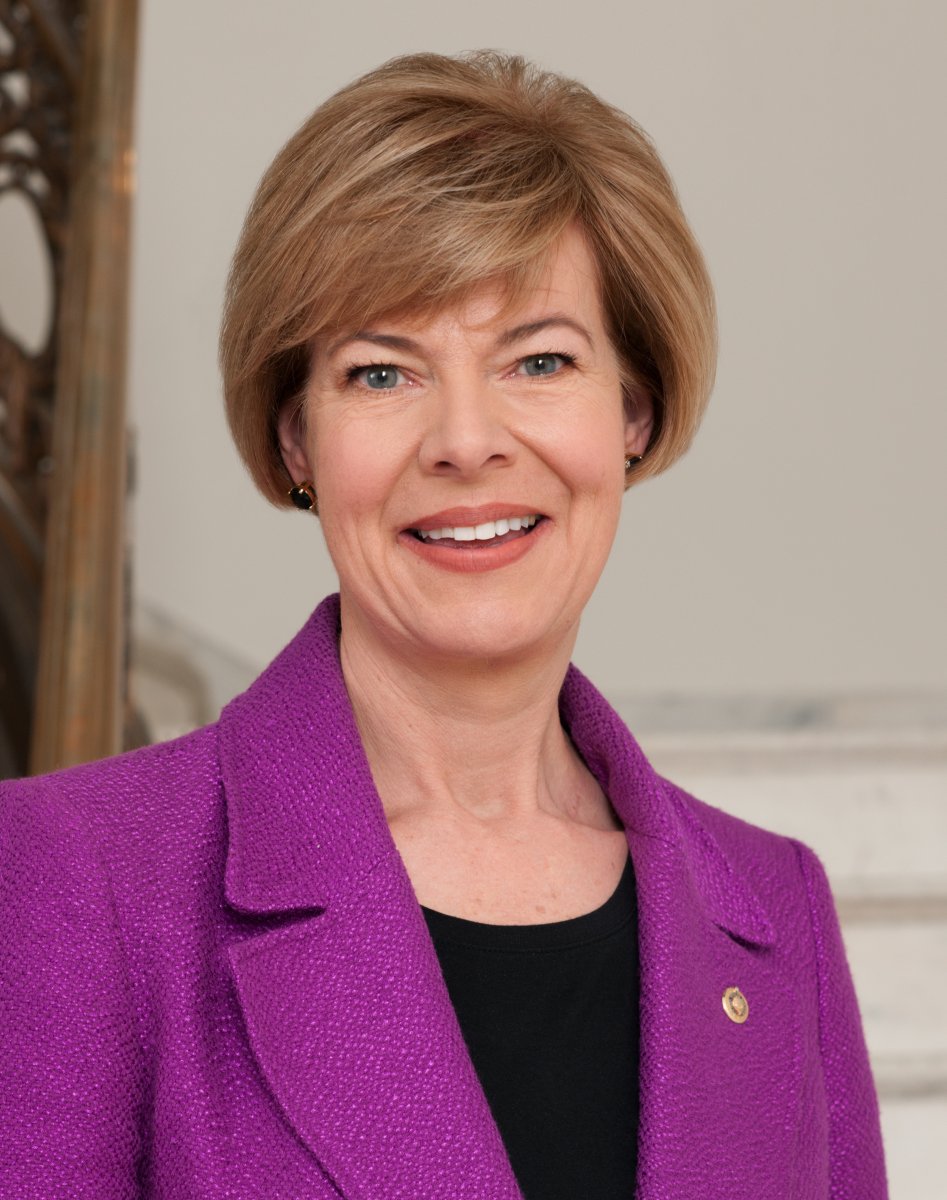

Baldwin, Braun, Shaheen, Fischer Introduce Bipartisan Legislation to Stop Student Debt Relief Scams

Bipartisan reform provides more tools to identify and shut down fraudsters who hurt borrowers

WASHINGTON, D.C. – As everyday Americans are struggling with student loan debt, U.S. Senators Tammy Baldwin (D-WI), Mike Braun (R-IN), Jeanne Shaheen (D-NH) and Deb Fischer (R-NE) today introduced the bipartisan Stop Student Debt Relief Scams Act, legislation that would enhance efforts to identify and shut down student debt relief scams.

“Far too many students are already struggling with student loan debt, and they deserve to be protected from scammers and bad actors who are preying on their financial security,” said Senator Baldwin. “I’m leading this bipartisan reform because it is just commonsense to stop these student loan debt relief scams that harm American students and prevent them from getting ahead.”

“Millions of Americans take on the burden of student loan debt in the pursuit of better opportunities through higher education and, unfortunately, many fall victim to predatory student debt relief scammers. I’m proud to co-sponsor this legislation to crack down on these scams and stop criminals from taking advantage of our students,” said Senator Braun.

“Hard working students and their families deserve protections from debt relief scams. With this bipartisan legislation, Congress would clarify that it is a federal crime to access the Department of Education’s I.T. systems for fraudulent purposes. I’m proud to cosponsor this common-sense solution to better protect the students who rely on loans to pay for higher education,” said Senator Fischer.

With Americans facing nearly $1.5 trillion in student loan debt, borrowers are looking for relief wherever they can find it. Debt relief scams falsely promise borrowers a quick fix with little hassle. These schemes robocall student loan borrowers until they agree to pay thousands of dollars in unnecessary fees for services that are available for free, claiming to reduce or forgive borrowers’ student debt.

In a March 2018 report, the U.S. Department of Education’s Office of Inspector General recommended that Congress strengthen federal law to help stop scam artists that fraudulently obtain access to borrower’s online login credentials, primarily by imposing meaningful financial penalties and prosecuting individuals and entities perpetrating these scams. The Stop Student Debt Relief Scams Act would accelerate the end to this rampant misconduct.

The Stop Student Debt Relief Scams Act of 2019 will enhance law enforcement and administrative abilities to identify and shut down student debt relief scams. Specifically, the legislation will:

- Clarify that it is a federal crime to access U.S. Department of Education information technology systems for fraud, commercial advantage, or private financial gain, and impose fines on scammers for violations of the law;

- Direct the U.S. Department of Education to create a new form of third-party access, akin to the current “preparer” function on the Free Application for Student Aid (FAFSA) for those applying on behalf of a student and their family, in order to protect legitimate organizations;

- Require the U.S. Department of Education to maintain common-sense reporting, detection, and prevention activities to stop potential or known debt relief scams; and

- Require student loan exit counseling to warn federal loan borrowers about debt relief scams.

This bill is endorsed by the Education Finance Council, Generation Progress, National Consumer Law Center, National Council of Higher Education Resources, Student Loan Servicing Alliance, The Institute for College Access and Success, and Young Invincibles.

“This legislation is a prime example of a smart, bipartisan effort to address a real and practical problem with real consequences for borrowers. Stopping these predatory so-called “debt relief” scammers who charge borrowers for assistance that their actual student loan servicer already provides – that’s something we should all agree on,” said Scott Buchanan, Executive Director of the Student Loan Servicing Alliance. “As those on the front lines of helping educate student loan borrowers to be able to make good choices amongst complicated options, we support this legislation’s goal of taking more steps to protect borrowers from scammers who do nothing other than prey on those who need the very help that real servicers already provide.”

“Education Finance Council’s (EFC) nonprofit member organizations are dedicated to assisting borrowers with managing their student loan debt and have seen first-hand the havoc that fraudulent debt relief companies can wreak on borrowers’ lives,” said Debra J. Chromy, President of the Education Finance Council. “It is critical to hold accountable such companies that are taking advantage of vulnerable borrowers for their own financial gain. We applaud Senators Baldwin, Braun, Fischer, and Shaheen for their leadership on addressing this critical issue.”

“The National Council of Higher Education Resources (NCHER) strongly supports the ‘Stop Student Debt Relief Scams Act of 2019,’ which will crack down on unlawful and unscrupulous third-party debt relief companies that target struggling borrowers and drive them deeper into debt. This important bill will protect students and families, allowing borrowers that are delinquent on their payments or in default to receive the specialized help that they need from their federal student loan servicers – for free. NCHER and its members are proud to endorse this important piece of legislation and work for its passage during the 116th Congress,” said NCHER President James Bergeron.

More information about this legislation is available here. The full bill text is available here.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by U.S. Sen. Tammy Baldwin

Baldwin, Murkowski Bipartisan Bill to Protect Our Shoreline Communities Passes Out of Senate

Mar 2nd, 2026 by U.S. Sen. Tammy BaldwinBill reauthorizes program that provides essential data and resources for coastal communities to protect against storms, boost safety, and plan for the future