Wisconsin Startup Investments Fell in 2023

So far in 2024, the state tech council has tracked $256M in startup investments.

Investment in Wisconsin startups slowed in 2023, but industry watchers called that a return to normal after a pandemic boom.

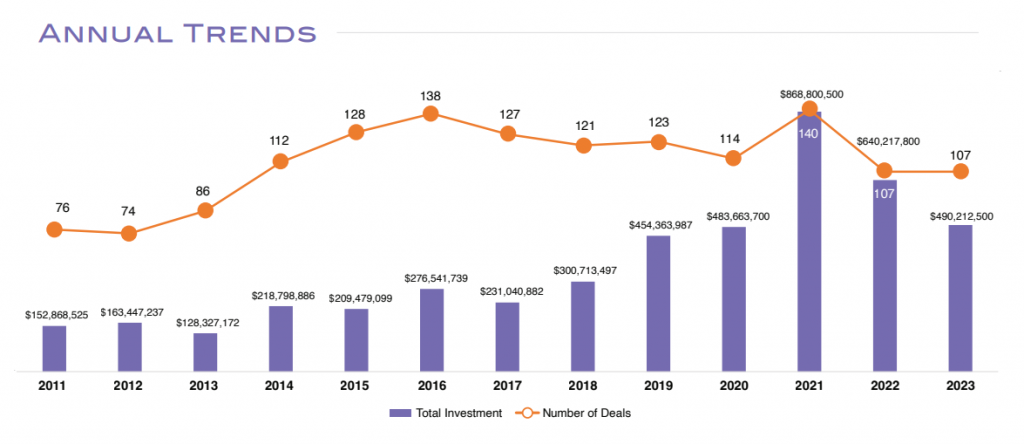

Last year, Wisconsin startups raised at least $490 million, down from $640 million in 2022 and the record-high $868 million in 2021, according to the Wisconsin Technology Council’s Wisconsin Portfolio report, which tracks investment in early-stage companies.

“Everyone saw this huge bump during COVID,” he said. “Now we’re kind of coming down from that sugar high that we had, and we’re really normalizing.”

Even though investment was down, 2023 still registered the third-highest level since the tech council began tracking the data.

So far in 2024, Kremer said the tech council has tracked $256 million in startup investments.

Health care accounted for the most investment last year at $245 million, just over half of all the dollars secured, according to the report. Kremer said investments in the health care industry also included those in biohealth and biotech companies.

“It’s going to raise the visibility of Wisconsin, and it’s going to really put Wisconsin on sort of a really special map,” Kremer said.

The $50 million in federal funding going toward the tech hub will also help reduce risk for investors and entrepreneurs in the biotech industry, he said.

One of the health care firms to receive funding in 2023 was Bend Health, a telehealth care provider based in Madison focusing on mental health services for kids, teens and young adults.

This graphic shows startup investment in Wisconsin dating back to 2011. There was a lot of activity in 2021 while the COVID-19 pandemic was still ongoing. Graphic courtesy of the Wisconsin Technology Council

According to the report, investors funneled at least $31.1 million toward Bend Health last year. A spokesperson said the company raised $32 million in 2023.

Monika Roots, co-founder, president and chief medical officer for Bend Health, said she and her husband created the company in 2021 in response to a critical need for youth mental health services. She said the company serves young people in all 50 states and the District of Columbia.

But Roots admitted attracting investors in the Midwest is harder than it is in coastal states like California or New York.

She said Bend Health was able to win over East and West Coast investors because it’s a national company, but others aren’t as lucky.

“For smaller companies, there really isn’t much in Wisconsin in terms of investment,” she said. “They frequently need to turn to investors in Minnesota, or they need to turn to Chicago. There still is just not enough money in the Midwest.”

Despite those obstacles, Roots said she’s hopeful the Madison area will become a hub for health care tech companies, pointing to Exact Sciences Corp. and Epic Systems as successful examples.

“There are many very, very intelligent people in the state and some of them are leaving these larger companies and starting companies of their own,” she said. “If we could start to look at Madison as really a hub for health care innovation, I think that that would bring a lot to the state in terms of growth and potential.”

Madison and Milwaukee continued to attract the most investment in Wisconsin in 2023. According to the report, the greater Madison area had the most deals at 54, while southeast Wisconsin secured the most money with $236 million.

Jon Horne, managing director of the Idea Fund of La Crosse, said startups in this part of the country can often be overlooked by national investors. In May, the Idea Fund announced that it raised $31.5 million for its second venture capital fund for startups in Wisconsin, Iowa and Minnesota.

Horne said that was about twice the amount of money the firm raised in its first venture capital fund, allowing the firm to roughly double its number of investments.

“Our second fund is really doubling down on the strategy we built out in the first one, which is we come in early, we take risks, we take concentrated positions in the portfolio,” he said. “We believe that if quality, hard-working people are given a chance, you’re gonna see more successes coming out of this part of the state.”

Wisconsin startup investment down in 2023 following pandemic boom was originally published by Wisconsin Public Radio.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.