A Look At Milwaukee Home Sales In First Quarter of 2023

Out-of-state buyers suddenly go quiet as sales volume drops to pre-pandemic levels.

Editor’s note: This is the first piece in a new series by Marquette University researcher John D. Johnson. It will explore trends in residential property sales in the city of Milwaukee using data-driven analysis of state real estate transfer records. Look for future analysis on a quarterly basis.

Amidst a slowdown in overall Milwaukee home sales, out-of-state landlords dramatically slowed their buying spree in the first quarter of 2023. The three largest out-of-state landlords, which own approximately 1,500 homes in the city, combined to buy only a single house during the period. But the news doesn’t mean a buyer’s market has been created. The percentage of homes being sold by owner-occupants trended upward and home prices remain higher than last year.

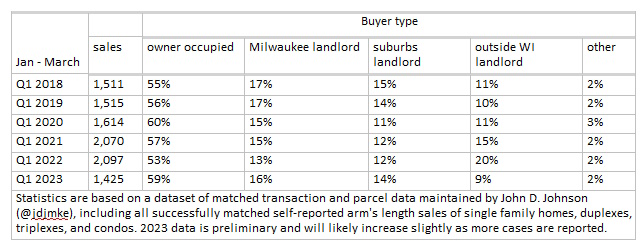

The total number of city of Milwaukee home sales fell to pre-pandemic levels during the quarter. Slightly more than 1,400 houses were sold in self-reported arm’s length (unrelated parties) transactions during the first three months of this year. That is down from nearly 2,100 in both 2021 and 2022, but similar to the sale volume in 2018 and 2019.

Out-of-state landlords dramatically slowed their pace of acquisitions. Their share of arm’s length home sales fell from 20% in the first quarter of 2022 to just 9% in 2023. The proportion of purchases by owner-occupiers and city or suburban-based landlords all ticked upward compared to the last two years.

Owner-occupiers accounted for 59% of arm’s length home purchases in January, February, and March. City-based landlords bought another 16% and suburban landlords 14%.

Table 1: First quarter arm’s length home sales in the City of Milwaukee

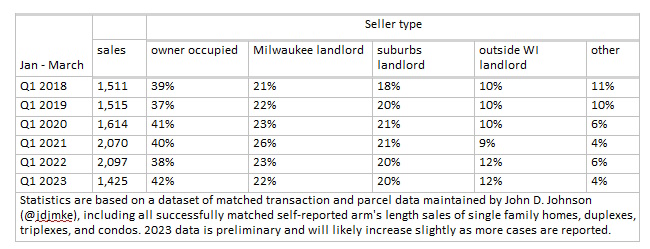

Table 2 shows the mix of sellers by ownership type. The share of sellers who were owner-occupiers ticked up slightly, from 38% in 2022 to 42% in 2023. In total, the share of sales involving an owner-occupier (either as the seller, buyer, or both) grew to 68% in 2023 compared to 61% in 2022.

Table 2: First quarter arm’s length home sales in the City of Milwaukee

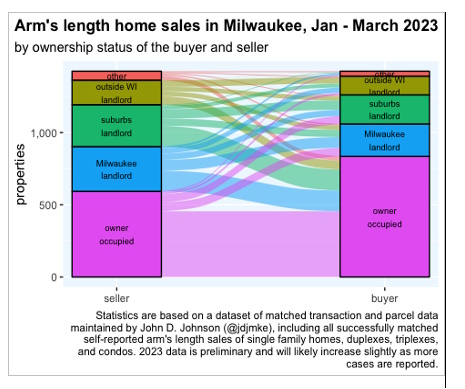

Notice that owner-occupiers comprised 59% of sellers but just 42% of buyers in the first quarter of 2023. This is because owner-occupiers buy the lion’s share of properties sold by other owner-occupiers along with a substantial fraction of the houses sold by landlords.

Owner-occupiers bought 77% of houses sold by other owner-occupiers, 46% of those sold by city-based landlords, 50% of sales by suburban landlords, and 36% of houses sold by out-of-state landlords.

Arm’s length home sales are a net source of new homeowners, but it’s important to note that this doesn’t necessarily translate into similarly high overall growth numbers of homeowners. Owner-occupancy experiences substantial attrition from non-arm’s length property conveyances (such as family transfers). Houses also cease to be owner-occupied when their resident owner moves out and converts it into a rental–a common occurrence in Milwaukee.

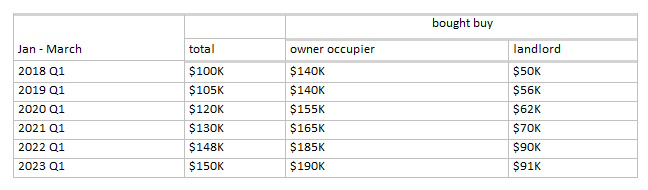

The volume of home sales may have plummeted, but prices haven’t followed suit. The pace of price increases tapered off, but typical home sales were still slightly more expensive in the first quarter of 2023 than a year prior.

Through March, the median overall home sale price was $150,000, compared with $148,000 a year ago and $130,000 in 2021. Among owner-occupiers, prices increased to $190,000 on average, up from $185,000 last year. Landlords pay much less. The typical landlord acquisition cost $91,000 in 2023, compared with $90,000 last year and $70,000 in the first quarter of 2021.

Table 3: Median sale price arm’s length home sales in the City of Milwaukee

Around The City

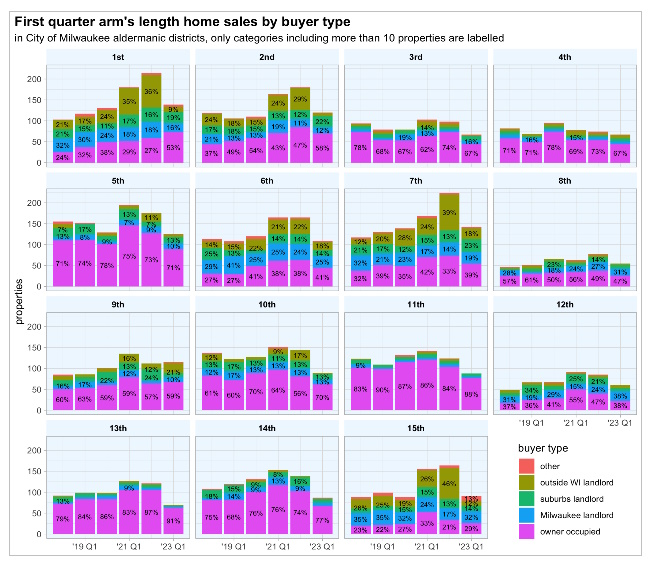

Compared to the first three months of 2022, sales in 2023 fell everywhere in the city except for the 9th aldermanic district on the Far Northwest Side. Most of the other northside districts saw steep declines in the number of transactions–mainly driven by the reduction in out-of-state acquisitions.

In the 15th district, for example, 46% of purchases in the first three months of 2022 were made by an out-of-state landlord. That dropped to 12% in 2023. Similarly, out-of-state landlords bought more than two-thirds of the houses sold from January through march in the 1st district during both 2021 and 2022, but this year they only purchased 9%.

Noteworthy Transactions

Despite the general slowdown in the real estate market, there were still several package sales of multiple houses. In the largest, Rentalvest, LLC (a property flipper) bought three duplexes and seven single-family homes from a local landlord for $555,000.

The largest three out-of-state landlords — all of whom spent the last two years aggressively buying properties — only reported a single transaction. VineBrook Homes bought one single-family house on N. 52nd Street for $115,000 from an owner in California. Neither Highgrove Holdings nor SFR3 recorded any purchases.

In 2021, VineBrook basically broke even, reporting a net income of $61,000. In 2022, it reported a net loss of $49.6 million. Its troubles haven’t ended in 2023.

On Jan. 17, it terminated purchase agreements to buy “approximately” 2,899 more houses, forfeiting initial deposits of $41 million. The 10-K does not provide information on why the publicly-traded firm exited the agreement.

VineBrook, according to its March 10-K filing, owns 1,032 homes in Milwaukee.

High interest rates have clearly dampened buyer enthusiasm in Milwaukee’s housing market. Buying activity has declined the most among landlords–particularly ones located out-of-state. Would-be homebuyers today face somewhat fewer competitors than a year ago, but prices remain about the same.

John Johnson is a Research Fellow at the Lubar Center for Public Policy Research and Civic Education at the Marquette Law School. His work focuses on housing, demographic, and political trends in Wisconsin and the Milwaukee metro area.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

More about the Milwaukee Housing Trends Series

- MKE Housing Trends: A Look At Milwaukee Home Sales In Second Quarter of 2023 - John D. Johnson - Aug 7th, 2023

- MKE Housing Trends: A Look At Milwaukee Home Sales In First Quarter of 2023 - John D. Johnson - Apr 26th, 2023

Read more about Milwaukee Housing Trends Series here

This is a great article!

Agreed, great research.

I’d also be interested to read more about the 3 out of state landlords regarding items related to avg rents or increasing rents after purchasing, who in general they acquired the properties from (ie: was it a large local property manager), demographics on their tenants, eviction policies, zoning violations…

Looking forward to reading more of these.

Great Article!