Costs of College Rising in Wisconsin

Gap between grants and aid received and total cost has soared since 2002, WPF report finds.

![Bascom Hall on the University of Wisconsin campus. Photo by Rosina Peixoto (Own work) [CC BY-SA 3.0 (http://creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons](https://urbanmilwaukee.com/wp-content/uploads/2016/12/Bascom_Hall_in_Madison.jpg)

Bascom Hall on the University of Wisconsin campus. Photo by Rosina Peixoto (Own work) (CC BY-SA 3.0), via Wikimedia Commons

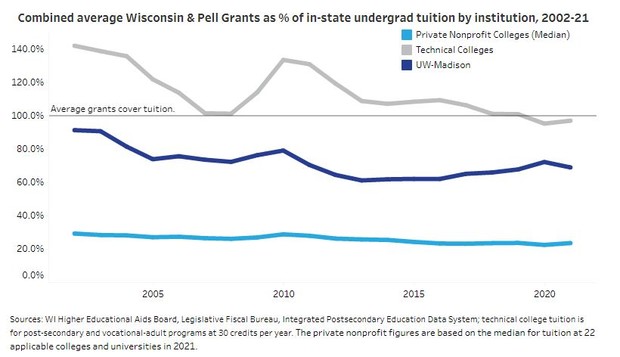

The average amount of federal Pell grants and state Wisconsin grants together covered 91.4 percent of tuition at the University of Wisconsin-Madison in 2002, for example, but only 69 percent in 2021.

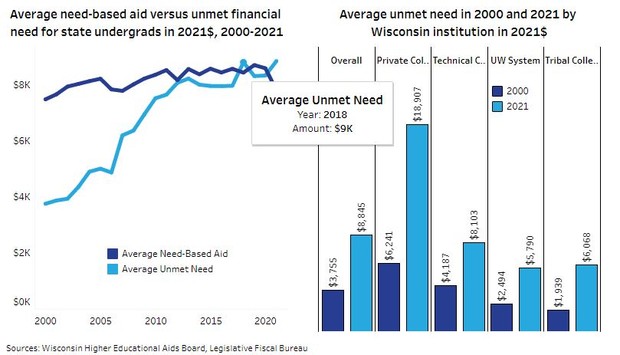

Students’ average unmet need, or the amount that remains after subtracting a family’s expected contribution and all the grants, loans, work study and scholarships they receive from total college attendance cost hit a new high of $8,845 in 2021.

“The buying power of the key need-based financial aid programs has diminished over time,” said Jason Stein, a researcher at the forum who authored the report. “And that doesn’t even count mandatory fees and textbooks and room and board, and all the other potential costs that a college student has.”

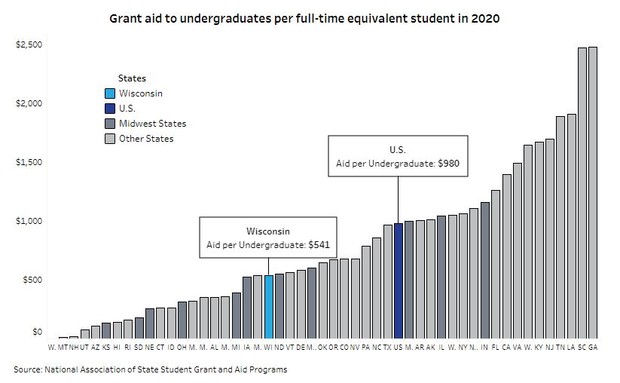

Wisconsin lags behind other states in how much the state spends per student on financial aid grants — $541 per undergraduate, almost half the $980 national average.

The burden of growing college costs and shrinking state and federal help falls heavily on students of color. The report found that 57.2 percent of Black students received federal Pell grants in 2018, compared to 28.2 percent of white students, so when those grants for students who have exceptional financial need can’t cover the costs of tuition and other college fees, they’re more likely to incur debt or have to drop out due to cost.

The high cost can have a snowball effect, Stein said.

In some cases, universities and colleges can make up the difference between state and federal aid and students’ financial needs. The University of Wisconsin-Madison, for example, has Bucky’s Tuition Promise, which covers tuition for Wisconsin residents whose household income is $60,000 or less.

“Institutions, in some cases, have been able to step in to the gap, but the flip side of that is that not every institution has the financial wherewithal to be able to provide that kind of assistance,” said Stein.

In an emailed statement, UW System Interim President Michael Falbo said the state university network would like to see the program expanded to other system campuses.

“While students and families are picking up more of the costs of education, student aid has also fallen behind. Declining student aid increases student debt, depresses enrollment, and exacerbates Wisconsin’s workforce challenges,” he said. “That is why we proposed expanding UW-Madison’s Bucky’s Tuition Promise to all UW System universities in the last budget. Targeted aid to students will help more than just those students and families affected, it would help all of Wisconsin.”

Wisconsin legislators have tried to control some of the costs of higher education by freezing tuition at the UW System, but the report noted that that doesn’t help students at private and technical colleges.

Listen to the WPR report here.

Gap between students’ college costs and state and federal aid in Wisconsin has grown, report says was originally published by Wisconsin Public Radio.

The importance of articles like this should not be underestimated. What the term “depressed enrollments” doesn’t really capture is the lives changed and the futures diminished by the exorbitant costs of public higher education. In addition to the burden of debt and the need to work, there are the large numbers of young people who simply will not go to college. Young people who will not develop critical thinking skills, learn about the world and acquire a range of specific economically valuable abilities. They are the human reality of “depressed enrollments.”

And, while students of color are the most adversely affected, that is mostly because of the disproportionate proportion of low-income students of color. This is fundamentally a class issue, one making low-income students of all colors the reality behind the term “depressed enrollments.”

In today’s world, as one of those low-income kids many years ago, I would have never gone to college. First in my family to finish high school, uninterested in learning, and graduating at the bottom of my MPS high-school class, the only school that would take me was UWM. It had open admissions and took everyone. College was an alternative to the assembly line at the American Motors plant.

But, what about the cost? My tuition at UWM was $80/semester. Get your books at Mike Green’s Used Book Store, which gave needy students credit. Multiply that number for inflation, and the annual cost of a UWM education was under $2,000. No impediment for even lower income families. That is all gone today, and the huge price that our society pays for it shouldn’t be masked by the term “depressed enrollments.”

Like many other low-income and working-class kids, in that era, a UWM education was a life changing experience for me. It was a different world, one whose disappearance should not go un-noted.

The program called “Buckey’s Tuition Promise” covers 100% of UW tuition if your parents AGI is below $60,000.

On top of that, there’s almost $38k of completely free money from the federal govt to cover your other qualified expense and your room & dining plan. (see figures below).

Result is that a kid needs to borrow maybe $10k to $15k max over 4 years (vs the current limit on Stafford loans of $27k for undergrads) to makeup the difference on their books, room & dining.

Hard to understand the reasoning in articles of this nature, especially when the author highlights families of “exceptional financial need”. It is important to understand (and even more important to inform kids & families…. instead of continually writing stories reinforcing their belief that they don’t have a chance in hell)…. when a student is from a “poor” family they easily max out on the free money and they have an exceptional opportunity to get a college degree nearly free of cost.

Do these kids & families a service by explaining how to get the free money. (ie:… maybe 1 in 1000 people know what the American Opportunity Credit is, and if they/parents dont claim it each yr during undergrad, they lose it forever)

Here’s the calcs for the completely free money:

$27,600 Pell Grant ($6900 * 4 yrs)

$10,000 American Opp Credit ($2500 * 4 yrs)

=$37,600 Total Free Money

If Germany can afford to give free health care and free college to its citizens, why can’t America?