3 Solutions to City, County Fiscal Woes

Without one or more of these solutions Milwaukee will see drastic cuts in service.

Can the City of Milwaukee and Milwaukee County succeed in overcoming their fiscal woes? Both face very challenging budgets in the next few years. In the short run, funds from the Federal American Rescue Plan Act (ARPA) will help delay the worst of the crunch. Once those funds are spent, however, the situation could become especially challenging.

The details are included in the proposed City of Milwaukee budget. A report from the Wisconsin Policy Forum, alarmingly entitled Nearing the Brink, has additional analysis of the future challenge.

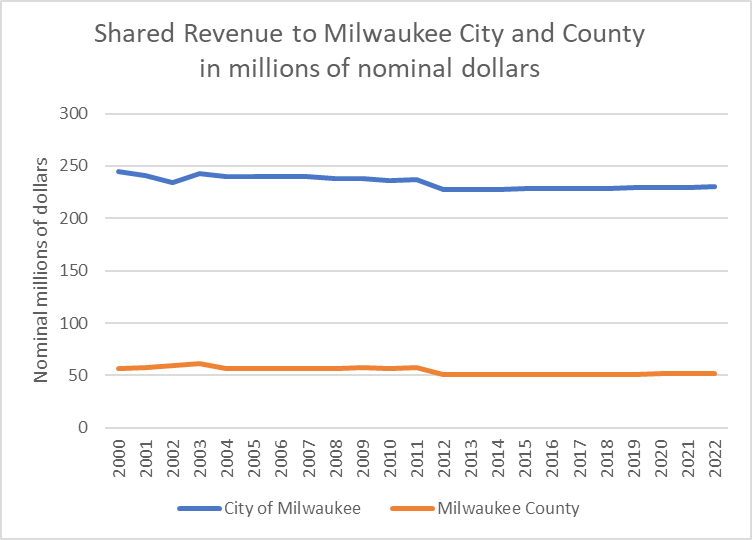

The chart below shows the nominal level, the value in then-current dollars, of these payments to the city of Milwaukee (in blue) and Milwaukee County (in rust) since 2000. In that year the state formally locked each municipality into the prior century’s nominal level.

Effectively, of the three major sources of tax revenue—taxes on incomes, on sales, and on property—Wisconsin has exclusive control of the first two, leaving property taxes to counties and local municipalities. That has made them very dependent on state shared revenue; that’s all the more true for local governments (like Milwaukee) with lower average property values to fund public services.

Shared revenue to Milwaukee city and county in millions of nominal dollars

Using nominal dollars, the numbers from then on are essentially flat. This approach ignores the effect of inflation. With inflation, the years go by, the buying power of the dollar gradually gets smaller.

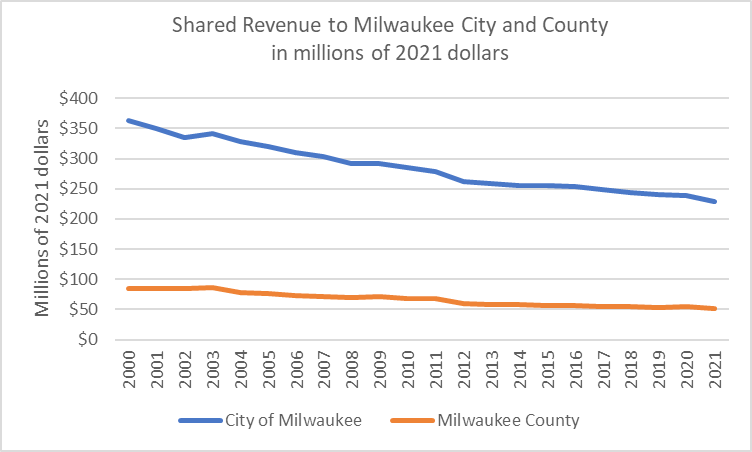

The next graph shows the same data but using “real” dollars that take inflation into account.

Shared revenue to Milwaukee city and county in millions of 2021 dollars

As can be seen from the two charts, when adjusted by the consumer price index, the $245 million that went to the city of Milwaukee in 2000 would have had to grow to $363 million today to have the same buying power. Similarly, the county’s $57 million would have to grow to $84 million. Put another way, both the city and the county have seen a cut of around 37% in a major part of their funding.

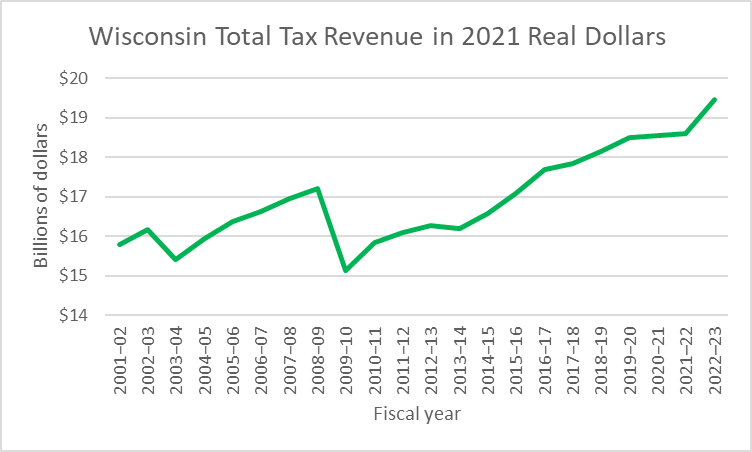

It is unclear to me why those making decisions thought it was smart policy to tie next year’s shared revenue to the previous year’s shared revenue in nominal dollars, thus assuring that shared revenue would be set on a course of decline, whatever happened to the overall economy. The chart below shows the tax revenue available to Wisconsin over the same period. Since the Great Recession bottomed out, Wisconsin’s tax revenue has steadily risen, by at least 29%, even as the revenue shared with Milwaukee has steadily declined.

Wisconsin total tax revenue in 2021 real dollars

Further good news for Wisconsin’s finance came in a report from the Wisconsin Department of Administration dated Oct. 14. The state enjoyed a surplus in the 2021-22 fiscal year (FY 2022) of $4.3 billion. The state’s “rainy day fund” (officially the “Budget Stabilization Fund”) is currently at $1.6 billion. Together, the two total slightly more than $6 billion

There are several possible measures that would help both the city and the county to get out of their present and growing financial crisis. Of these the solution that has received the most attention is a city or county sales tax. According to the Tax Foundation, only 13 states do not allow local governments to impose sales taxes (all but 5 states have statewide sales taxes).

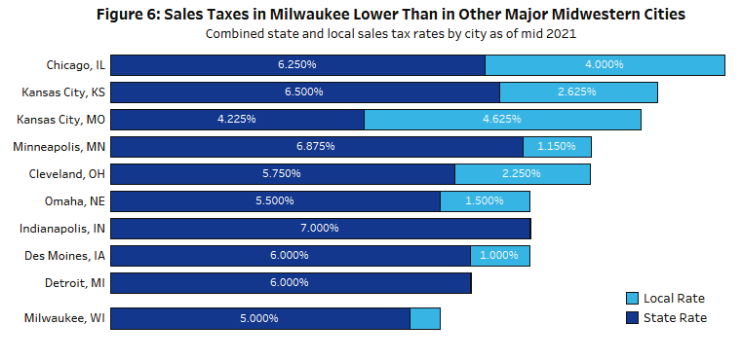

Included in the Wisconsin Policy Forum’s report on Milwaukee’s fiscal condition is a table showing the combined state and local sales tax of the Midwest’s largest cities, which I have reproduced below. Milwaukee has the lowest sales tax rate of all the cities. One argument for such taxes is that it would also be paid by visitors and those with jobs in the city who benefit from city services. Otherwise, the whole cost of those services falls on residents.

Sales taxes in Milwaukee lower than in other major midwestern cities

A second possible source of new income is a local income or wage tax. According to a list compiled by the conservative Tax Foundation, 17 states allow local governments to impose income taxes, including two of Wisconsin’s neighbors, Michigan and Iowa, as well as a near-neighbor, Indiana. Compared to sales taxes, and for that matter property taxes, an income tax can be designed to be progressive—so that higher income people pay more, an advantage at a time of growing concern about inequality. By the same token, that feature may draw the attention of lobbying groups that advocate for lower taxes on the wealthy.

The fact that the Wisconsin Policy Forum discusses a sales tax but not a local income tax may reflect a judgement that the income tax is not viable politically. It is notable, however, that Iowa and Indiana are considered safely Republican states.

The city and county and Milwaukee business leaders have been pushing hardest for the local sales tax. Without this or some other solution both the city and county will be forced to make drastic cuts in services. As the Wisconsin Policy Forum’s report concludes, “the terrain ahead is steep and treacherous and Milwaukee and state leaders cannot delay for long the work that will be needed to chart a path to safety. With this report, we hope we have provided them a clearer picture of the dangers to come and a sense of urgency in negotiating them.”

More about the Local Government Fiscal Crisis

- Mayor Johnson’s Budget Hikes Fees, Taxes In 2025, Maintains Services - Jeramey Jannene - Sep 24th, 2024

- New Milwaukee Sales Tax Collections Slow, But Comptroller Isn’t Panicking - Jeramey Jannene - Jun 28th, 2024

- Milwaukee’s Credit Rating Upgraded To A+ - Jeramey Jannene - May 13th, 2024

- City Hall: Sales Tax Helps Fire Department Add Paramedics, Fire Engine - Jeramey Jannene - Jan 8th, 2024

- New Study Analyzes Ways City, County Could Share Services, Save Money - Jeramey Jannene - Nov 17th, 2023

- New Third-Party Study Suggests How Milwaukee Could Save Millions - Jeramey Jannene - Nov 17th, 2023

- Murphy’s Law: How David Crowley Led on Sales Tax - Bruce Murphy - Aug 23rd, 2023

- MKE County: Supervisors Engage in the Great Sales Tax Debate - Graham Kilmer - Jul 28th, 2023

- MKE County: County Board Approves Sales Tax - Graham Kilmer - Jul 27th, 2023

- County Executive David Crowley Celebrates County Board Vote to Secure Fiscal Future and Preserve Critical Services for Most Vulnerable Residents - David Crowley - Jul 27th, 2023

Read more about Local Government Fiscal Crisis here

Data Wonk

-

Life Expectancy in Wisconsin vs. Other States

Dec 10th, 2025 by Bruce Thompson

Dec 10th, 2025 by Bruce Thompson

-

How Republicans Opened the Door To Redistricting

Nov 26th, 2025 by Bruce Thompson

Nov 26th, 2025 by Bruce Thompson

-

The Connection Between Life Expectancy, Poverty and Partisanship

Nov 21st, 2025 by Bruce Thompson

Nov 21st, 2025 by Bruce Thompson

I think the city and county could also look at ways to cut spending as well. If they can increase revenue and tighten the belt on spending they have a chance to get the fiscal outlook to improve.

The Sentinel or maybe the Journal had a cartoonist Opha or something like that. There was a cartoon and Opha always held a little sign that had a reflection on the cartoon. The cartoon image of a city in ruins and the sign saying the TAX RATE is zero! Yes we should definitely cut more and of course what gets cut is the kids. When will we ever learn? The children who are traumatized, whose behavior is socially unacceptable, NEED therapy NOW to HEAL their INJURED brains because it is better for them and cheaper than prison in the future.

Yet again I try to break what seems to be an invisible barrier that children whose behavior is socially unacceptable are CRYING for HELP not challenging adult authority. Maybe Urban Milwaukee and Data Wonk could research the history of how may times SOCIETY had an opportunity to change the course of Mr Brooks and did not. We know the events of last December changed his life but also hundreds if not thousands of other lives as well. Had he gotten the therapy that he needed along the way that event on that fateful December Day would never have happened. Anytime someone wants to begin the discussion I am ready. 414 403 1341

Some assumptions – all based on experience – that should be tested about what are known as urban “fiscal crises” and Milwaukee’s immediate future: (1) Mismanaged – especially by higher levels of government – they do permanent damage to the city facing the crisis; (2) While Milwaukee may not spend every public dollar perfectly, there is – especially after decades of growing needs and flat revenues – no “fat” in current city budgets; (3) Tinkering around the edges with small cuts will only do more damage; (4) There are major unmet public needs in the areas of public safety, public health, education and the environment; (5) The reactionary – and often racist – view of state Republicans that “the worse the better” in the case of Milwaukee is in many ways at the heart of both the impending fiscal cliff and the long-term decline in the city’s fiscal health; and, (6) Milwaukee needs increased revenues, and the state needs to find a way to get them to it, whatever the vehicle.

Ryan, you say “I think the city and county could also look at ways to cut spending as well.”

What makes you think they don’t do this already?

I will note that Education and some public health cost are a MPSchools expense and so a different taxing entity which would address some of the “police expense” in the long run. If MPS would stop suspending kids and treat those kids for the TRUAMA they have or are experiencing that would in a few short years reduce the need for the police services which would lower cost. Children who are suspended are children who are CRYING for HELP not challenging authority. They have been or are experiencing TRAUMA in their lives and they are getting NO HELP in dealing with it, Yet again will anyone respond? 414 403 1341

PS Just as I signed off the City should stop talking about how bad it will be and today lay out the budgets for the next 5 years showing the impact of the needs for the pension and then what has to be CUT What specifically will be cut since only the Federal Government can run a negative budget

A follow-up thought on Thomas’ theme. There was a time when Milwaukee was almost certainly the best city in the country for low-income kids to grow up, with an extraordinary range of year-round supports and programs. Despite the city’s extreme segregation, these programs – mostly run by MPS and the Recreation Department – benefited all kids.

In addition, low income high school graduates had the golden opportunity of UWM in their hometown, open admissions and tuition that was $160/year ( less than $1,000 per year in today’s dollars), as opposed to the current rate of $9,000.

That is all long gone, and it is a distinct possibility that six weeks from now, Wisconsin will be a permanently controlled Republican state, with Republican officials across the board themselves controlled by a handful of far-right plutocrats. For these officials, governor, legislators and judges, the worse things are in Milwaukee, the better for them. Since Milwaukee residents are not their constituents, reducing crime and violence is not in their interest. The worse, the better. Just look at the campaign ads. And the wellbeing of those kids mentioned by Thomas is the furthest thing from their minds.

“the wellbeing of those kids ….” Those kids are their cannon fodder and until the Dem’s wake it, they will continue to be

“waging a Good War” the civil rights movement 1954 to 1968. by Thomas E. Ricks

Seems to be very readable Highlights the need for nonviolent action in the continued effort of social justice.

Still no on interested in a series based upon “Why They Kill” by Richard Rhodes and “The Body Keeps the Score” by Dr Bessel van der Kolk MD.