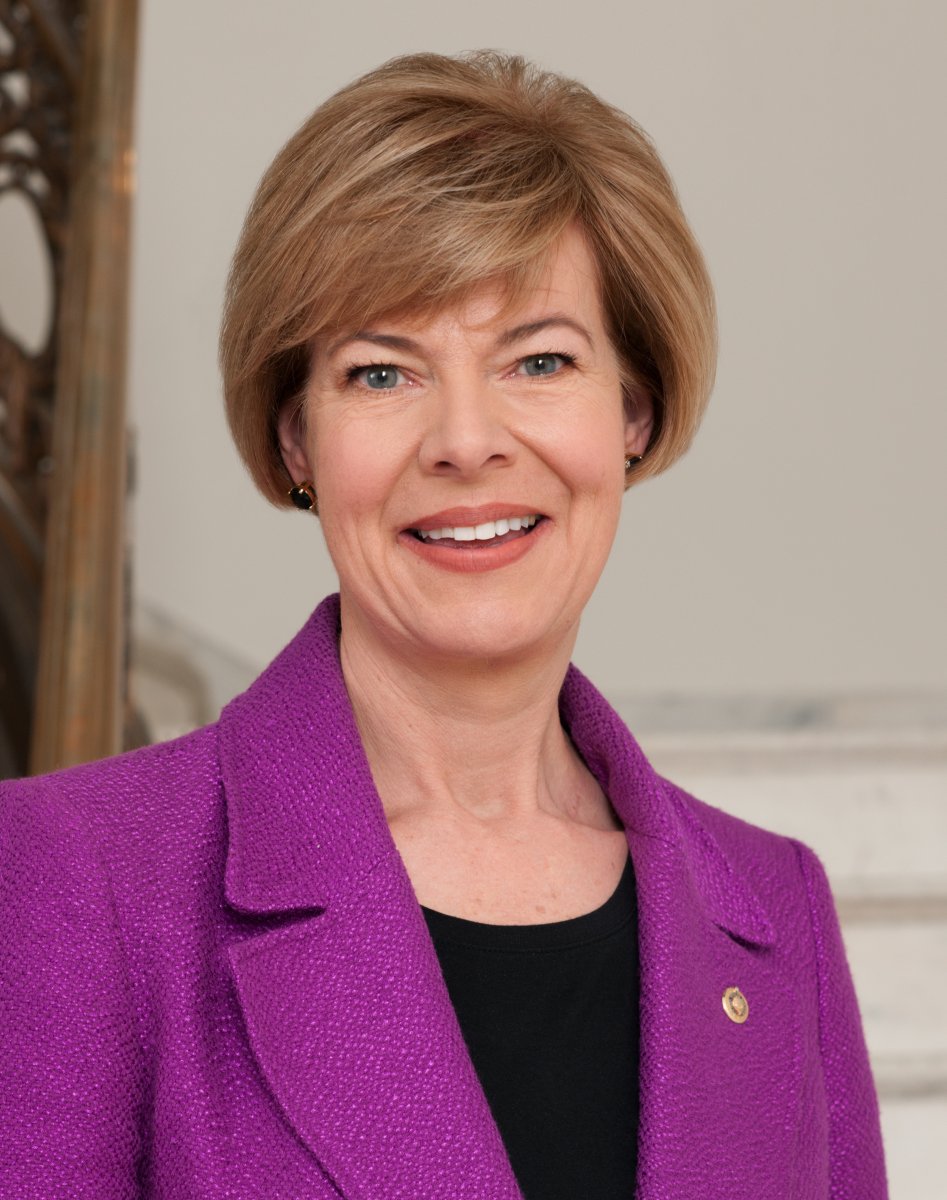

Baldwin, Colleagues Call for Long-Term Relief for 43 Million Student Loan Borrowers Amid Pandemic

Administration’s executive order to extend student loan relief still leaves millions of Americans behind

WASHINGTON, D.C. – Today, U.S. Senator Tammy Baldwin (D-WI) joined her colleagues, led by Senator Mark R. Warner (D-VA), in urging Senate leaders to include long-term relief for millions of Americans with student loans in the next coronavirus relief package as negotiations between Senate Republicans and Democrats continue. The letter comes after the President issued an executive order that only places a three-month forbearance for some student loan borrowers, leaving nearly eight million student loan borrowers to fend for themselves in the midst of an economic crisis caused by the COVID-19 pandemic.

“Although the President recently issued an Executive Order temporarily extending forbearance for some borrowers and waiving interest through the end of the year, Congress must act to ensure this relief is reliably available until the public health emergency ends. Further, only congressional action will ensure that all of our nation’s 43 million federal student loan borrowers are able to access full relief. Just as the Coronavirus Aid, Relief, and Economic Security (CARES) Act provided six months of relief following administrative action, we strongly believe that student loan forbearance should be codified for the duration of our economic crisis in the next COVID-19 response legislation,” the Senators wrote in a letter to Majority Leader Mitch McConnell and Minority Leader Chuck Schumer.

“Unfortunately, nearly 8 million borrowers were not eligible for the CARES Act relief, and will not benefit from the President’s Executive Order. These donut holes must be closed. And, while administrative action extending the forbearance will provide relief to many borrowers, it is not clear how the U.S. Department of Education will handle crucial issues related to credit toward forgiveness, credit reporting, loan rehabilitation, and collections that were addressed by the CARES Act. It is critical that Congress provide this relief legislatively so that payments do not resume before the economy is showing signs of recovery, that borrowers do not experience collateral damage from further donut holes in the Executive Order, and that no one faces unnecessary uncertainty about the status and treatment of their loans during this difficult time,” wrote the Senators.

In the letter, the Senators underscore that student loan debt has had a disproportionate impact on Black and Latino Americans. Approximately 90 percent of Black students and 72 percent of Latino students take out loans, compared to 66 percent of their white counterparts. While the student loan crisis has always contributed to inequality in the U.S., the COVID-19 crisis has only exposed and exacerbated these inequities.

To help make sure that all student loan borrowers have access to financial relief, the Senators also urged that the next COVID relief package include long-term financial relief for all federal student loan borrowers through September 2021, which mirrors provisions from the House passed HEROES Act.

In addition to Baldwin and Warner, the letter was signed by Senators Michael Bennet (D-CO), Elizabeth Warren (D-MA), Jacky Rosen (D-NV), Tim Kaine (D-VA), Debbie Stabenow (D-MI), Jeanne Shaheen (D-NH), Chris Van Hollen (D-MD), Dianne Feinstein (D-CA), Tina Smith (D-MN), Amy Klobuchar (D-MN), Sheldon Whitehouse (D-RI), Cory Booker (D-NJ), Sherrod Brown (D-OH), Dick Durbin (D-IL), and Bernie Sanders (I-VT).

The letter is available here and below. An online version of this release is available here.

Dear Leader McConnell and Leader Schumer:

We write in support of our nation’s federal student loan borrowers, specifically the millions of those whose ability to repay their loans has been negatively impacted by the novel coronavirus (COVID-19) pandemic and resulting economic crisis. Although the President recently issued an Executive Order temporarily extending forbearance for some borrowers and waiving interest through the end of the year, Congress must act to ensure this relief is reliably available until the public health emergency ends. Further, only congressional action will ensure that all of our nation’s 43 million federal student loan borrowers are able to access full relief. Just as the Coronavirus Aid, Relief, and Economic Security (CARES) Act provided six months of relief following administrative action, we strongly believe that student loan forbearance should be codified for the duration of our economic crisis in the next COVID-19 response legislation.

For the 19th consecutive week, over 1 million Americans have filed for new unemployment benefits. This unprecedented increase in job loss in the U.S. resulting from the coronavirus has left many people unable to afford even basic necessities. Despite the sudden and rapid rise in unemployment numbers, the U.S. is likely to experience high unemployment levels for a significant time. A recent report from the Congressional Budget Office (CBO) estimates that unemployment will still be over 9% by 2021. As families continue to face sudden joblessness, high medical bills, and other financial setbacks resulting from the crisis, tens of millions of student loan borrowers have continued to worry about when they will have to resume their payments.

Unfortunately, nearly 8 million borrowers were not eligible for the CARES Act relief, and will not benefit from the President’s Executive Order. These donut holes must be closed. And, while administrative action extending the forbearance will provide relief to many borrowers, it is not clear how the U.S. Department of Education will handle crucial issues related to credit toward forgiveness, credit reporting, loan rehabilitation, and collections that were addressed by the CARES Act. It is critical that Congress provide this relief legislatively so that payments do not resume before the economy is showing signs of recovery, that borrowers do not experience collateral damage from further donut holes in the Executive Order, and that no one faces unnecessary uncertainty about the status and treatment of their loans during this difficult time.

We also know that the burden of student debt is even heavier for Black and Latino borrowers. About 90% of Black students and 72% of Latino students take out loans, compared to 66% of white students. The student loan crisis has always contributed to inequality in the U.S., and, without further Congressional action, COVID-19 will only exacerbate the problem. Given the dire circumstances for many student loan borrowers, we urge you to ensure that an extension of reprieve on student loan payment is codified in future COVID-19 related legislation.

The U.S. House of Representatives passed the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act on May 15, 2020. The bill would extend the current suspension of payments, interest, and involuntary collections through September 2021. This timeline is essential given the projected length of the economic crisis borrowers are facing. The bill also extends the relief in the CARES Act to all federal student loans. We request your leadership in ensuring that the Senate adopts these HEROES Act provisions, and appreciate your continued work in getting essential relief to our nation’s student loan borrowers.

Sincerely,

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by U.S. Sen. Tammy Baldwin

Baldwin, Murkowski Introduce Bipartisan Bill to Protect Our Shoreline Communities

Jul 10th, 2025 by U.S. Sen. Tammy BaldwinBill reauthorizes program that provides essential data and resources for coastal communities to protect against storms, boost safety, and plan for the future

Baldwin Statement on House Passage of Republicans’ Budget Bill That Guts Medicaid, Raises Costs for Families

Jul 3rd, 2025 by U.S. Sen. Tammy BaldwinIn Wisconsin, the bill will terminate at least 250,000 people’s health care, reduce or eliminate 90,000 Wisconsinites’ food assistance, and threaten to close rural hospitals