How Fair Are Wisconsin’s Taxes?

The wealthy pay a lower percent of their income in taxes. Evers proposal addresses this.

Jericho / (CC BY 3.0)

A recent report from the Wisconsin Policy Forum calculated that Wisconsin’s state and local government tax burden—the percentage of income going to taxes–had continued its long-term decline in the most recent year. This decline in average taxes as a proportion of average income is shown in the graph below.

The report concluded that the tax burden from local taxes had declined from 4.5% in 1990 to 3.2% in 2024 (shown in blue). Meanwhile, the burden from state taxes (shown in orange) declined from 8.1% to 6.4%. Combined, state and local taxes dropped from 12.6% of income to 9.6%.

One factor behind the strong performance was a rise in personal income. It grew by 5.2%, “a relatively strong increase that was twice as large as in the previous year … Because this latest increase in income easily outstripped the growth in tax collections in 2024, the overall tax burden was driven down.” On a less positive note, the report refers to “a notable trend that has been accompanied by drops in spending on services such as K-12 education.

The report also cautions that:

… the growth in personal income in Wisconsin for the most recent year once again lagged the national average of 5.9%, as it has in every year since 2009. That slower growth in incomes means over time Wisconsin residents can afford to pay for fewer goods …

The Policy Forum’s report does not attempt to quantify who benefits from the reduction in tax burden. Does it go mainly to already-wealthy taxpayers, to people barely getting by, or to a mix of both? Every few years, the Institute on Taxation and Economic Policy (ITEP) issues a report called Who Pays, which analyzes taxpayers’ tax burden by income for each of the states. The report’s 7th edition was issued at the start of last year.

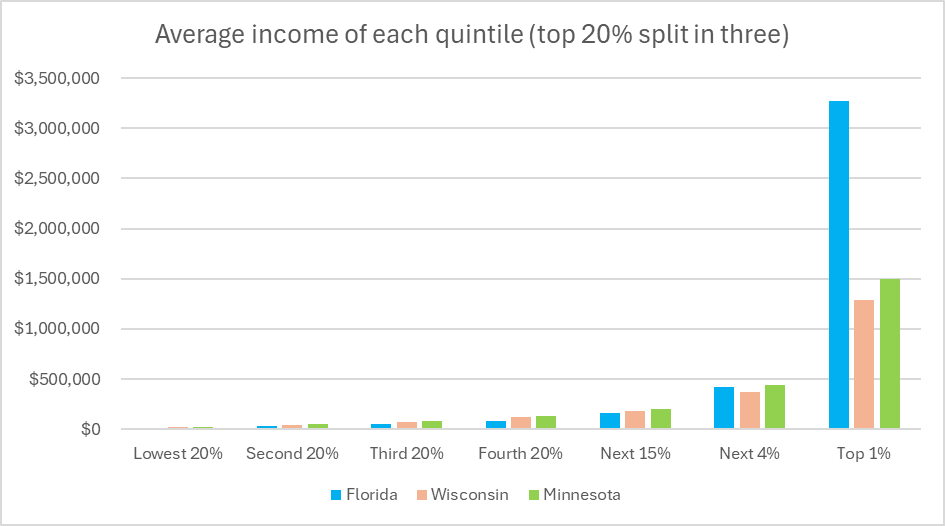

To fully explain this ITEP ranks people by income, dividing the state’s families into five quintiles (fifths) in order of increasing income. The top quintile is split into three groups: the next 15%, the next 4%, and the top 1%, resulting in seven groupings. The next graph shows these groups and the average income in each.

Florida is shown in blue, Wisconsin in pink, and Minnesota in green. Note that the average income of Florida’s one-percenters is more than double those of Wisconsin and Minnesota.

The obvious problem with the graph shown above is that in order to fit the Florida one-percenters onto the graph, the vertical scale must be shrunk such that the lower quintiles are shrunk to the vanishing point.

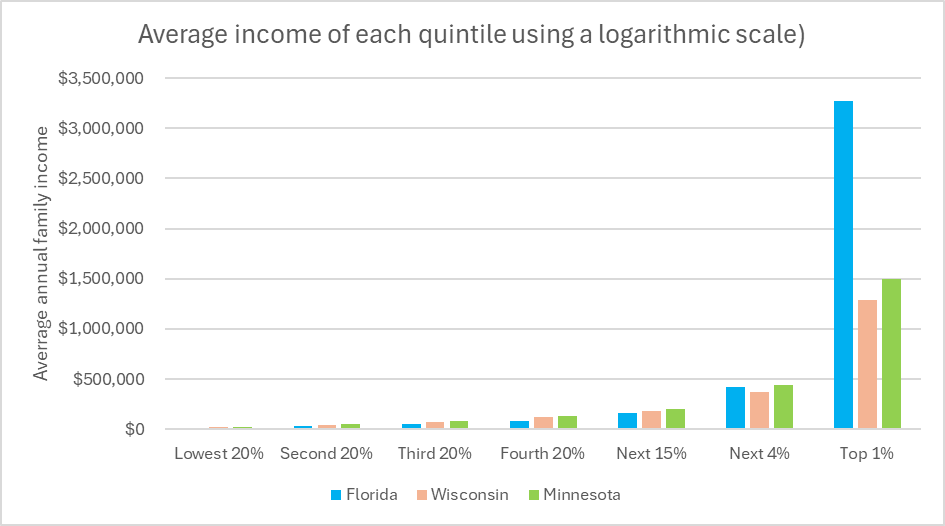

One possible solution is to replace the vertical scale with a logarithmic scale, as shown below in which each horizontal line is ten times the line below it. The downside of this approach is that it gives the impression that the incomes are much closer together than they really are. For instance, average income for the Florida one percenters is more than double that for the other states. Also, one would be hard pressed to discern that in Florida, people in the top 1% of incomes are making almost 300 times the income of Floridians in the first quartile.

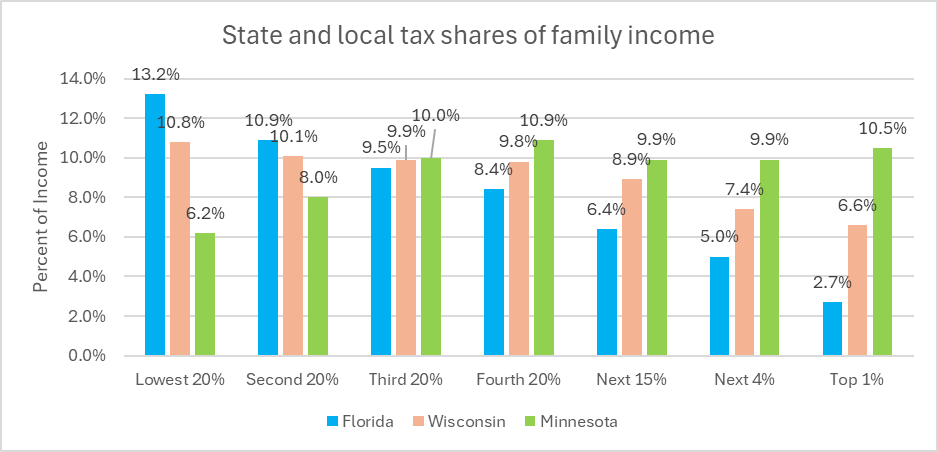

The next chart shows ITEP’s estimates of the percentage of family income going to taxes in each of the three states. For the poorest people in Florida the total tax takes 13.2% of income. As income rises, the share of income paid to taxes drops down steadily, bottoming out at 2.7% for people in the top 1%.

Wisconsin’s taxes also decline with increased income, but not nearly as strongly as in Florida. Unlike Florida, Wisconsin has an income tax, which tends to counter the regressive effect of other taxes, especially taxes on sales.

In contrast, Minnesota’s taxes on people in the first two quintiles are lower than those of the other three quintiles. For higher quintiles, they are around 10% of income, which makes them higher for millionaires than in the other two states.

In his budget proposal Governor Tony Evers calls for a new individual tax income tax bracket with a marginal rate of 9.8% on taxable income above $1 million for single filers and married joint filers, and above $500,000 for married taxpayers who file separately. The current top tax bracket has a 7.65% rate and applies to single filers making $315,310 and joint filers making $420,420.

Other provisions of his proposal would also make the tax system more progressive including offering a state payment to local governments if they agree not to raise local property taxes. Even his proposal to eliminate taxes on tips would appear to push Wisconsin in the progressive direction.

Will Evers proposals be passed or will Republicans oppose any effort to make Wisconsin less regressive? We shall see.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

Data Wonk

-

Life Expectancy in Wisconsin vs. Other States

Dec 10th, 2025 by Bruce Thompson

Dec 10th, 2025 by Bruce Thompson

-

How Republicans Opened the Door To Redistricting

Nov 26th, 2025 by Bruce Thompson

Nov 26th, 2025 by Bruce Thompson

-

The Connection Between Life Expectancy, Poverty and Partisanship

Nov 21st, 2025 by Bruce Thompson

Nov 21st, 2025 by Bruce Thompson