How Will Higher Assessments Impact Your Taxes?

Milwaukee properties are worth 17% more says city assessor.

Homeowners across Milwaukee might be fearing what their property tax bill will look like after opening their mail this week. The City of Milwaukee Assessor’s Office sent out new assessments that show big increases in property values.

However, the fact that assessed values are surging across the city is likely to dampen the actual tax impact for many.

The average Milwaukee property’s assessed value increased 17.36%. The surge can be attributed to a hot real estate market and the fact that, for most property owners, it represents two years of change since the prior year was a “maintenance year” where no citywide assessment was conducted.

The assessment process is separate from actually levying property taxes and does not impact the amount of revenue the city can collect. As defined in state law, the assessment process is to be used to determine a fair market value for each of the more than 150,000 properties in Milwaukee. “Our goal is a fair and accurate determination of these properties,” says Assessment Commissioner Nicole Larsen in a video released Friday.

Assessments and property taxes are linked in a way that can be best compared to dividing up the check at a restaurant. Assessments determine what portion of the property tax levy each property owner will pay by calculating their share of the whole. Both the tax levy and assessment process are governed by state law, with the former being effectively capped.

What will the actual individual property tax impact be? A rule of thumb is that if an individual property’s value increases at a rate less than the citywide average (of 17.36% this year), the actual tax bill is likely to go down. But there is one key factor that will break that rule this year: the recently-passed Milwaukee Public Schools referendum. Voters narrowly endorsed allowing the district to exceed its property tax cap, which will cause that portion of the property tax bill to increase for everyone regardless of the assessment process.

In addition to the city and school district, other entities that levy a property tax include Milwaukee County, the Milwaukee Metropolitan Sewerage District and Milwaukee Area Technical College. With climbing values, the entities will need to cut their property tax rate (mill rate) to stay in line with state-imposed revenue limits. Through a web of state statutes, the amount of property tax revenue collected is allowed to grow only for the value of new construction and a small inflation increase.

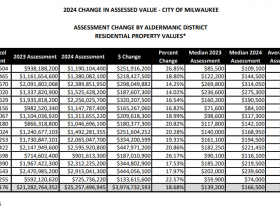

The average residential home value climbed from $155,149 to $184,125. The median residential home value climbed from $139,200 to $166,500. The assessed values for residential properties are designed to reflect the sale price of a property when sold on Jan. 1.

But increases are not uniform across the city. When viewed by aldermanic district, many areas that saw falling values for decades are now seeing large percentage increases, though the average residential property value is still below the city average.

The biggest increase was in the 1st District, which encompasses much of the northeastern side of the city just west of Interstate 43. Values in that district increased by 26.85%, though the average residential assessment remains the second-lowest at $113,300. The second-largest increase was in the 12th District, which encompasses Walker’s Point and other near southside neighborhoods. Values rose 26.17% to an average of $136,649. The third largest percentage increase was in the central-city 15th District, where values rose 22.57%, but the average home remains the lowest in value at $87,915.

The lowest growth rate was seen in the 4th District, which includes Downtown and the Near West Side. Residential property values there increased 14.02%, but the average value is the highest at $379,460. The dollar value growth of the average property ($46,669) nearly doubled that of the 1st District ($23,983). The 3rd District, which encompasses the East Side and Riverwest, saw the second lowest increase at 14.25%, but has the second-highest average value at $358,299 and highest median value at $314,050. The district-by-district figures include condominiums, but not apartments.

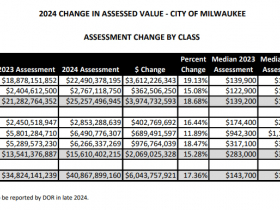

Single-family homeowners will shoulder a bigger portion of the property tax burden next year because their properties are growing in value faster than properties in other classes. Residential assessments increased 19.13%, while condominiums increased only 15.08%, apartment buildings increased 18.47%, small commercial buildings (local mercantile) increased 16.44% and larger commercial properties including office buildings, hotels and shopping centers (special mercantile) climbed only 11.89%. The data, produced by the Assessor’s Office, excludes manufacturing properties that are assessed by the state. A report says those figures will be reported by the state Department of Revenue later this year.

The combined value of city-assessed properties is $40.9 billion, up from $34.8 billion in 2023 and $30.5 billion in 2021.

Governed by state law, the city’s assessment process relies on data from the sale of comparable properties and more than 140 assessor-defined neighborhoods. A software model compares properties and is mixed with data on property conditions, property style, size and other factors. The assessor does not individually visit each of the city’s properties.

Property owners have until Monday, May 20, at 4:45 p.m. to file an appeal under a process known as “Open Book.” If the Assessor’s Office declines to make any change, property owners may then appeal to the city’s Board of Review and ultimately to circuit court. Several thousand appeals were filed during each of the past two reevaluation years (2020 and 2022).

Images

UPDATE: The list of the districts experiencing the largest increases has been expanded.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

City Hall

-

Council Blocked In Fight To Oversee Top City Officials

Dec 16th, 2025 by Jeramey Jannene

Dec 16th, 2025 by Jeramey Jannene

-

Latest Effort to Adopt New Milwaukee Flag Going Nowhere

Dec 3rd, 2025 by Jeramey Jannene

Dec 3rd, 2025 by Jeramey Jannene

-

After Deadly May Fire, Milwaukee Adds New Safety Requirements

Dec 2nd, 2025 by Jeramey Jannene

Dec 2nd, 2025 by Jeramey Jannene

With the MPS referendum alone, our ’24 property tax bill will be at least 12% higher year over year. I shutter to think of what might happen with the latest assessment. There is a lot of blame to go around from the grubby withholding of funds from our GOP Legislators to the grifter local officials who gave themselves preposterous raises. Problem is that you have priced us out of staying in the state & city we love.

LOBK: It would be interesting to investigate cities similar to MKE in size to see how their property values and taxes change year by year. My guess is that the same thing is happening everywhere.

So…our taxes are going up. I’ve lived in the city for 25 years. I truly cannot remember my property taxes going down and if they did, not by much. I’m willing to pay hefty property taxes as long as I get the services I am paying for. When I call the police, they come and quickly. My streets are plowed when it snows. The street lights are maintained. Parks are free and well maintained. Potholes are filled and roads are kept up. If my house is on fire, firefighters come quickly and put it out. We can assess to what degree our taxes are meeting the above and other criteria and needs. Sometimes it’s worth the money. Sometimes, well, we have a ways to go with getting a true value for our tax dollars.

The key words in jrockow’s comment above: “I’m willing to pay hefty property taxes as long as I get the services I am paying for.” I wholeheartedly agree. I love Milwaukee. I’ve lived here at various stages in my life over three decades. And many of our services are top notch and worth the high taxes. But it seems there’s a growing list of items where service has become sub par and we’re not getting what we pay for. And that has me very concerned that at some point, the negatives may outweigh the many positives.