Bipartisan Way to Reduce Inequality

Increased Earned Income Tax Credit is simple measure that most state residents would favor.

Income inequality has been on the minds of many voters during the presidential primaries. If you think it’s only a concern of Democrats, take a look at the results of the most recent “Wisconsin Survey” – a St. Norbert’s poll conducted for Wisconsin Public Radio and Wisconsin Public Television. The survey last week of 616 registered Wisconsin voters found that 66% favor “increasing taxes on wealthy Americans and large corporations in order to help reduce income inequality in the U.S.,” compared to only 28% who said they were opposed.

There are lots of different ways to adjust taxes (and labor policy) to reduce income inequality. Unfortunately, most of those – such as closing corporate tax loopholes and increasing the minimum wage – have little chance in Congress right now. But one promising policy option that does have a chance is to provide a significant increase in the Earned Income Tax Credit (EITC) for adults who don’t have dependent children. That idea has been endorsed not only by President Obama, but also by House Speaker Paul Ryan.

The federal and state EITC provide a powerful work incentive for parents and lift millions of families out of poverty. However, the federal EITC for low-wage childless adults (and non-custodial parents) is only a small fraction of the EITC for workers with dependent children, and childless adults are ineligible for the credit if they’re under 25. In addition, the Wisconsin EITC applies only to working parents with dependent children, not to childless adults.

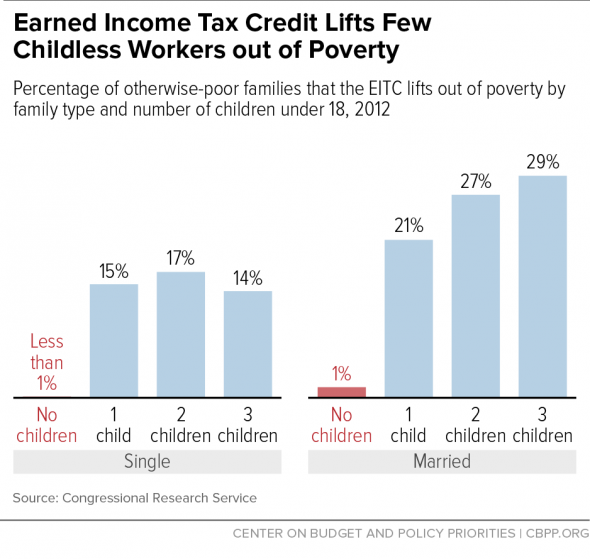

The bar graph, which was prepared by the Center on Budget and Policy Priorities (CBPP), examines the effect of the EITC for adults with income below the poverty level. It illustrates that for married couples with children, the current federal credit lifts more than 20% of those families above the poverty level. But for childless married couples, it only lifts about 1% of those households above the poverty level, and even less for unmarried childless adults. In fact, in 2014 the federal tax code taxed more than 8 million childless adults into poverty or deeper below the poverty line. A recent blog post provides this example:

“Consider a 21-year-old man just entering the labor market and making poverty-level wages (about $12,500 in 2016) on a construction site. He has $956 in payroll taxes deducted from his paycheck and pays $214 in federal income taxes. Because he receives zero EITC, he’s taxed into poverty.”

Speaker Ryan and President Obama have both endorsed proposals that would help make work pay for childless adults by increasing the EITC. They have different ideas about how to pay for it, but that shouldn’t be an insurmountable problem. (Here in Wisconsin we don’t have an EITC for childless adults, but Rep. Zepnick has proposed legislation, AB 434, to extend the credit to those adults.)

Voters want politicians to change the tax code to reduce income inequality. No single step will cure the problem, but a great place to start during the current Congressional session is to increase the federal EITC for childless adults.

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.

Jon, another excellent piece of scholarship on matters deemed tedious by the masses, but so very important. Not sure if you remember me from the Anne Arneson days, hope so. Keep up the fine work. I know that my eldest, Austin King was and still is a big fan of yours. He’s an atorney now working for Better Markets in D.C. Best, Bob.