City Funds Three Affordable Apartment Buildings

Effort to get construction started on MLK Library, Edison School and Five Points Lofts.

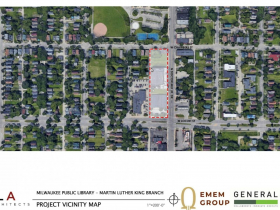

Preliminary rendering of Martin Luther King Library and Garfield Theatre redevelopment. Rendering by JLA Architects.

The City of Milwaukee will use tax incremental financing districts to close financing gaps in three long-planned affordable apartment buildings. The planned districts are intended to advance the redevelopment of the former Edison Middle School, the creation of the Five Points Lofts on a vacant lot on N. Martin Luther King Jr. Dr. and the development of an apartment building and new Martin Luther King Library at the intersection of W. Locust St. and N. Martin Luther King Jr. Dr.

All together, the three projects would create 214 affordable apartments.

“I’m telling you, all of those developers have gotten up at 3 a.m. with cold sweats,” said Gorman & Co. Wisconsin market president Ted Matkom, a partner on the redevelopment of the former Edison Middle School, to the board of the Redevelopment Authority of the City of Milwaukee (RACM) on Nov. 17.

Borrowing a phrase from city affordable housing specialist Maria Prioletta, Matkom said the resulting financing package for each project looks “like lasagna.” His proposal relies on nine funding sources.

The city is using its increasingly-common strategy of structuring the TIF districts as developer-financed agreements. Instead of borrowing the money up front and granting it to the developer, the city will instead create a commitment to use increased property revenue from the development to repay a set amount, plus 4.5% interest, over a maximum of 20 years. The structure places the risk on the developer.

The RACM board unanimously approved creating each district, but the Common Council must still approve the districts.

King Library

The city has spent six years cycling through proposals to redevelop the Martin Luther King Library, 310 W. Locust St. A revised development team of General Capital Group and Emem Group is poised to finally bring the now $37.2 million development to fruition.

According to the TIF district proposal, the project’s financing package relies on $18.1 million in housing tax credits, $6.4 million in mortgage financing, $5.5 million from the library, $3 million from the state’s American Rescue Plan Act grant, $1.5 million in applied-for funding from the city’s ARPA-backed Housing Trust Fund, $940,000 in TIF support, a $775,000 grant from Bader Philanthropies, $666,300 from a deferred developer fee and approximately $270,000 in other grants and loans.

For more on the proposal, see our September 2021 coverage.

Renderings

Site Photos

Edison Middle School

First introduced in 2020 as a $20 million proposal, Gorman is partnering with Malik Cupid and Lutheran Social Services of Wisconsin and Upper Michigan on redeveloping what was originally the Village of North Milwaukee’s high school, 5372 N. 37th St. Gorman’s proposal has grown to $27.5 million and includes 63 units of affordable housing targeted at elderly residents and 12 new townhouses for families.

The school was built in 1924 and later reconfigured and expanded to house Custer High School and finally Edison Middle School. It’s been vacant since 2008.

“What we really love about this community is that there are a lot of homeowners around us,” said Matkom. The school fills a 3.5-acre city block.

The proposal’s financing was imperiled before things got started because the state historic preservation officer initially ruled the building wasn’t historic, rendering it ineligible for such tax credits. Matkom said repositioning the application from one of a brick school from 1928 to a vestige of the long-gone Village of North Milwaukee helped secure the designation. The preservation credits offset 40% of preservation-related costs in exchange for redeveloping properties in line with historic standards.

According to the TIF district proposal, the project’s financing package relies on $10.6 million in housing tax credits, $6.3 million in historic preservation tax credits, $3 million in state ARPA funding, $2.5 million in mortgage financing, $965,000 in applied-for funding from the city’s ARPA-backed Housing Trust Fund, a $900,000 grant from the Federal Home Loan Bank, $875,000 in TIF support, $884,000 in developer financing, $750,000 in city-managed federal HOME funds and $707,000 from a deferred developer fee.

Lutheran Social Services will use an office in the building to connect residents, both from the building and neighborhood, to service providers. Matkom said such a proposal helps improve the project’s scoring to receive the competitively awarded housing tax credits.

Cupid is an assistant principal with Milwaukee Public Schools, but graduated from the Associates in Commercial Real Estate (ACRE) program designed to train women and minorities for careers in real estate. “I have learned so much and I am looking forward to doing my part to serve my community at all levels,” he told the board.

Gorman has led the redevelopment of a number of former schools in Milwaukee.

For more on the proposal, see our March 2022 coverage.

Photos

Interior Photos

Renderings

Five Points Lofts

The final of the three developments being advanced is the most straightforward. A partnership of Anthony Kazee‘s KG Development Group and the Martin Luther King Economic Development Corporation would develop a five-story, 55-unit apartment building on a city-owned, 1.13-acre site on the 3300 block of N. Martin Luther King Jr. Dr.

“It was a no brainer for us to partner with KG Development,” said MLKEDC executive director Nicole Robbins. Like Cupid, Kazee is a graduate of the ACRE program.

The $16.4 million proposal includes 46 affordable apartments and nine market-rate units. Kazee told the board that 1,000 square feet of space on the first floor is intended to serve as a pop-up library with the public library cycling materials through the space. The building includes a substantial outdoor amenity space for residents at the rear of the site.

According to the TIF district proposal, the project’s financing package relies on $7.2 million in housing tax credits, $2.5 million in mortgage financing, $2 million from the state’s ARPA grant, $1.4 million in applied-for funding from the city’s ARPA-backed Housing Trust Fund, $737,000 in TIF support, a $690,000 grant from the Federal Home Loan Bank, $500,000 in city-managed federal HOME funds, a $500,000 grant from Bader Philanthropies, a $500,000 loan from the Greater Milwaukee Foundation, $200,000 from RACM’s Brownfield Revolving Loan Fund, $154,600 from a deferred developer fee and approximately $270,000 in other grants and loans.

For more on the project, see our July 2020 coverage.

2020 Renderings

Site Photos

Eyes on Milwaukee

-

Church, Cupid Partner On Affordable Housing

Dec 4th, 2023 by Jeramey Jannene

Dec 4th, 2023 by Jeramey Jannene

-

Downtown Building Sells For Nearly Twice Its Assessed Value

Nov 12th, 2023 by Jeramey Jannene

Nov 12th, 2023 by Jeramey Jannene

-

Immigration Office Moving To 310W Building

Oct 25th, 2023 by Jeramey Jannene

Oct 25th, 2023 by Jeramey Jannene

These developers remind me of dairy farmers. The main difference is that they milk taxpayers instead of cows.

i am very glad there are projects for affordable housing. i wonder if all of them need to be built in what is considered black neighborhoods. there are no other vacant lots, empty schools or libraries that can be developed? how about on the south side. how about on the east side. how about thinking of integrating all of us and not just some of us.

I very much appreciate the effort and creativity that have gone into these projects. I certainly don’t feel “milked.” Rather, I would prefer to see my taxes go to even more developments which help reshape parts of the city that have known only neglect. And the report of efforts to build affordable housing in Tosa indicates we may finally be seeing units in other parts of the metropolitan area.

did i miss something. is one of these proposed projects in tosa?

Let’s talk about milking taxpayers. There is a enormous storage of affordable housing with the most severe being in the near north side. People are having to live in unsafe environments, pay as much as half of their monthly income in rent, sofa surf, live in their cars, or shelters. If by chance they do get a section 8 voucher or qualify for section 42 subsidized apartment, there still are months and months on waiting lists BECAUSE THERE IS A SHORTAGE OF AFFORDABLE HOUSING. That shortage exists in both inner cities and remote rural communities.

What is most disturbing about complaints about milking taxpayers is that the working poor in both urban and rural areas are also taxpayers. They pay a larger percentage of their income in taxes than upper middle class and wealthy Wisconsinites. In fact, their tax dollars go to subsidize private school vouchers for suburban families while public school funding for their children is always under attack. Their taxes go to street maintenance, garbage pick, and snow plowing, knowing full well their neighborhoods and streets will be the last to receive service.

It is so easy to pass judgment on people you go out of your way to avoid. You should know that the working poor are the hardest working people in this country. They are also the last to receive any benefit from the taxes they pay. It is also offensive to be patting ourselves on the back for finally making process on integrated, fair, and affordable housing. The fair housing act was past in 1968. The Wauwatosa open housing campaign was waged throughout 1968-69. That’s over 50 years ago. The expectation that working poor take on the enormous burden of moving to the “white” parts of Milwaukee is the height of hubris. The lack of integration in Milwaukee County has everything to do with redlined zoning ordinances, discriminatory land covenants, AND underfunded public transit policies.