Fund for Housing Mid-Atlantic 8 to Benefit Residents in the Mid-Atlantic

Fund MA8 is a $73.3 million multi-investor LIHTC fund that will support the creation of 712 affordable homes across 8 new construction and rehabilitation projects in five states, including an inaugural opportunity in West Virginia.

As a full-service Community Development Financial Institution (CDFI), Cinnaire works with socially conscious investors and mission focused organizations to support housing and community development work. Cinnaire helps investors accomplish their goals in underserved communities, including fulfilling the environmental social governance goals for the clients we serve. Cinnaire is continually reviewing activities, operations, and bottom-line results to ensure our investment strategies align with a heightened focus on addressing ESG considerations.

About Cinnaire

Cinnaire is a non-profit financial partner that supports affordable housing developments along with community and economic revitalization initiatives through creative investments, loans and real estate development services. Since 1993, Cinnaire has invested $5.7 billion to support the development of 863 housing communities in 10 states, providing 63,000 affordable apartment homes for more than 114,000 individuals and families and has provided community development loans to support the creation/retention of more than 4.7 million square feet of commercial, mixed-use, and community space. Cinnaire is a cooperate owner in CPC Mortgage Company, a national mortgage lending company specializing in Freddie Mac, Fannie Mae, and Federal Housing Administration (FHA) finance products. In its mission to change lives and transform neighborhoods into thriving communities, Cinnaire has helped to create or retain over 80,000 jobs and spur $10.1 billion in economic impact. https://cinnaire.com

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by Cinnaire

Cinnaire Closes Funds Totaling $193 Million, Committing Capital for Affordable Housing in Ten States

Jan 2nd, 2024 by CinnaireFund Closings Brings Total Equity Investments Raised in 2023 to $417 Million

Century-old Wisconsin Manufacturer Expands, Builds New Foundry in Manitowoc

Oct 17th, 2023 by CinnaireFacility Built Leveraging New Markets Tax Credit Program to Bring 80 New Jobs to the Area